If you've spent any time scrolling through social medial platforms like Twitter or Facebook recently, you've probably seen the meme of Al Pacino in The Godfather: Part III.

Even if you haven't seen the movie, you probably know the line I (Jeff Havenstein) am talking about. Pacino's character, Michael Corleone, had been trying to become a legitimate businessman for years, but found it was difficult to leave a life of crime for good. He famously said, "Just when I thought I was out, they pull me back in."

Social media has been having a field day with the line recently. I've seen it used in all different kinds of memes and GIFs.

And it's being used because of the return of the "meme stocks." (I first wrote about these stocks back in February when they dominated the news.)

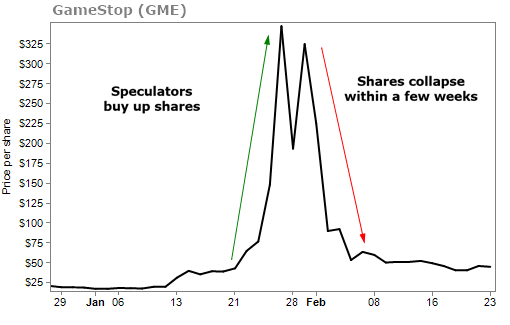

As you'll likely remember, GameStop (GME) polarized the investment world a few months ago. Shares of the outdated retailer surged after a group of Reddit traders pumped up the stock. It was up nearly 800% at one point, in just over a week.

GameStop and other meme stocks were all anyone could talk about at the time. (On a personal note, I recently got new neighbors. I was talking with them the other day and they said they were able to afford the down payment for the house because they bought into GameStop early... and used all of their winnings for the down payment.)

After a brief pause, the meme stocks are back...

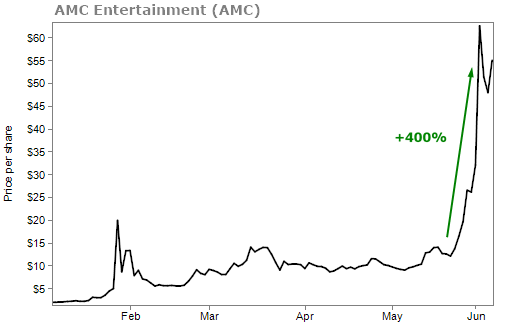

This time around, the stock that's really stealing the headlines is AMC Entertainment (AMC). The movie-chain has gone parabolic. It was up over 400% in just two weeks...

But what caught my eye over the last few days is that these Reddit traders – usually 20- and 30-year-old males – have been getting into the options market. Specifically, they have been buying "call options" to speculate.

A call option is a contract that gives the buyer the right, but not the obligation, to buy shares of a stock at a specific price before a certain date.

Options are great for speculators because they don't cost as much as buying shares of a stock. And speculators are buying AMC calls in droves...

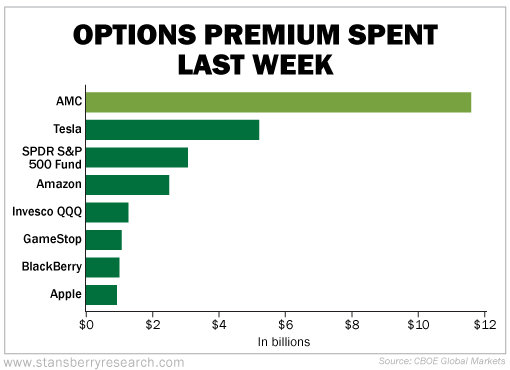

According to data from CBOE Global Markets, traders spent $11.6 billion on AMC options contracts last week... That's more than what was spent on contracts tied to the SPDR S&P 500 Fund (SPY), Invesco QQQ (QQQ) and Tesla (TSLA) combined.

For those who bought call options on AMC early, congratulations. You likely have enough for a down payment on a new house.

But for anyone buying them now – well, good luck. Buying options is a tough game to play. Especially now because AMC options are so expensive.

Let me explain why...

Let's say a stock is trading at $100 and you think the stock is going to rise. You can buy shares of the stock and if it rises to $110, you'd make 10%. But you could also pay $2 for a call option with a strike of $105, so that would cost you $200.

Owning this call means you can buy 100 shares for $105 each at any time before expiration. Let's say you're right and the stock rises to $110. You can use your option to buy shares at $105, and you can sell them immediately in the market for $110. That means you can earn $5. Since you only paid $2 for the option, you'll have a profit of $3 and a gain on your capital of 150%. That's a lot more than a stock investor who would've just made 10%.

But let's say the stock doesn't rise and it stays at $100. You have the right to purchase shares for $105, but that wouldn't make sense. You'd be losing money. Since you're under no obligation to buy shares, you can just forget about it. So you'll just take the loss on your $2 investment.

Now, that doesn't sound like that much. And if you think the stock has a good chance of rising without a major risk of falling, it might be a smart speculation.

I have no problem with folks who want to speculate with a small amount of money. I do it from time to time as well. It's fun. It's something to talk about with your friends and family.

But I only do it with money I'm willing to lose. And I'm definitely staying away from buying options on these meme stocks.

As I mentioned before, if you want to buy calls on AMC right now, they're expensive. You'd likely spend around $50. (Remember that each option contract controls 100 shares, so the total cost to you is $5,000.) And the chances of your speculation working out are slim.

Take a look at what happened to GameStop when speculators swarmed it...

Back in January, we saw frenzied buying of GME, but then most of the early buyers quickly cashed out as shares soared. So it only took a couple week for the stock to correct back to a more expected price.

AMC is likely to turn out the exact same way. It won't be long for shares to fall again, and for lots of folks to lose money.

Meme stocks are back – and they are fun to talk about. It's even fun to throw a small amount of money into them and see if you can ride the wave. (Please, no one put your rent money into them.)

As for buying speculative call options – especially on the advice of random people on Reddit – my advice would be to stay away. You can find better ways to lose money.

What We're Reading...

- AMC and Wendy's are leading the "meme stocks" rally.

- SEC considers crackdown on stock gamification.

- Something different: Top NBA prospect Jalen Suggs shares the best money advice he's ever gotten.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein with Dr. David Eifrig

June 9, 2021