On February 24, 2022, Russia's tanks rolled into Ukraine...

As every news station began broadcasting images of Ukrainian President Volodymyr Zelenskyy in his olive-green sweatshirt, a crucial financial event took place away from the spotlight.

The United States and its G7 allies froze nearly $300 billion of Russia's assets.

Now, we can debate the merits of this action. Many people would not hesitate to call Russian President Vladimir Putin a cold-blooded killer. But the fact is, under international law, seizing another nation's assets like this is – at best – legally questionable.

As the Financial Times reported, any actions that cast doubt over the protection of central bank assets have "profound implications" for the financial system.

This seizure immediately woke non-Western nations up to just how vulnerable their U.S. dollar reserves were. And that sparked a chain reaction.

How do you think the authorities in China, India, Brazil, Turkey, or Saudi Arabia felt as they watched Russia's dollars get frozen?

The world's financial insiders realized the existing financial system was on fire. It wasn't backed by anything real and tangible. Therefore, there was only one exit from this burning building...

Gold.

During times of turmoil and war, gold has proven itself to be valuable. It has been an amazing store of value all throughout history, through every major crisis you could think of. This time was no different.

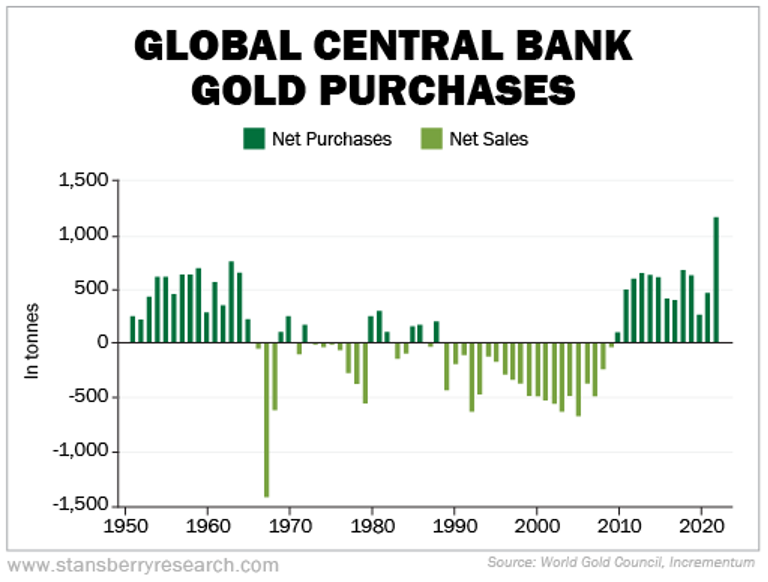

The chart below shows how central banks began purchasing large amounts of gold after the Russian invasion...

Specifically, the People's Bank of China added 62 tonnes (well, officially)... Turkey bought 148 tonnes... Egypt 47 tonnes... and India 33 tonnes...

Qatar, Iraq, and the United Arab Emirates – three major energy exporters – jumped into the top 10 gold buyers.

Some of this was to circumvent the Western sanctions on Russia. As the Economist reported a little less than a year after the invasion...

Almost no central banks keep roubles as foreign-currency reserves. For those countries that traditionally do a fair bit of business with the Kremlin – from Turkey to Turkmenistan – gold offers an alternative, if clunky, means of exchange. This motley group of emerging markets have been among the biggest buyers of gold this time around.

In the Western world, most people own little or no physical gold. With each decade, Americans move further and further away from real, honest-to-God money you can hold in your hands. They instead favor paper, credit-card debt, and risk.

In the East, it's just the opposite.

Their ancestors saved in gold, and this is what they have been taught as well. They know that precious metals – particularly gold – are the only risk-free money there is.

In India, for example, 87% of households own gold, even those at the lowest income levels. According to a recent survey, more than 75% of families in the poorest 10% still managed to buy gold.

Gold is flowing eastward at a staggering pace.

If you've been following me for long, you'll know I've been pounding the table to buy gold. Given the price of gold today – right off an all-time high – I've been right in my "gold crusade."

But the gains are far from over...

