Folks thought my plan was doomed...

I wanted to gather a team of health experts who'd join me in researching investment ideas in one of my favorite market sectors: health care.

Everybody I talked to agreed that we'd find incredible investment ideas... and that we'd never find anyone who'd want to read them. Health care is a complicated business, and it doesn't capture folks' imaginations like speculating on meme stocks or artificial intelligence.

Still, nearly a year ago, Stansberry Research agreed to help me launch my newsletter called Prosperity Investor. And fortunately, the doubters were wrong: While we are finding exceptional stock recommendations, thousands of folks have understood the opportunity and joined us.

Our all-star team tracks the sector to help subscribers unlock the massive possible gains by navigating the tricky and complicated world of investing in health care.

First, Thomas Carroll is a health care investing legend. Fortune magazine once named him the No. 1 health care analyst in the U.S. He holds a master's degree in health care finance from the Johns Hopkins Bloomberg School of Public Health.

John Engel is a former research scientist and world-class tech and biotech analyst. He holds a Master of Science from Johns Hopkins University and went on to work in biotechnology startups and world-renowned pharmaceutical companies.

And, of course, for readers who might not know, I spent years trading at Goldman Sachs before changing careers to become an ophthalmologist. Now, for more than 15 years, I've shared everything I've learned in finance and medicine to help readers live a healthier, wealthier life.

At Prosperity Investor, our team looks for investments that will not only provide the opportunity to create generational wealth but will improve the quality and length of our lives. The next decade will bring us amazing advances in managing our No. 1 asset – our health.

We're all customers when it comes to the $4.3 trillion health care industry. Because of that, demand in the sector will only increase as medical science makes advances we could only dream about.

And health care is an industry that pays no matter what's going on. When times are tough, we can eat out less at restaurants, scale down our vacation plans, or hold off on upgrading our TVs. But when we get sick, there aren't many corners we can cut.

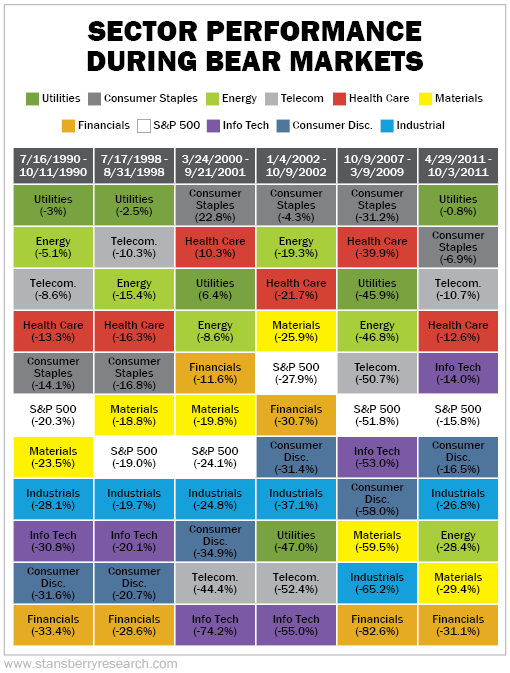

Take a look at the 10 broad sectors of the market and their bear market performances from 1990 to 2011...

This table offers some clear lessons. Utilities, consumer staples, and health care stocks offer opportunities to safeguard your wealth.

That's why Tom, John, and I created a newsletter that not only focuses on how to be healthier, but how to profit from the companies that are leading the future of the health care industry.

Our company, Stansberry Research, has a long history of spotting groundbreaking medical advancements before the U.S. Food and Drug Administration ("FDA") approves them. We've shown some readers how to make double- and triple-digit gains within a few months of publishing our advice.

But Tom recently uncovered a story that's far bigger than anything we ever reported on in the past.

It's the "great white whale" of FDA-approval stories. And Tom believes we're in the early days of a massive shift in the world of health care.

And one company stands to benefit more than the rest.

Click here to learn more about this remarkable story.

Now, let's get into some of the things you've had on your minds this week. As always, keep sending your comments, questions, and topic suggestions to [email protected]. We read every e-mail.

Q: If I want to add gold to my holdings, is buying physical gold (like bars and coins) preferable to stocks? – D.H.

A: Buying physical gold isn't as simple as buying gold stocks. You have to find a reputable dealer, figure out where to store it, and then accept that gold pays no interest or income.

So it depends on what you ultimately want to hold gold for. If you're wanting to hold gold in case of a major currency, economic, or societal collapse, you'll have to make the effort to buy physical gold.

But if you just want some gold in your portfolio as a chaos hedge, go for the easier option – gold stocks.

To us, gold stocks count as a chaos hedge just like physical gold. The quickest and easiest way to get direct exposure to the price of gold is through SPDR Gold Shares (GLD). The fund holds actual gold bullion in a London vault and tracks the price of gold well. Owning this fund is less risky than buying shares of a gold miner, which will be more volatile than the price of gold, but it still just takes a few clicks in your brokerage account.

Q: You mentioned a few types of meditation, but which type do you think would work best for someone with a wandering mind and who has a hard time sitting still? – C.G.

A: You're in good company, C.G. Anytime we write about meditation, we always get e-mails from folks who think it can't work for them and people who've just given up after trying once. Our own managing editor has these same issues with meditation.

The first thing to remember is that you don't have to sit quietly and still while you meditate. It's OK to fidget a bit... It's OK to let your mind wander. If you want to try more traditional styles of meditation – like Transcendental Meditation – take a moment to recognize these times and then get yourself back to a quieter place.

And if that doesn't work for you, I'd highly recommend the movement meditation style we wrote about on Tuesday. This forces you to concentrate more on what you're doing since you have to focus on your movement. It also takes some of the pressure off since you're not forced to sit still.

Let us know how you get on.

What We're Reading...

- Did you miss it? Three ways to make the most out of your meditation.

- Something different: How hot dogs became Norway's national snack.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

June 9, 2023