Some people like to invest in stocks. Some people like to invest in real estate. Some people like to trade commodities...

But all I want is an investment that goes up every year, regardless of what's going on in the stock market.

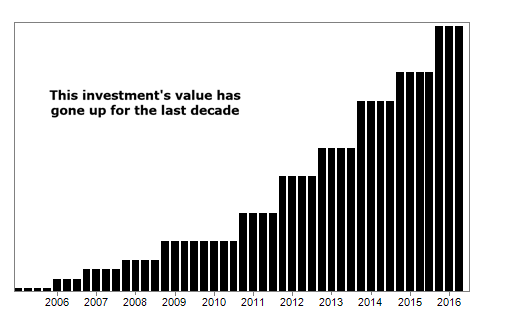

What you want is a chart that looks like this:

No, that's not a share-price graph. It's a picture of larger and larger amounts of cash placed directly in shareholders' pockets by a business that has paid higher and higher dividends each year.

We call these businesses World Dominating Dividend Growers (WDDG). WDDGs are often the No. 1 or No. 2 companies in their industries. And they have a history of rewarding shareholders with growing dividends.

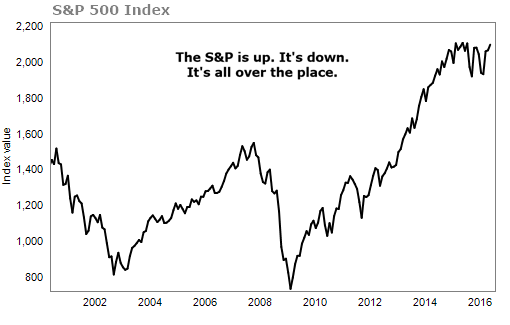

Let's compare that WDDG graph with a chart of the S&P 500 from 2000 through 2016.

It's important to understand that you cannot safely rely on the stock market's action as a source of investment return. No share prices march straight up forever. But everyone can invest in businesses with a history of consistently rising dividends. That's why investors who want to make consistent returns from stocks need to focus on dividends... and relentless dividend-growers like WDDGs.

When the dividend goes up, the true value of your investment goes up.

If you're buying an income investment, the investment's value is based on the income you receive. When the income rises, the value of the investment rises, too. The stock market might take years to recognize it. But smart income investors know that the price on any given day doesn't matter as much as the income you receive.

When you buy WDDG stocks and hold them for a long time, you're tapping into an income stream that rarely goes down.

Let me explain...

Collecting dividend payments year after year is one way to make consistent returns. But that is not enough if you want to grow the income these stocks pay you every year. The real key to high income comes from reinvestment.

Investors love dividend stocks these days. That drives up their price a bit. The best WDDGs don't always have very high current yields. Microsoft, for example, is a WDDG. It yields around 2.8%.

That's not very impressive when compared with some of the other dividend-paying stocks out there. But real income growth – the type that always goes up – can be achieved by reinvesting those dividends.

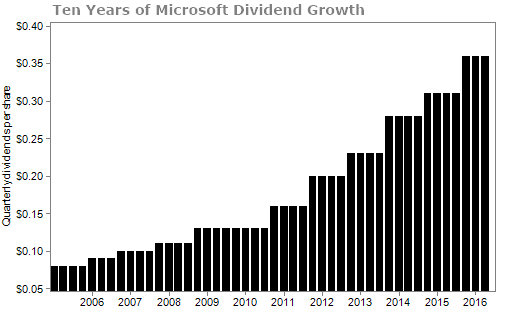

Let's take a look at Microsoft to see just what reinvesting in shares with a growing dividend can do.

Microsoft started paying a dividend in 2003. Since then, it has grown the dividend every year. In 2003, Microsoft's dividend was $0.08. For 2016, Microsoft is set to pay $0.36 per share in dividends each quarter. That's an incredible 350% increase.

For the last five years, it has increased its dividend nearly 19% a year... And I see no reason for growth to slow down much.

And Microsoft's dividend is safe, too. Microsoft's revenues have continued to rise every year, except for a small drop in the crisis year of 2009. But it has come back stronger than ever, so there's little reason to believe sales and profits won't continue to grow, even if there's another serious crisis.

Microsoft has a decent current yield. But you can build that into a much-better-paying retirement nest egg...

For example, say you buy 100 shares at $50 per share. Total cost: $5,000. The stock yields about 2.8%, and the dividend has been growing at 19% a year, so let's be conservative and assume that slows a bit to 10%.

At the end of the first year, you'll receive $140 in dividends ($5,000 x 2.8%). Since Microsoft raises its dividend 10% in Year 2, you'll earn $154 in dividends.

Repeat this process for 10 years, and you'll make $363.12 in dividends in the 10th year. That's a 7.3% dividend yield off your initial $5,000 investment ($363.12 / $5,000).

Accountants call this "yield on cost." Your cost was just $5,000, but you're now earning 7.3% instead of just 2.8%. A rising dividend payout is one of the strongest ways to build wealth in finance.

With Microsoft, in three years, you'll be earning a 3.7% yield over your cost. You'll be earning 4.5% over your cost in five years... and 7.3% within 10 years. In 20 years, you'll be earning an astounding 18.8% over your original cost.

Even so, you can earn more. The yield above is what you'd get if you took the dividends as cash for spending. Instead, when you plow them back in, buying extra shares through reinvestment, you'll earn an even higher rate of return. Take a look...

Let's assume you buy 100 shares at $50 each and reinvest all your dividends. Assuming 10% annual dividend growth and 5% annual share-price growth, you could turn an initial investment of $5,000 into more than $35,000 in just 20 years...

| No. of Years | Total Value |

| 0 | $5,000.00 |

| 3 | $6,825.70 |

| 5 | $8,043.03 |

| 10 | $12,481.83 |

| 20 | $35,355.69 |

As you can see, sitting back and letting your reinvested dividends earn their own dividends grows your investment dramatically...

What We're Reading...

- How to make a dollar grow more than you can imagine.

- Something different: Merriam-Webster answers the age-old question – is a hot dog a sandwich?