It's no secret that the Federal Reserve is willing to do whatever necessary to keep the market afloat.

And this bodes well for one particular asset...

On March 23, the Fed announced it would purchase an unlimited number of Treasury bonds and mortgage-backed securities in order to support the financial markets. This is what's known as quantitative easing ("QE").

Central banks use QE to stimulate economic growth. By buying assets and lowering interest rates, the money supply increases. In theory, that should lead to more business investments and consumer spending.

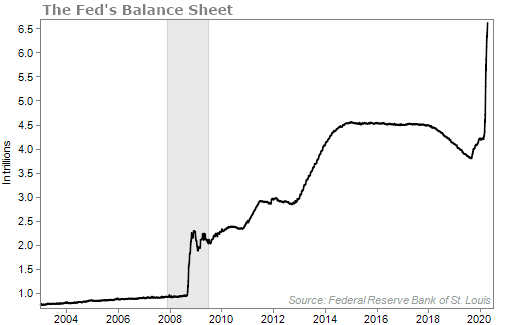

The Fed started using QE during the depths of the 2008 financial crisis... Its balance sheet ballooned from $900 billion in 2008 to $4.5 trillion in 2015.

Some believe the massive amount of QE helped prevent another Great Depression from occurring.

To combat the economic damage of our current shutdown, the Fed is growing its balance sheet once again. As of April 22, its balance sheet is at nearly $6.6 trillion, which is more than the gross domestic product of Japan...

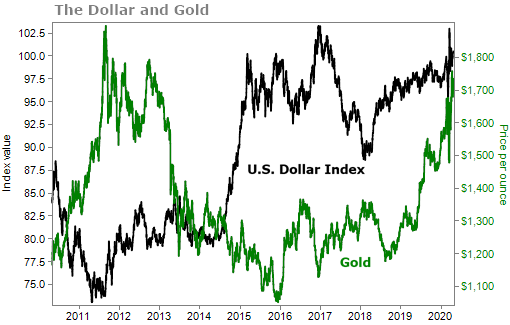

One of the problems with unlimited QE is that it significantly reduces the purchasing power of the U.S. dollar. And that's good for the price of gold.

You see, gold is the ultimate hedge if the dollar weakens.

That's because gold has no real industrial use. It's just a globally accepted store of value. Gold's value depends on the currency it's valued in, which for us is the U.S. dollar.

When the dollar is strong, the price of gold usually falls. When the dollar weakens, gold usually rises.

By no means am I predicting some doomsday scenario where the dollar collapses... but it will likely weaken in the coming months.

With U.S. debt levels headed toward the moon, investors may want fewer dollar-denominated bonds... which will also reduce the demand for dollars in general.

There's another reason why I expect the price of gold to do well in the near future...

Negative real interest rates. They're here.

As part of the Fed's plan to survive the COVID-19 crisis, interest rates have been cut to practically zero.

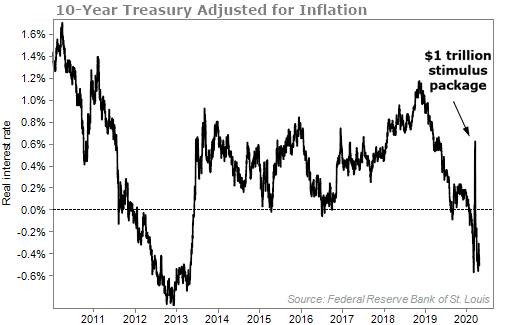

Savers hate this. They don't make anything on their investments. And when you consider inflation, it's a losing proposition. Here's a chart of the real interest rate (that's the official rate minus inflation) for the 10-year Treasury...

The 10-year Treasury rate spiked in mid-March because investors sold 10- and 30-year bonds in a hurry when news broke of a potential $1 trillion federal stimulus package. The sell-off caused bond prices to fall. When bond prices fall, yields rise.

But today, real interest rates are back to negative. And they'll likely remain negative for the foreseeable future with the 10-year Treasury yielding just 0.67%.

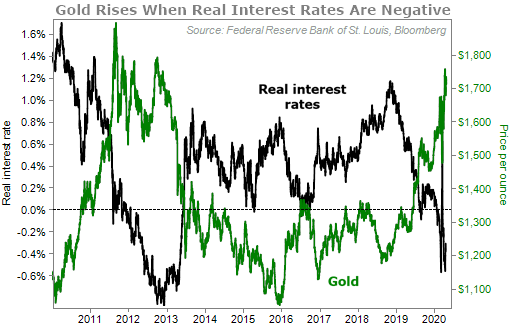

Now take a look at what happens when we layer the price of gold on top of the chart of real interest rates. It's no coincidence that when real rates were negative back in 2011 and 2012, gold was hitting new highs...

One of the big knocks against holding gold is that it doesn't produce anything. There's no yield. It just sits there. But when there are negative real interest rates, savers would rather own a safe asset like gold.

Demand for gold should remain strong.

Additionally, it's unlikely that the market volatility we're experiencing today is going away anytime soon.

In the coming months, we'll see many well-known businesses file for bankruptcy. We'll also see just how high the unemployment rate will be. And when the economy reopens, we are willing to bet that things won't return to "normal" as fast as everyone thinks.

I've long called gold a "chaos hedge" because it tends to perform well during times of economic crisis. There will be plenty of fear in the weeks and months ahead... and that should drive investors towards gold.

In a report titled "The Fed can't print gold," Bank of America (BAC) recently raised its 18-month gold price target from $2,000 per ounce to $3,000 per ounce.

And it's true... the Fed can't print gold. It can't be diluted like the dollar can. So investors feel that their money is safe in gold.

Stansberry Research's gold expert John Doody also believes that gold can move up to $3,000 per ounce. That's nearly 2 times higher than the current price of gold...

In short, all the pieces are present for the next great gold bull market to unfold.

You're likely to do well if you buy gold today and hold for the next year or so... But you can do even better by owning the right gold stocks. These stocks can significantly outperform the returns of gold and can make investors a small fortune...

John Doody and his business partner Garrett Goggin joined Stansberry Research publisher Brett Aitken on Monday morning for a "Gold Rally Kickoff Call" video conference. If you want to hear from a gold investing legend and want to learn how to make the most money from the coming bull market in gold, I suggest you watch their conference call.

You can watch it for free by clicking here.

What We're Reading...

- 'The Fed Can't Print Gold,' Bank of America Says.

- The Fed's low rates will punish people who save.

- Something different: Piglets aborted, chickens gassed as pandemic slams meat sector.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

April 29, 2020