"Buy when there's blood in the streets."

Baron Rothschild, an 18th century British nobleman and member of the Rothschild banking family, is credited with this famous saying. Rothschild made a vast fortune when he bought during the panic right after the Battle of Waterloo against Napoleon.

Some of the biggest market gains throughout history are a result of using this buying mindset when there's fear.

When surveying the market today, there's certainly blood in the streets. One group of stocks in particular is getting crushed lately. And these companies happen to be some of the oldest and sturdiest companies in the world. It's not retail. It's not MLPs...

It's consumer staples.

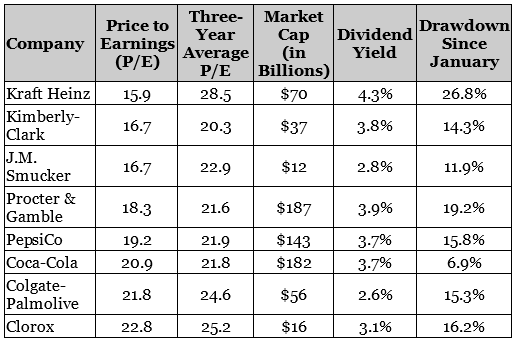

Consumer staples are firms that provide the basics like food, beverages, tobacco, and everyday household items. You'll know most of the major players... Coca-Cola (KO), PepsiCo (PEP), Clorox (CLX), Kimberly-Clark (KMB), Kraft-Heinz (KHC), Procter & Gamble (PG), Colgate-Palmolive (CL), and J.M. Smucker (SJM).

Usually, investors view consumer staples as safe investments for a few different reasons.

First, they're boring. And in this case, boring is a positive. These companies don't grow revenues at 50% and revenues don't fall 50% either. Cash flow is constant, so you mostly know what to expect from each earnings report. You'll also have a good idea of what your returns as an investor will be.

This makes them defensive stocks. No matter what's going on in the economy, folks are still going to buy toothpaste or diapers in similar quantities. Consumer staples had the second lowest volatility of any market sector from 1962 to 2015.

They also tend to pay an above-average dividend and have a long history of growing dividends. Coca-Cola has increased its dividend in each of the last 55 years and Procter & Gamble has done it for the past 61 years.

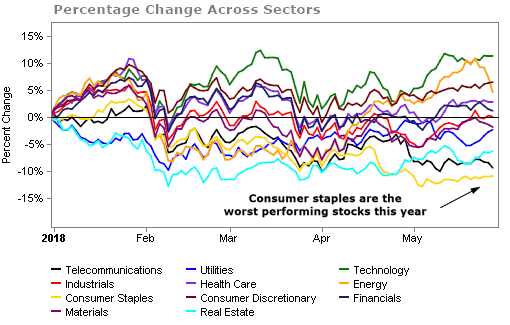

Yet, consumer staples are the most hated stocks right now...

Real estate and telecommunications are having a tough year as well, but staples are suffering the most. Thinking like Rothschild, this brings up the question... Is now the time to buy?

Before you can answer that, you have to understand why staples are down in the first place...

Rising interest rates have played a role. With the 10-year Treasury yield climbing above 3% for the first time in a few years, folks don't find consumer staples' yields as attractive. So there's been a rotation out of staples and it's likely that money has flowed straight into fixed income.

Another factor is the strengthening of the U.S. dollar. Since most of these companies have global operations, a stronger dollar makes overseas profits less profitable.

[optin_form id="73"]

Costs and pricing are headed in the wrong direction as well. Commodity and freight costs are both rising. And these companies can't just raise prices to offset those costs because of increased competition in the space. As a result, prices are falling.

Private-label brands and companies like Amazon are putting pressure on prices even though consumer staples have well-known and established brands like Procter & Gamble's Charmin toilet paper or J.M. Smucker's Jif peanut butter.

Rising costs and more competition of course hurts margins and the ability to churn out higher profits.

After hearing all this you're probably thinking, why on earth would I want to buy staples? It's true, there are some serious problems that these companies face. But I also think there's an opportunity...

Brands like Coca-Cola, Pepsi, Kraft, Kleenex, and others have been around for a long time. And trust me, they're going to be around for many decades to come. These companies aren't going bankrupt anytime soon and will figure out how to overcome some of their problems. You can also count on them to continue to reward shareholders through dividend increases and stock buybacks.

Plus, thanks to the recent sell-off, you can buy them at a discount. The sector traded for 22.2 times earnings one year ago and now it trades for only 18.7 earnings.

Let's look closer at some of the individual stocks...

Each stock is trading at a discount to its three-year average and is down by more than 10% since the start of the year, excluding Coca-Cola. There's definitely some bargains here with big yields.

To be clear, consumer staples may still fall further... It's likely that this low is not the bottom for the sector. Again, there are real problems that these companies face and investors know that.

Buying today would be contrarian. But if you are a buyer, you'll be able to scoop up some of the best brands in the world at a discount.

Also, if there is a correction or a bear market over the next few months, we're likely to see a rotation back into staples as investors get defensive.

Some contrarian investors like to see a stock in an uptrend before they buy... The uptrend confirms their thesis. Others have a longer-term mindset and they know how valuable the stock is. They buy when the price becomes cheap enough – even if it may fall further.

The real problem is getting past the mental hurdle of buying while others are selling.

I'm not officially recommending any individual consumer staple to buy, but some of the names in the sector are certainly worth a second look.

What We're Reading...

- Something different: 101 graduates owe more than $1 million in student loans.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

May 30, 2018