Doc's note: I like to learn from the best... especially when things could go belly up.

Today, I'm sharing a Stansberry Digest issue from my colleague Brett Aitken. Earlier this month, Brett detailed the death of an American icon and why he expects things to get a lot worse.

Brett also explained why it's more important than is had been in years to have access to the most valuable research on Wall Street.

And he shared a way to get you "in the room" with some of the smartest folks in finance today... in two weeks at newsletter legend Jim Grant's annual conference.

Remember, investors only beat the market when they have better information than the masses. This conference is where that information circulates and takes shape. Click here to reserve your seat.

***

The most important company in the country just went belly up...

And few people seem to care... or even notice.

As I'll (Brett) explain today, the death of this American icon is a sure sign that the country's experiment in endless debt is about to explode. We've been watching this situation for more than two years... And the recent news only confirms what we've known has been coming.

But I am getting ahead of myself. Let me back up to where it all began...

In November 2015, we launched Stansberry's Credit Opportunities, our publication dedicated to buying distressed corporate debt.

At the time, we believed that America's credit markets – swollen by cheap credit funneled into student and auto lending – were reaching a tipping point. We foresaw a wave of defaults coming that would undermine the entire debt market... and drive down the prices of corporate bonds, many issued by high-quality businesses that were in no danger of defaulting on their debts.

Smart investors with ready capital can swoop in and buy these discounted "distressed" bonds and lock in a healthy income stream... as well as a big capital gain when the bonds mature.

The best investors in the world use this strategy. And we wanted to help subscribers take advantage of the strategy, too.

Still, outside of our Alliance members, few retail investors ever seem to understand it...

Most investors sign up for newsletters expecting to get rich by next week. They want hot stock tips. Bond investing is too slow and "boring." But that's not why I'm writing about it today.

While you may never buy a bond, you can still learn from the bond market. And recently, we received an important message...

Bond Investors Are Smarter

The old adage says that bond investors are smarter than stock investors...

The bond market is also far bigger than the stock market. The global stock market sits at around $65 trillion, according to data from the World Bank, while the global bond market is about 35% bigger, at around $90 trillion.

The bond market is full of institutional money. These firms pay brilliant people tons of money to know what's going on in the markets and to make the right decisions.

Bond investors are also higher on the food chain than stock investors. They get paid first in the event of a bankruptcy... And they have a much bigger say in what happens when it matters. We saw that play out again earlier this month.

We've warned again and again about the country's looming debt problems...

Since launching Stansberry's Credit Opportunities, we've warned readers about a wave of debt coming due that would have to be refinanced between 2018 and 2020. We were especially wary of high-yield (or "junk") bonds.

Of course, the skeptics called us fearmongers. That's fine with us... We're used to it. Our contrarian advice often cuts against the mainstream wisdom... and earns us criticism. Regardless, we persisted. As we wrote in the March 2016 issue of Stansberry's Credit Opportunities...

Between now and 2020, $1.32 trillion of junk debt is expected to come due. Most of that matures toward the end of the five-year period.

We didn't have any special insight when we wrote that. We were simply stating the facts... and explaining why we were warning about the credit markets.

The Demise of an American Icon

Among the companies laboring under an enormous pile of junk debt was an American icon... struggling 70-year-old toy company Toys "R" Us.

The global toy market does around $90 billion in annual sales. We don't think for a minute that kids will ever stop loving toys. But we doubt that kids born today will ever step foot in a brick-and-mortar retail toy store. Online gaming and Internet shopping with retailers like Amazon (AMZN) are putting an end to that.

As we told readers at the time, the death knell for Toys "R" Us likely happened in 1998, when discount retailer Walmart (WMT) began to sell more toys than Toys "R" Us. The emergence of the Internet compounded those problems... and put toy stores on a crash course toward obsolescence.

In 2016, Toys "R" Us owed creditors more than $6 billion, most of which stems from a leveraged buyout back in 2005. A huge portion of that debt – $1.6 billion – was coming due in 2017 and 2018. With more than $1.3 trillion in junk debt coming due at the time, Toys "R" Us knew it had to cut to the front of the line if it wanted to find a willing lender.

We thought that if Toys "R" Us could refinance and survive, other troubled companies might, too. Therefore, interest rates would likely remain lower for longer... And it might take longer to reach the end of the credit cycle than we had originally anticipated.

But if creditors spurned Toys "R" Us, refusing to let it refinance at affordable rates, then many, many other indebted companies faced similarly dire prospects.

Toys "R" Us was the canary in the bond market coal mine...

That's why we called Toys "R" Us – laden in debt, and with an increasingly obsolete business model – the most important company in the U.S. economy.

