Anytime there's uncertainty in the market, investors follow the same playbook...

They flee to "safe haven" assets. And that's exactly what we're seeing today.

Lately, there have been clear signs that economic growth is slowing. There were more than 75,000 jobs cut last month, the highest nonpandemic-era August tally since 2009... Credit-card debt has ballooned... And default rates for that debt are at their highest level since the financial crisis.

It's clear that higher interest rates are taking their toll on the economy. Couple this with higher valuations for equities, and investors are very worried.

The most obvious safe haven in these uncertain times is gold. Doc Eifrig and I (Jeff Havenstein) have been writing about the importance of owning gold for more than a year. It has been a trusted store of value for thousands of years.

We're also seeing investors take refuge in two different sectors within the stock market... utilities and consumer staples.

Utilities are public companies that provide specific localities with daily necessities – things like water, gas, and electricity.

Many utilities are highly regulated natural monopolies. The government allows utilities to set rates on water or electricity that provide the company an agreed-upon return on capital – usually somewhere between 8% and 10%.

So even if an electricity provider needs to pay to upgrade its infrastructure, the government lets it pass those costs on to its customers... who can't get their juice from anyone else.

Traditionally, utility stocks have been extremely safe investments. They can act almost like bonds, holding up when other stocks slide. Even as sober an institution as the New York Times has said, "If your grandmother played the market, she probably invested in utilities for safety and income."

Turning to consumer-staples stocks in times of turmoil is self-explanatory... Even when times are tough and budgets are tight, folks will still head to their local store to buy necessities like toilet paper, toothpaste, and laundry detergent.

While you can go without a night out at a restaurant, your friends won't put up with you if you're smelling bad and your house is a mess.

Also, consumer-staples stocks tend to pay higher dividend payments than other stocks. So it makes sense why investors want to collect their safe dividends instead of taking a chance on a low (or no) profit, non-dividend-paying tech stock.

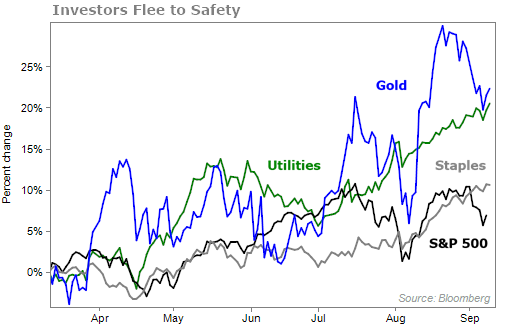

Because of all the uncertainty about the economy, investors have been piling into gold, utilities, and consumer staples. Since March, their gains are greater than the S&P 500 Index's. Take a look...

It will be interesting to see what happens next... And it all comes down to how folks feel about the economy moving forward.

If we continue to get worrisome news about economic growth, then you should expect the rotation to these traditional safe havens to continue. But if there is progress on the economic front – and interest rates are cut – then we'll likely see investors go back to their old ways of buying the next hot stock... usually something to do with AI.

In today's Retirement Millionaire, set to publish in a couple hours, we dive into exactly where our economy stands today and the force that will drive returns in the near future. Most important, we detail exactly how you should protect the gains you've accumulated over the past several years... and share a few of our favorite safe havens so you can ride out any potential storm in the market.

Many Health & Wealth Bulletin readers are already subscribed to Retirement Millionaire. If you're one of them, today's issue is a must read. Again, check your inboxes in a few short hours.

If you're not subscribed to Retirement Millionaire, we have a fantastic offer for you to join us today. Click here to get all the details.

What We're Reading...

- Something different: The NFL's historic week-one viewership signals another dominant season.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

September 11, 2024