When people think of Wall Street, they often picture a flurry of floor traders in color-coded vests barking bids at one another. Or they think of riding a hot tip they got from a guy who "knows something" and then seeing an immediate windfall.

That's not how it works. Or rather, that's not how it should work.

We don't want excitement in our investment accounts. We don't want risk and drama, or to be spending all of our time sitting in front of a computer watching our brokerage account.

We want to put our money to work for us.

After all, we've got enough to worry about in times of crisis... And we want our wealth to be a buffer against that, not another thing to worry about. We want to invest for calm and freedom.

There are two things you need to do to make that happen...

First, you need to plan ahead and manage your risk.

We've talked about ways to do that before... Buy the stocks of high-quality businesses... Diversify with low-cost funds... Allocate to stocks, bonds, and other real assets... And limit your speculations to sizes you can handle.

These ideas aren't original to us. They can be dull, and they can get repetitive...

But every panicked investor today wishes he or she did those things three months ago. The simple work of building a sturdy portfolio pays off in a crisis... even if it doesn't excite in a boom.

The second thing you need to do to invest for calm and freedom involves your mentality.

You need to accept that stocks are volatile. Stocks build wealth over time... But they don't do it in a straight line. If you want the money, you've got to be willing to walk the path.

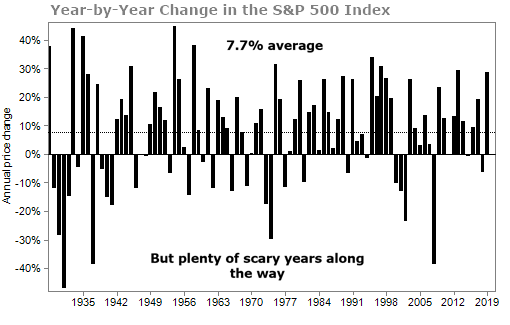

The market has returned about 7.7% a year since 1928... But it certainly didn't return that each and every year. Down years of 10%, 15%, or 20% happen with regularity.

Charlie Munger – Warren Buffett's long-time business partner – put it this way...

If you are not willing to react with equanimity to a market price decline of 50% two or three times a century, you are not fit to be a common shareholder and you deserve the mediocre result that you are going to get, compared to the people who do have the temperament who can be more philosophical about these market fluctuations.

Drawdowns in stocks happen. It's the cost of admission.

Don't fool yourself into thinking you can avoid them when they hit. Crises like this are unpredictable. And if you sell at every sign of fear, you end up selling little dips, buying back in at a higher price, and missing the good parts of the market.

To quote another legendary investor, Peter Lynch, "Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves."

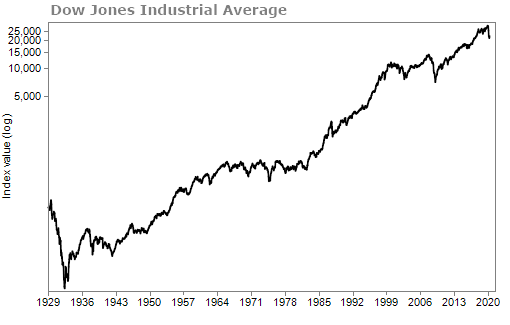

So this second step toward calm and freedom is a mental one... or one of temperament. You need to accept that your stock portfolio will give you a scare every so often. But history has shown us that stocks eventually come back.

At what point on this chart was it a bad time to buy or hold stocks?

We don't know exactly what will happen with the coronavirus... We don't know how long we'll be isolated, or how long our economy will be shut down. There will be bankruptcies, business closures, and economic pain.

We could be entering a recession (we're already effectively in one) – maybe even a depression... Though, that's unlikely with the government and Federal Reserve willing to spend whatever is necessary to avoid one.

Who knows? Stocks may take years to hit new highs...

But this will not end society as we know it. During the financial crisis of 2008, the banking system nearly collapsed. That created much more risk of ending the current economic regime and starting a new one.

This time, the economy will come back... And the stock market will, too.

With that said, in times like these, you want to own stocks that you know and love... Companies that will be around in 10, 20, even 30 years.

At its core, investing is simple: Buy great businesses at reasonable prices and hold for a long time.

It doesn't have to be any more complex than that. You can find great businesses all around you.

Here's one way to do it... Right now, we are in a time of crisis and what's likely the first month of a recession. Everyone has pulled back on their spending. But what are they still buying?

Well, whatever they're buying... they're ordering it from Amazon (AMZN). We haven't seen revenue numbers yet, but Amazon said it plans to hire 75,000 more people for jobs ranging from warehouse staff to delivery drivers. That's in addition to the 100,000 people Amazon said it would hire last month...

And with people online and streaming at home, we suspect that revenue for its cloud-computing Amazon Web Services (AWS) platform will surge as well.

Amazon Prime has more than 100 million subscribers, all happily paying about $13 a month. That's a recurring revenue stream of $1.3 billion per month.

And again, the great thing about Amazon is that you don't need to be a professional money manager to realize it's an amazing company. You've used its products... And you've seen it grow its market share.

Companies like these – ones you use and can understand – are the ones you should be buying during market turmoil like this.

Our advice is to own companies whose business models you could explain to a complete stranger. And we also think you should own companies with lots of cash – businesses that can survive a recession and even gain market share as competitors struggle.

Consider legendary investor Warren Buffett's holding company, Berkshire Hathaway (BRK-B).

We all know of Warren Buffett and his success in the investing world... Buffett buys great businesses and holds them for many years, compounding his capital along the way. Berkshire's return has roughly doubled the return of the S&P 500 Index since 2000.

And now, Buffett's in a terrific position to take advantage of the COVID-19 panic. Berkshire is currently sitting on a cash pile of $127 billion. (Only two companies in the S&P 500 hold more cash, and both are banks.)

Over the past couple years, Buffett has been criticized for his lack of large deals and for not spending his cash. But he'll look like a genius if he gets aggressive and starts buying great companies at a discount thanks to this bear market. And we suspect he will...

Berkshire can act prudently and take advantage of its huge cash position – just as it did in 2008 and 2009. Berkshire is exactly the kind of stock everyone should own.

The stock market may have already bottomed, and it's possible stocks have further to fall from here. Either way, our advice is to own great companies like Amazon and Berkshire... and hold them for a long time.

If you are a subscriber to my Income Intelligence newsletter, we are recommending buying another one of these companies in Thursday's issue. It's a stock we know and love and want to hold for many, many years. The best part, the stock is the cheapest it has been in about seven years.

If you're already an Income Intelligence subscriber, check your inboxes on Thursday for our full write-up. If you're not a subscriber, click here to get started.

What We're Reading...

- Ten U.S. states developing 'reopening' plans account for 38% of U.S. economy.

- Something different: Here's a state-by-state breakdown of where golf's allowed and where it isn't.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

April 15, 2020