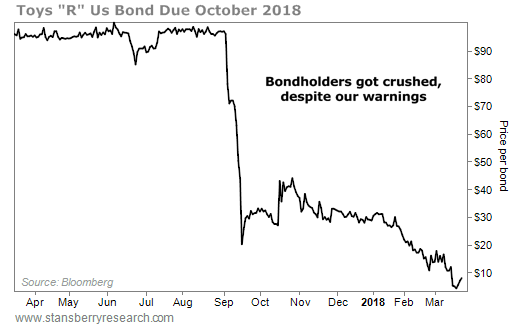

Toys "R" Us is a private company. But its bonds traded publicly... And the bondholders had become far too complacent. As recently as last June, the company's bonds maturing in October 2018 traded for more than par ($1,000). Bondholders were completely ignoring the risk in order to get its 7.3% yield. Even in August, the bonds traded for $980.

Then, reality set in...

On September 7, the bonds fell 25%. About a week later, they traded for less than $400 per bond.

By September 19, the company filed for Chapter 11 bankruptcy protection. It received a $3 billion lifeline while it tried to renegotiate the debt and reorganize the company.

Management shut down some of the underperforming stores and continued to operate the remaining 1,600 locations in an effort to turn around its failing business. The bonds plummeted to less than $300.

Last week, the company took its last breath, announcing it couldn't find the necessary financing and would be forced to liquidate its assets.

The company will close all of its U.S. stores. More than 30,000 people will lose their jobs. CEO David Brandon said he was "very disappointed with the result." That may be true, but we doubt he was surprised.

For years, management had tried to improve operations. But the headwinds were in plain sight. The increasing traffic to online retail, a heavy debt load, and dwindling cash flows were working against Toys "R" Us.

Why are we telling you this story?

Two years ago, we told Stansberry's Credit Opportunities readers that if Toys "R" Us didn't make it, we expected things to get worse – a lot worse – in the bond market.

We believe it will matter more than most people realize... Plus, another well-known American business – iHeartMedia – filed for bankruptcy last week. The mass-media communication firm has 850 stations across America... and $20 billion in debt.

Despite last year's rally in junk bonds, we see a credit crisis on the horizon...

Since junk bonds – as represented by the iShares iBoxx High Yield Corporate Bond Fund (HYG) – hit their highs last July, they've been in a steady downtrend. If that continues like we believe it will, you can expect a lot more volatility in the stock market as well. The forecast for the rest of the junk-bond market is starting to look ominous...

How to Make It in the Bond Market

Among the carnage is a bit of good news...

None of this has to hurt you.

Our Stansberry's Credit Opportunities team has been following every movement in the bond market for more than two years. They're eager for a jump in bond-market volatility.

They know that as fear hits, bondholders – even those owning the bonds of companies we know are safe – will panic. They'll sell for whatever they can get, just to move to cash or cash-like securities. That's when we'll swoop in and make recommendations at a huge discount to par.

We know many of you aren't interested in "boring" bonds. But patient investors will be rewarded. They'll earn interest payments along the way and enjoy massive capital gains when they get paid in full at maturity (or when the market sends the bond prices back to par).

Hopefully, you can see why this is such a great investment strategy. The past two years have been tough for our team to find bargains in the bond market. But we've still made 23 recommendations since November 2015, racking up an impressive win rate of 74%, with average annualized gains of 22% (including nine open positions). Our win rate on 14 closed positions is 79%, with an average annualized gain of 33%. That earned them a well-deserving "A+" on this year's Report Card.

We aren't the only ones who are waiting patiently...

So is Howard Marks, the guru of distressed debt.

Longtime readers may recognize Marks' name. He's the billionaire founder of asset-management firm Oaktree Capital (OAK). At the end of last year, his firm had $102 billion in assets under management.

Around the Stansberry Research office, Marks is considered the maestro of distressed debt. He got his start in high-yield debt markets back in 1978. He has made his funds' investors average annualized gains of 19% over the past 25 years. Few investors can make those returns in a year, let alone average it for more than a quarter of a century.

Around 25% of the funds Marks runs are normal, open-end funds that anyone can buy through a brokerage account. But his specialty is buying debt when it's selling at liquidation prices. In 2007, he launched a special fund to take advantage of the massive bubble he saw in the financial markets. By mid-2008, he had raised $10 billion... just before the meltdown at Lehman Brothers. At the time, it was the largest distressed-debt fund ever.

When Lehman filed for bankruptcy in September 2008, the bond and stock markets crashed. That's when Marks started buying debt for pennies on the dollar. By the end of the year, he had invested about $7.5 billion. Then... he sat tight.

Four years later, Marks returned every penny of the $10 billion to his investors, plus an additional 25%. Even if investors had the nerve to buy and hold stocks at the time – and most didn't – the returns were about flat as stocks drifted sideways over the same period. Marks went on to more than double his investors' money... all through distressed debt.

Today, Marks is at it again. He has spent the past two years building another gigantic fund to buy up debt when it goes on sale as the next crisis unravels. He currently has around $20 billion ready to deploy... with about $9 billion earmarked for his distressed-debt fund.