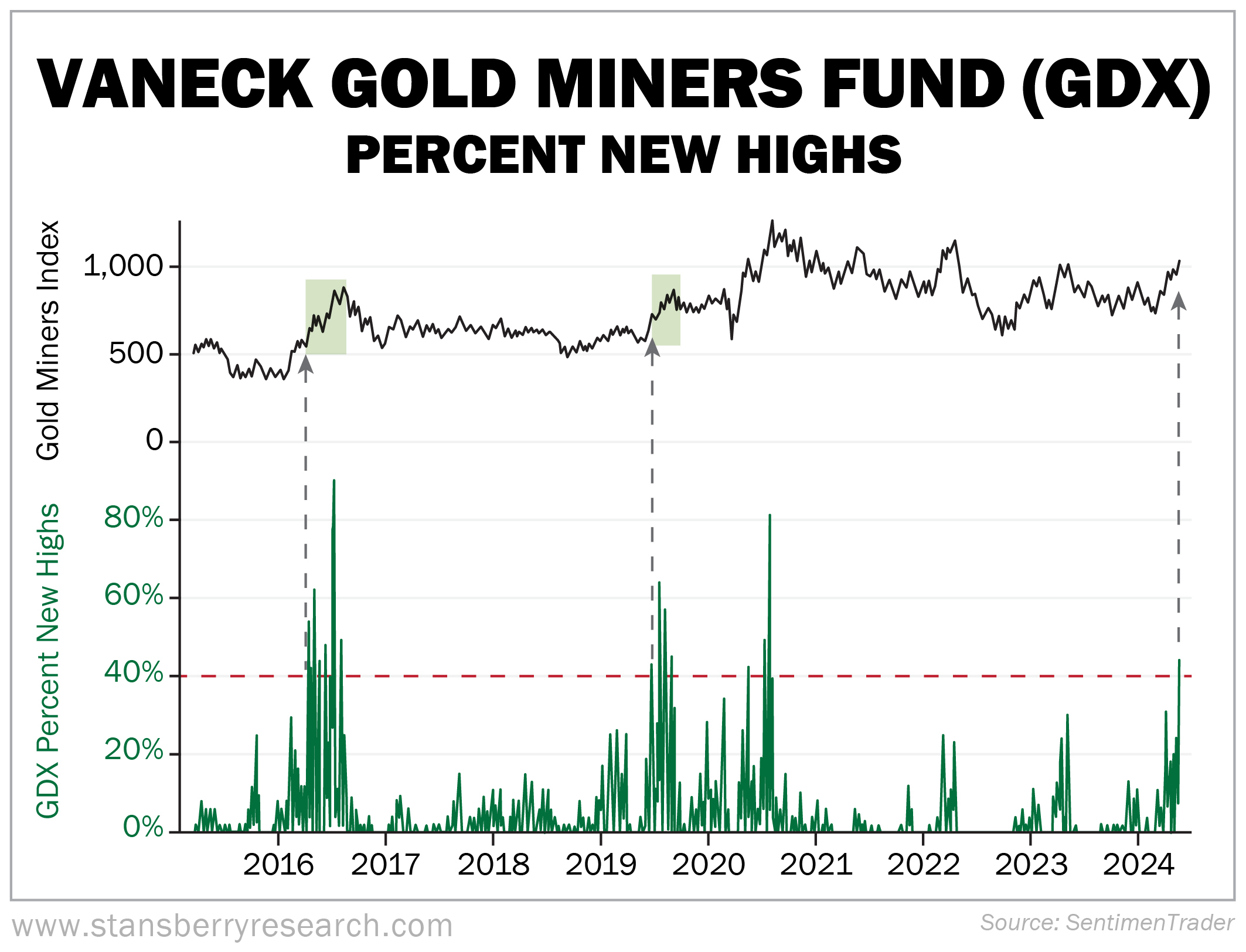

The chart below comes from Jason Goepfert over at SentimenTrader. According to Jason, more than 40% of gold-mining stocks recently hit a 52-week high. This was the first time this happened in more than a year... And the last few times we saw 40% of gold-mining stocks hit fresh highs, more gains followed.

Specifically, Jason said...

Over the past 30 years, when gold mining stocks have seen cycles in selling and buying pressure similar to the past few months, they showed gains 2-3 months later almost every time.

Given my fundamental outlook and Jason's data, the gains in precious metals and gold-mining stocks are far from over. I suggest you think about owning gold or gold stocks today if you don't have exposure in your portfolio.

And if you want to own some of the best gold stocks in the world, I suggest you check out this recent presentation from my colleagues Brett Eversole and John Doody.

Click here to learn more before this video goes offline.

What We're Reading...

- The gold, silver, and copper rally has just taken a breather – new highs are not that far off, experts say.

- Something different: Activist Elliott takes a $2.5 billion stake in Texas Instruments and urges the company to improve free cash flow.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

May 29, 2024