It's the largest U.S. bank failure since the 2008 financial crisis... and the second-biggest bank failure in U.S. history.

Silicon Valley Bank, the 16th-largest bank in the country, failed this past Friday.

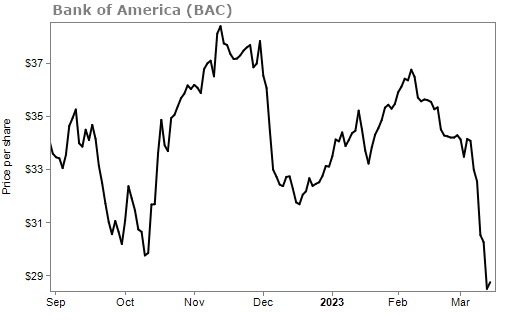

The news has sent shockwaves through the financial sector. Financials are down 14% over the past month. Even mega-banks like JPMorgan Chase (JPM) and Bank of America (BAC) have seen their share prices plummet as a result.

I (Jeff Havenstein) will get into why that's an opportunity in a moment. First, let's talk about what actually happened...

Silicon Valley Bank, or SVB for short, provided banking services to nearly half of the country's venture-capital-backed technology companies. For a long time, business was booming as SVB capitalized on the growth in venture investing.

Deposits in the bank grew from roughly $60 billion in 2018 to $189 billion in 2022.

In order to generate a return on all this cash – with interest rates at almost 0% at the time – the bank bought long-term debt securities.

Then, inflation happened. And to combat inflation, the Federal Reserve increased interest rates... by a lot. That made the value of these bonds go down.

And with the economic uncertainty that many startups faced over the past year, plus the lack of new cash rolling in, many of these companies were looking to get their money back to keep their businesses afloat.

SVB announced last Wednesday that it would be raising $500 million from venture firm General Atlantic while also unloading holdings worth roughly $21 billion at a loss of $1.8 billion.

What we saw next was an old-fashioned bank run. Customers withdrew $42 billion of deposits by the end of Thursday. The bank collapsed, though U.S. regulators said customers would be made whole.

This collapse happened just days after crypto-focused bank Silvergate failed. And just after the SVB news broke, New York-based Signature Bank had to be rescued by the government as well.

With that in mind, it's easy to understand why there is panic in the financial sector. Regional banks are being hit the hardest. But even some of America's biggest banks are seeing their share prices collapse, too.

I personally don't think we're going to see a collapse in the financial sector. This isn't 2008. Everything that happened to SVB and Signature Bank is not representative of the rest of the sector.

Instead, I think the sell-off is an opportunity to buy shares of some well-established banks at a discount.

One way to look at this is through a bank's total risk-based capital ratio. It's the ratio of total capital to risk-weighted assets. Under the federal rules, each bank must have a total risk-based capital ratio of 8%.

In the chart below, you'll see how major banks today have a total risk-based capital ratio well above the minimum. The ratio is just off its all-time high...

Major banks are well capitalized and can handle today's uncertain economic environment.

One of my favorite opportunities is Bank of America. This is a mega-bank that is well capitalized and does not have as-risky depositors as SVB or Silvergate.

In fact, rising rates are a good thing for banks like Bank of America...

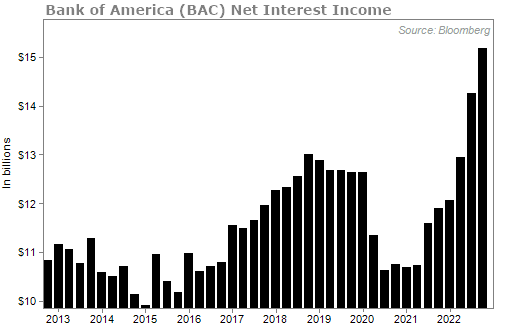

In its most basic form, a bank takes deposits and pays out some interest rate. Then it lends out that cash at a higher interest rate. The difference is called its "net interest income."

The higher the net interest income, the more profits for the banks.

Net interest income follows the overall trend in interest rates. With the federal-funds rate topping 4% and the Fed showing few signs of slowing, banks should enjoy high profits. Take a look at Bank of America's net interest income...

I see this dip as a buying opportunity as Bank of America is off its November highs by more than 20%...

Don't be fooled by what you've been reading in recent days. This is not the start of another 2008 financial collapse. It's time to start looking to buy the "babies thrown out with the bathwater" – stocks like Bank of America.

What We're Reading...

- Something different: United Airlines (UAL) shares tumble after airline forecasts first-quarter loss.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

March 15, 2023