Americans are in a tough spot...

According to new data from the U.S. Federal Reserve Board's 2022 Economic Well-Being of U.S. Households report, 35% of adults in the U.S. said they felt that they were worse off financially last year than they were in 2021. That's the worst year-over-year change since 2014. Americans are piling on more debt, saving less, and spending more of their income each month on essentials.

The Fed's report found that many Americans are cutting costs where they can. For example, they're switching to cheaper brands of products, using less of the things they do buy, and holding off on big purchases until they feel more financially stable.

The stock market hasn't helped much... Last year, the S&P 500 Index fell nearly 20%. And while stocks are up this year, we haven't made up the loss yet.

While everyone is feeling the pinch, it's especially bad for anyone retired or planning to retire soon. A report from Fidelity found that from late 2021 to late 2022, folks' retirement accounts lost nearly a quarter of their value. Without that money, more older Americans are delaying their retirement or – if they've already retired – going back to work.

It doesn't have to be that way... Proper asset allocation can solve much of the problem that Americans saw in their retirement accounts.

I'm not just talking about what stocks you're investing in, but how you distribute your portfolio among different asset classes – stocks, fixed income, cash, and chaos hedges (like precious metals). Keeping your wealth stored in a diversified mix of investable assets is the key to avoiding catastrophic losses.

If you keep too much wealth in one or two stocks and the stock market goes south, you'll suffer badly no matter how good the companies are. Consider what happened to a friend of mine... He had allocated virtually all of his wealth into a single asset – the stock of one company. When a crisis struck that company, he was in deep trouble.

Or if you had quit your job to move to Florida and put all your wealth in rental real estate, as some folks did during the mid-2000s housing bubble, you'd be wiped out in a big real estate crash (like those poor souls were in 2008).

The same goes for all asset classes... gold, oil, bonds, real estate, blue-chip stocks, etc.

Concentrating your retirement nest egg in just a few stocks or a few different asset classes is way too risky. Keeping your eggs in one basket is always a fool's game.

While lots of people have some sort of exposure to stocks, bonds, and real estate, many overlook one of my favorite chaos hedges – gold. Several small surveys over the past few years found that only about 10% to 12% of people own any gold.

One way to invest in gold is to own some of the metal yourself. But there's an even better way – if you know what you're doing.

During his recent 2023 Gold Rush event, gold-investing legend John Doody explained...

There's a right way and a wrong way to invest in gold during times like this. Get it right, and you could make huge amounts of money. Get it wrong... well, you could be wiped out.

If you missed John's Gold Rush presentation, and you want to learn about what he says is possibly the most lucrative gold opportunity of his lifetime, click here to watch it now.

Now, let's get into some of the things you've had on your minds this week. As always, keep sending your comments, questions, and topic suggestions to [email protected]. We read every e-mail.

Q: I thought that Dr. Eifrig wrote an article about long-term care insurance and how to manage the extreme cost of long-term care. I am not able to find it on the Health & Wealth Bulletin. Can you direct it to me? – T.O.

A: The investment you're thinking of is called Asset-Based Care ("ABC"). Essentially, an ABC is an annuity on steroids. ABCs are safe and liquid, and they yield more than most certificates of deposit ("CDs") at your local bank.

You may have seen the full report we prepared for paid Retirement Millionaire subscribers detailing what we love about ABCs and how you can get started with them. Subscribers can read that here. If you're not already a subscriber, sign up now to get access.

Q: What are some good S&P 500 ETFs to invest for the long term and let the money compound in a young adult's Roth IRA? – J.B.

A: There are a lot of S&P 500 exchange-traded funds ("ETFs") to choose from. They all aim to duplicate the performance of the S&P 500 Index. So the answer to this question mainly comes down to fees.

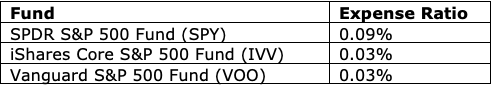

Since all funds are essentially the same, simply choose the one where you pay the least amount of fees. Here are some of the biggest S&P 500 funds and their expense ratios...

SPY is the most liquid S&P 500 fund. But it also has a higher expense ratio than IVV or VOO. Both IVV and VOO offer some of the lowest expense ratios you'll find, and that often makes them the best choice for long-term investors. Plus, both funds have plenty of volume.

Picking between a 0.09% fee and a 0.03% fee may not seem like a big deal – $9 versus $3 snipped off the top of a $10,000 investment once a year – but over time, it will add up. Not only will that fee increase as the fund goes up in value, but any money you save on fees will also compound over the years.

There's no reason to give away money for nothing. You can't go wrong buying IVV or VOO if you plan to hold for a long time.

What We're Reading...

- Did you miss it? Avoid this common investing mistake.

- Something different: Is California becoming uninsurable?

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

June 2, 2023