If you're a Wells Fargo (WFC) shareholder, you're not too happy today.

The banking giant plunged 5% yesterday after it reported a terrible quarter...

Wells Fargo had a net loss of $2.4 billion in the second quarter, which was much worse than analysts expected. This is Wells Fargo's first quarterly loss since the Great Recession.

Part of the problem is that the bank set aside $8.4 billion to cover losses from loan defaults because of the coronavirus pandemic.

With millions out of work, it was expected that some of its loans would go bad... But with Wells Fargo setting much more money aside than analysts expected, it looks like the loses could be much worse than anticipated.

Perhaps the worst part for shareholders, Wells Fargo slashed its dividend. Last quarter, it paid a quarterly dividend of $0.51, and going forward, it will only pay $0.10.

Wells Fargo has typically paid a high dividend yield. And now with such a low dividend, more income investors may want to jump ship. And as the pandemic continues to drag on, it's likely going to take a while for the stock to recover... especially since Wells Fargo is already down nearly 55% this year.

Put simply, it's been a brutal year for shareholders. Here's what CEO Charlie Scharf had to say...

We are extremely disappointed in both our second quarter results and our intent to reduce our dividend. Our view of the length and severity of the economic downturn has deteriorated considerably from the assumptions used last quarter, which drove the $8.4 billion addition to our credit loss reserve in the second quarter

Wells Fargo isn't the only bank going through tough times. Financial stocks in general are down 23% in 2020. Again, given the economic standstill that we've seen for much of the year, that makes sense. (Although recent results from JPMorgan Chase and my old firm Goldman Sachs are showing that they may have some life finally.)

But between bank stocks and energy stocks – which have gotten crushed with the price of oil so low – these are two of the most hated groups of stocks in the market.

A close third is small-cap stocks...

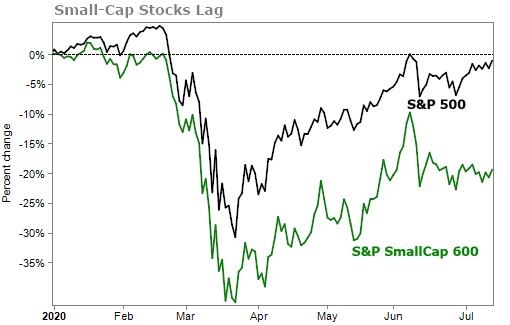

While the S&P 500 Index is nearly flat for the year, the S&P SmallCap 600 Index is down around 20%.

I've been saying for a while now that this is a small-business recession. The smaller companies are the ones impacted the most. They don't have the cash reserves like the larger companies and can't afford a couple months with no operations.

It's been the mega-stocks like Amazon (AMZN), Microsoft (MSFT), and Apple (AAPL) that have been driving the market higher.

Investors feel like their money is safe in these giants. And since they have been moving higher the past couple months, investors want to continue to ride them higher.

Folks have been so consumed by the FAANG stocks we all know that they probably haven't heard much about small-cap stocks. But you should think about them. There are barely any eyeballs on the smaller stocks... and that means there is tremendous opportunity.

My colleague and good friend Professor Joel Litman believes that investors can make life-altering gains in the smallest of stocks – microcaps.

Investors tend to hear microcaps and run away... They think they're too dangerous. Joel believes investors shy away from microcaps for three main reasons...

- Lack of liquidity

- Zero Wall Street coverage

- Many institutional investors simply can't buy microcaps because of their own internal rules

But when you add all of these up, all it means is that there can be inefficiencies in the microcap world. That can lead to 1,000%-plus winners...

For example, a microcap stock could have strong cash flow and a business shielded from competition... But if no one is paying attention to the company, it could trade sideways for some time. Eventually, its superior business model will attract the eyes of investors... And that's when the stock could skyrocket.

The trick is to get in before the rest of the world gets interested.

With a guide like Joel Litman, you can do exactly that.

In the wake of the 2020 coronavirus crash, Joel and his team ran "forensic analysis" on the entire stock market... And they were surprised to discover that the biggest distortions have occurred in microcap stocks.

Joel believes microcap stocks have far bigger upside than any other group of stocks over the next several years. In fact, he has used forensic analysis to identify seven tiny stocks in particular that he believes have 1,000% upside from here...

Click here to watch a recent interview with Joel and learn all the details.

What We're Reading...

- Wells Fargo shares tumble 5% after posting $2.4 billion loss.

- Moderna coronavirus vaccine shows 'promising' safety and immune response results in published Phase 1 study.

- Something different: 'Jaw-dropping' global crash in children being born.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

July 15, 2020