There's a massive bull run happening that no one is talking about...

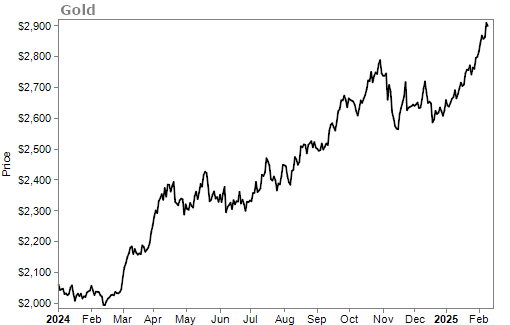

Gold had an amazing year in 2024 – up 28%, beating the 23% return for the S&P 500 Index.

And it's already off to a hot start in 2025, recently breaking out to new all-time highs. In the short term, gold prices have risen as investors have turned to safe havens because of fears over a global trade war.

Here's what's so odd...

No one seems to care.

Normally, when there's a stock or an asset making big moves higher like this, it's all you'd see on TV. You'd be bombarded with questions from distant relatives and neighbors about how much more they should buy.

With gold? Crickets.

In fact, we're seeing money moving out of gold funds here in North America.

According to the World Gold Council, North American physically backed gold exchange-traded funds ("ETFs") saw net outflows of nearly $500 million in January. This is the second straight month of net outflows in the West.

Again... this is all while the price of gold is ripping higher.

Other parts of the world, however, are starting to get behind the metal.

European funds added a net $3.4 billion of gold in January. This was the largest monthly inflow for Europe since March 2022.

And looking at the bigger picture, global gold funds saw net inflows during January for the second consecutive month. The World Gold Council also reported that global gold-trading volumes rose 20% in January.

Global investors are finally ready to add gold back to their portfolios, but North American investors aren't as convinced. They have too many options to invest in, like the Magnificent Seven, bitcoin, or anything that claims to use artificial intelligence.

Eventually, though, cash moves to where it's going to make returns.

If gold continues to charge higher, North American investors will have no choice but to pull cash out of other assets and buy.

For now, gold is in a ripping bull market, but it's not loved. And that tells me prices can still go higher.

Of course, the reason why every investor needs to own gold is simple... It's the ultimate "chaos hedge."

Gold has been used as a currency throughout all recorded history. Its supply is limited, and it also has some real-world uses, such as for jewelry and electronics components.

When things get rocky in the economy or stock market, folks turn to gold as a safe haven. It has historically held its value across borders, cultures, and political systems... in peacetime and in wartime.

I've always said every investor needs to own some gold. With the current hated bull market, plus the risks I see in the economy... more gains are on the way for this chaos hedge.

Folks should think about increasing their allocation to the metal.

What We're Reading...

- Perfect storm fuels gold's best yearly performance since 2010 as Trump 2.0 looms.

- Something different: Gucci sales slump continues as market awaits turnaround.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

February 12, 2025