Doc's note: We all know it by now... Real estate in the U.S. is booming. But what's driving the housing craze? And will the housing boom continue?

Those are the questions Dr. Steve Sjuggerud is answering today...

***

Housing was already a hot market. Then, COVID-19 struck...

It poured fuel on the fire. And it has led to one of the craziest housing markets of our lifetimes.

Maybe you've experienced this firsthand if you went looking for a new home or investment property this year. If not, I'm sure you've at least seen the craziness taking place.

The pandemic revealed a major imbalance in the American housing market. The reality is, we haven't been building enough homes.

Today, I'll explain the simplest way to see that... and most important, what it tells us about how long the current housing boom could last.

I covered this housing craziness earlier this year in DailyWealth. But it's worth looking at again. That's because this crucial piece is what everyone seems to miss when they look at the housing market today.

After the housing crisis, homebuilders practically walked away from the game. Homebuilding rates fell to 50-year lows.

That decline made sense. We were in the worst housing bust of our lifetimes. But everyone knew it wouldn't last forever. So you'd expect that building would have started up again soon enough.

Unfortunately, it didn't.

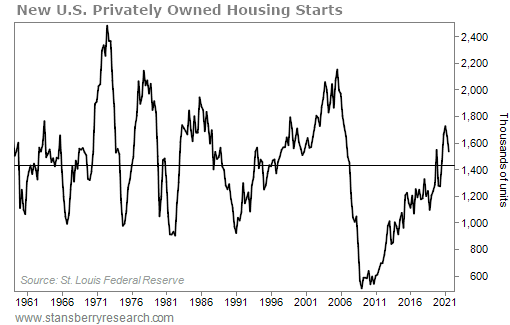

Instead, new housing construction stayed below average rates... for a decade. Take a look...

This chart shows new housing starts between 1961 and 2021. It measures the number of "housing units" that have begun construction in the U.S. in a given month.

This metric includes multifamily units, like apartments, as well as single-family homes. But we commonly use it as a way to look at homebuilding in a broad sense.

As you can see, residential construction fell off a cliff in the wake of the housing bust. The problem was that as the economy improved, homebuilders never ramped back up.

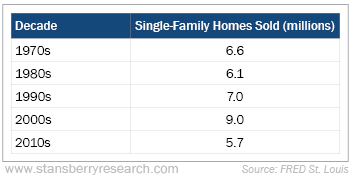

That's likely because home sales were incredibly low all through the last decade. You can see it in the table below, which breaks down the total number of single-family homes sold in the U.S. by decade. Take a look...

In the 2010s, fewer single-family homes were sold in the U.S. than in the 1970s... Yet the U.S. population has grown by roughly 125 million since then!

After the devastating housing bust, it's no wonder that homebuilders slowed the pace of development as demand fell. But they slowed it too much and for too long... And it's causing real problems today.

Single-family homes have become a prized commodity in America. Demand has exploded again – far beyond the number of homes on the market.

All of this tells me that we could see another long-term boom for housing prices over the course of this decade. The last decade was simply too slow for it not to happen...

The National Association of Realtors believes the U.S. is short about 2 million single-family homes... and about 3.5 million multifamily units.

Looking at the single-family homes alone, that's roughly $700 billion worth of inventory based on today's median home price. The scale of this deficit is massive. And that's just to get us in line with where we "should be" today... not with future demand.

America has a lot of building to do. That's why we're seeing such an incredible boom in the housing market today... And it's why that trend will continue for years.

Good investing,

Steve Sjuggerud

P.S. The housing boom is my No. 1 prediction for the 2020s. I doubt anything else will come close. And you can position yourself to profit in minutes.

I recently sat down to cover the full details of what's coming. I urge you to check it out now to learn why several companies could be positioned for 1,000% gains... You can see my whole presentation for free right here.