We're already in a recession...

According to a survey from Investor's Business Daily's IBD/TIPP Poll, that's what 58% of Americans believe.

With our daily lives getting more expensive, stocks continuing their downward trend, and the Federal Reserve signaling more drastic action to fight inflation... that percentage is likely going to be higher this month, too.

But I'm not so sure we're there yet...

Now, this might sound odd. After all, the traditional definition of a recession is two consecutive quarters of negative growth.

In the first quarter of this year, the economy contracted by 1.6%. In the second quarter, the economy contracted by 0.9%.

Boom! We're in a recession.

But there's a lot more to calling an official recession...

The responsibility of declaring an official recession falls to the nonprofit National Bureau of Economic Research ("NBER"), a group of academics and economists across the nation. Even though there have been two consecutive quarters of negative economic growth, it hasn't blown the recession whistle just yet.

The NBER defines a recession as a "significant decline in economic activity that is spread across the economy and that lasts more than a few months."

It's a pretty broad definition. But it means that this group looks at much more than gross domestic product ("GDP") headlines. It considers employment, business sales, manufacturing production, and consumer spending and income.

Right now, the unemployment rate is at 3.5% – tied for a 50-year low. Profit margins for major businesses are just a touch off their all-time highs at nearly 12%. Total corporate profits are up 8.1% from a year earlier... And finally, consumer spending for July was up 8.7% from where it was a year ago.

That doesn't sound recession-y to me.

The labor market in particular is historically strong with the "quit rate" at 2.8%. Typically, folks only choose to leave their jobs when they can find more money at another position.

Of course, there's more data you can look at that proves the opposite point. And there's no doubt that some parts of the economy are struggling and stalling a bit. It's not hard to understand why – with inflation coming off of 40-year highs, the Fed raising rates, and the disruption in global supply chains.

But calling this an official recession already seems premature.

Let's talk about GDP and gross domestic income ("GDI") for a moment.

For every dollar someone spends to buy a good or service – a movie ticket or a new watch – another individual earns a dollar of income to make and deliver that good or service. GDP captures the spending side of these transactions. GDI captures the income side.

In a perfect world, GDP and GDI would be the same. But we don't live in a perfect world... There is always some difference because they are measured using different data sets and different sources.

Still, there shouldn't be much of a gap. Many economists get a clear picture of the economy by averaging GDP and GDI.

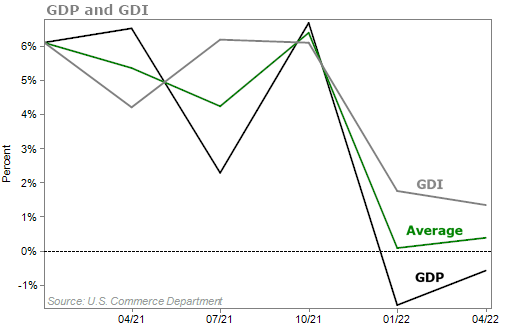

This year's gap between GDP and GDI has been unusually large.

According to the U.S. Department of Commerce, during the first half of the year, GDP contracted at a 1.1% annual rate, adjusted for inflation. At the same time, GDI expanded at a 1.6% annual rate. The average of the two comes out to about a0.2% annual rate, adjusted for inflation, over the first six months of the year.

You can see the divergence by using quarterly data...

Looking at the average line, the economy is not contracting. It's just remaining relatively flat.

Also, some studies have shown that when initial estimates of GDP and GDI differ notably – like they do today – GDP tends to be eventually revised toward GDI. That means it's possible that most recent GDP contraction might be revised away in the years ahead. Only time will tell...

For now, we're in a strange place.

There are all these bad things happening to the economy. But we're still seeing signs of strength, especially in the labor market.

We are going to be dialed in and watching all the data that comes out over the next few months. It's possible that inflation keeps draining consumers, along with rising interest rates. If that's the case, we could very well see the NBER call for an official recession soon.

But if we see inflation slow, the Fed might become a little more conservative when hiking rates. We could then see the economy get back on track.

Let's see what happens.

What We're Reading...

- What is gross domestic income (GDI)?

- Key U.S. growth measures diverge, complicating recession debate.

- Something different: NASA delays debut Artemis flight of new moon rocket after engine cooling issue.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein with Dr. David Eifrig

August 31, 2022