We watch Marks closely and read his memos. And next month, we're going to see him.

Access Some of the Most Valuable Research on Wall Street

On April 10, Marks will be among the most important attendees at a small, exclusive meeting in New York...

Twice a year, Jim Grant – the founder of the excellent Grant's Interest Rate Observer newsletter – hosts a meeting at the five-star Plaza Hotel in New York City.

(As an aside, I make a point to read every one of Jim's issues. I have for years. It's the only financial newsletter outside of our own that I read without fail. He offers unique financial insights that you won't find anywhere else. And he delivers it in a unique writing style. It's not for everyone, and it requires a good understanding of finance to get the most out of it. But it's like nothing else on the market.)

I've personally attended Jim's conferences since 2012. In that time, I've heard fantastic insights from JPMorgan Chase CEO Jamie Dimon... flamboyant and colorful hedge-fund manager David Einhorn... famed short seller Jim Chanos... and fearless activist investor and billionaire Paul Singer. Last year, Porter and I sat in the front row, watching Jim interview former Federal Reserve Chairman Alan Greenspan.

This year, Marks will be presenting at the Grant's conference. Another world-class asset manager will be there, too: Harvard-educated John Hathaway, senior portfolio manager at Tocqueville Asset Management. Hathaway co-manages the Tocqueville Gold Fund and is considered one of the foremost experts on gold and precious metals.

Hathaway is frequently cited in Barron's, the Wall Street Journal, and Bloomberg. He regularly appears in Jim's newsletter and numerous other financial media outlets. I'm eager to hear what he thinks about precious metals today. Almost no one has done more high-quality research on the subject.

But this year, we're attending the Grant's conference for another reason entirely...

For the first time ever, Jim has invited one of my Stansberry Research colleagues to present at the Grant's spring conference. I'm talking about senior analyst Bryan Beach... the editor of Stansberry Venture Value and a frequent contributor to Stansberry's Credit Opportunities and Stansberry's Investment Advisory.

Last fall, after reading the September issue of Stansberry's Investment Advisory, Jim personally called Bryan to learn more about our "Golden Triangle" research (which spawned from our bond research and confirms the belief that the bond market is smarter than the stock market).

If you're unfamiliar, we found the Golden Triangle strategy when we were researching bonds for Stansberry's Credit Opportunities. We discovered a way to consistently double your money within two years in the stock market.

Without disclosing the details of the strategy, our analysts figured out how to gauge when bond and stock investors disagree over the quality of a business... and individual investors can take advantage of the situation.

Almost every finance professor and Wall Street guru will tell you that's impossible to do on a regular basis. But Bryan and Stansberry's Credit Opportunities editor Mike DiBiase have found that the Golden Triangle reliably identifies stocks that are poised to soar quickly.

On average, Golden Triangle stocks went on to more than double in two years. It's our most important breakthrough yet. Porter has called it "our most lucrative discovery ever."

And next month, Bryan will be a featured presenter at Grant's spring conference, alongside Marks, Hathaway, and many more of the finance industry's sharpest minds.

This is a huge honor for us... And we would love to share this experience with you.

Here's How to Join Us

We've arranged a special offer for next month's conference... an offer that no other publisher on the planet has been able to convince Jim to allow. In short, you'll get a virtual "seat" at the Grant's spring conference (which normally costs $1,750... go ahead, see for yourself right here) and one full year of Grant's Interest Rate Observer (which sells for $1,295), for a one-time fee of just $1,295.

That's like getting access to the spring conference at an unheard-of discount of more than 25%... and getting a full year of Grant's Interest Rate Observer absolutely free.

You may remember we were able to put together a similar Stansberry Research subscribers-only offer for Grant's fall conference last October. The feedback we got at Stansberry Research from folks who took us up on that offer was incredible. Take, for instance, what we heard from Paul W., who wrote in to tell us...

Excellent experience. Combining the Grant's Conference with a subscription was brilliant. The conference was icing on the cake but tremendously valuable icing. Entirely worthy of the money paid.

As we did last year, we'll also be sharing our own thoughts from the conference in real-time via live chat updates. It's the next best thing to being "in the room" with Porter and our team in New York.

And once again, we'll take on all the risk... Take the next few weeks to read Jim's work, and attend the conference on April 10. If you aren't completely satisfied, simply let us know and we'll issue a full Stansberry Research credit for every penny you paid.

You literally have nothing to lose.

We hope you appreciate just how special this opportunity is...

There's a reason Porter clears his calendar to attend both the spring and fall conferences every year, no matter what. As an attendee of Grant's conference, you'll hear ideas you won't hear anywhere else, from the smartest folks in finance today.

If you've been with us for long, you know our aim at Stansberry Research is to give you the information we would want to know if our roles were reversed. Thanks to Jim's generosity, that's exactly what we've been able to do. Click here to reserve your spot now.

Regards,

Brett Aitken