Everyone wants to be a contrarian...

A lot of people like to think they're contrarian investors. They want to buy something that no one else would touch with a ten-foot pole and make a killing. It makes for a great cocktail party story.

But Michael Lewis, bestselling author of Liar's Poker and The Big Short, put it best when he said, "On Wall Street everybody says he's a contrarian, and nobody is."

Contrarian investing is a tough game. A lot of folks don't have the stomach for it.

Most of you probably fit into one of two categories – value investors or growth investors.

Value investors love a great deal. They scan the markets for companies that are trading for less than their intrinsic value. All it takes is for a stock to return to what it should be worth and the value investor makes a healthy profit. No wild gamble or some big event to happen... just a return of the stock to fair value.

Growth investors buy companies that increase their sales year after year at a high clip. The companies they buy are usually in a new and upcoming industry – mostly tech.

The average investor loves growth stocks.

Growth stocks are easier to spot, and the promise of big gains would tempt anyone.

For example, you notice your children and their friends are glued to their gaming systems. You check what games they're playing and see that they're all made by the same company. If a company can turn your kids into mindless zombies playing games for hours on end, it must be growing like wildfire.

One quick look at the company on Yahoo Finance and you see that you're right... That company is practically printing money at an incredible rate. You invest and make a killing in a short amount of time.

Some of the best investing ideas are created by real-world observations like in this example.

Value investing isn't that easy. You can't walk past a store and know right away that it's undervalued. You can't walk up to a cashier and ask what's the store's price to earnings ("P/E") ratio is and what it has historically been trading at.

Value investing takes a lot of work. You have to do quite a bit of research and most importantly – you have to be patient. From my experience, the average investor isn't patient. He wants to get rich quick.

It's more fun to be a growth investor and it's been more profitable too...

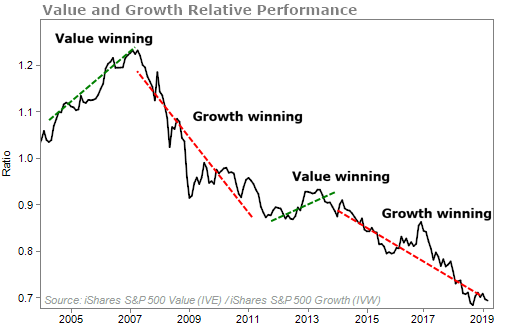

Over the past decade, growth investing has dominated value investing. The chart below shows the performance of value vs. growth since 2004...

To all the growth investors out there, congratulations. You've likely had some bigger winners over the past few years.

But growth investing doesn't always work out this way. You're taking a chance that a stock will keep growing the way it has in the past.

And as my colleague and editor of Extreme Value Dan Ferris says, the market is changing...

Investors forget about the power of value strategies and need to rediscover them every 10 years or so. This time is no different.

Growth has been in charge since 2009. Based on history, we can expect at least eight years of value outperformance when this growth cycle is done.

This next period could be the Golden Age of Value Investing. And for investors focused on buying great businesses at cheap prices, it could be one of the most profitable times you ever see in the markets.

As Dan points out, growth stocks have done extremely well in this bull market. But as the bull starts to slow down, cheaply priced stocks will be due for a comeback.

Recently, Dan told his subscribers about a stock that could give you the chance to see 20 times your money over the long term, beginning immediately.

He said, "If I had to put every penny of my life savings into one company, this would be it."

What We're Reading...

- Something different: A new $2 million all-electric "hypercar" accelerates faster than an F-16 jet.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

March 6, 2019