I can see it now...

A beautiful 75-degree day on the beach with a slight breeze. No worries about work. Just a nice cold drink in my hand, and the promise of a good meal at the end of the day.

Summer is underway, which means it's officially vacation season. Many look forward to their summer vacations all year long... I know I do.

Everything feels more relaxed. Colleagues are spending more time out of the office... Our feedback line gets quiet... Even the stock market isn't as hectic as usual.

You may have heard the old adage, "Sell in May and go away." This reflects the typical period of low volatility during the summer, when Wall Street goes on vacation. When people are starting to take time off in May, less money is available for investing. And people also pay less attention to their investments during the lazy days of summer.

But if you follow the markets, this summer has been anything but a peaceful stroll along the beach.

It's been one frightening headline after another.

The constant back-and-forth between the U.S. and China is a major cause of concern. President Trump recently announced his administration is prepared to impose more tariffs on all $500 billion in Chinese goods. The products affected will range from pickles to refrigerators to air conditioners.

And it's not just the trade war. It's the Federal Reserve raising rates, growing household debt, and of course the looming threat of a recession – as we talked about a couple weeks ago with the flattening of the yield curve.

For those who follow the markets, or who have jobs related to economics and finance, a weeklong getaway from work seems to be a thing of the past.

Even if you do go on a vacation, I'm willing to bet your smartphone is within your grasp most of the time... just to stay informed, because you never know what's going to happen.

[optin_form id="73"]

What if the Fed makes a comment about getting even more aggressive with rate hikes? Markets might sell off. And you might have to make a tough decision as to whether or not to sell some of your stocks.

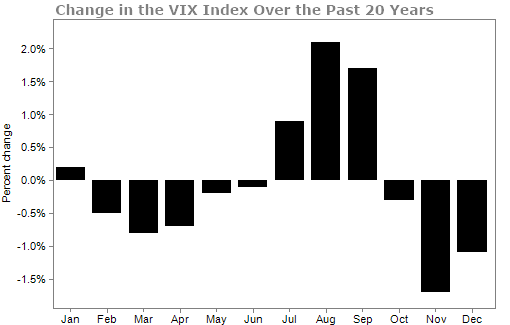

July, August, and September – the prime vacation periods – are actually the most turbulent months out of the year.

August, which starts in a matter of days, is the most volatile month. To gauge volatility, we often use the CBOE Volatility Index, or the "VIX" for short.

The VIX shows the market's expectation of volatility over the next 30 days by using the implied volatility of options from the S&P 500 Index.

We refer to the VIX as a "fear index" because when the VIX is high, we know folks are paying more for downside protection. It's a good way to measure investor complacency. And volatility increases in August...

On average, the VIX increases 2.1% in August. The next highest increase happens in September, which goes up by 1.7%.

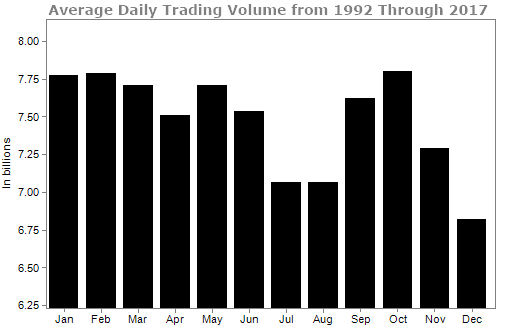

There's a simple reason why volatility increases in August... Liquidity dries up.

There are fewer trades made per day, because investors are on vacation. The chart below shows the historical average trading volume by month...

With less trading volume, each trade during August has an outsized impact compared to if there were more trades. Think about it this way... If a stock is a part of an index with 20 other stocks, and that stock shoots up 20%, it's going to affect the index more than if the index was comprised of 1,500 stocks.

The five-year average of the VIX is 14.6%. It's currently just above 12%, a good amount under the average. For much of 2017 and 2018, the VIX has been pretty quiet.

So maybe this August is finally the August where investors can actually enjoy their vacations without checking their news feed on the beach...

Maybe. But it's hard to bet against history.

And thanks to the plethora of geopolitical events that may cause panic in the markets, it may be time to start preparing for some volatility.

- Something different: Three Internet bosses lead list of top-paid retail CEOs.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

July 25, 2018