There's a crisis in the U.S that few people are concerned about.

It's not about corporate America's love affair with debt. (Although I hope you have been paying attention to it.) It's not about a run-up in risk assets or anything like that...

I'm talking about a savings crisis.

The numbers are shocking.

Regular readers know that I preach saving a good chunk of your money every month. I always say that you should have enough cash available to cover at least three months' worth of expenses in case things go bad. And trust me, things go bad all the time.

Maybe you lose your job... or your car breaks down... or there's an unexpected hospital bill that's going to set you back a few thousand dollars. There are so many things that can go wrong – you need to have money set aside to be ready for them.

But most Americans aren't able to afford surprise expenses. In fact, the Federal Reserve reports that about 40% of American households would have difficulty paying for a $400 emergency expense. If an emergency did occur, they would have to sell something or borrow money to cover it.

That is mind-boggling to me. When I was growing up, it was second nature to save your money. But today, people need the newest pair of sneakers or need to go on a fancy vacation... Even though they can't cover a $400 emergency expense. It makes no sense.

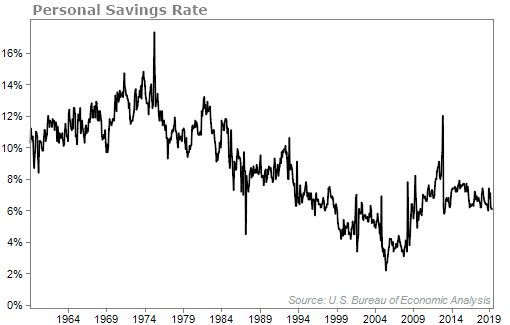

You can see how the savings rate in the U.S. is in a 60-year downtrend...

Although the savings rate is up from a 2.2% low in 2005, it is still incredibly low compared to the double-digit savings rates in the 1960s and 1970s.

According to Northwestern Mutual's 2019 Planning & Progress Study, 15% of Americans have no retirement savings at all. And the numbers were not skewed by younger Americans who haven't been working long enough to save... According to the study, 14% of both Gen X-ers (ages 39 to 54) and Baby Boomers (ages 55 to 73) have nothing saved.

If you fall in this category, you need to start saving ASAP.

Even if you can't afford to put away $1,000 every month, put away whatever you can – even if it's only $25 a month. It doesn't sound like much, but it's all about making saving a habit.

Perhaps the most shocking thing about saving is regarding the younger generation...

They have no clue about 401(k)s. It's pretty scary.

If you're not taking advantage of your 401(k) or your working child is not, let me pose this question...

If I told you that you could have an account where you could put $1 in today and immediately have $1.50, and then you can build on it for 30 years tax-free, would you do it?

Of course you would... That's the best return on investment you could ever achieve. Virtually everyone has access to that deal but very few take advantage.

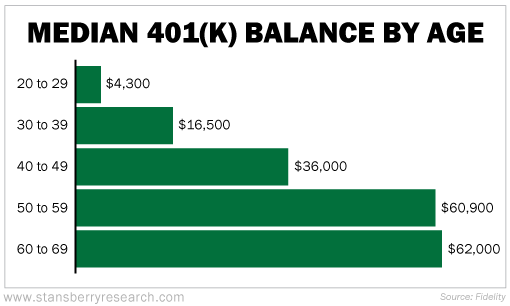

The chart below shows the median 401(k) balance by age as of the first quarter of this year. As you can see, most Americans do not have enough in their 401(k) by the time they hit retirement age...

Here's my advice...

Always contribute to your 401(k) and maximize your employer match. I'd recommend starting your 401(k) even if you've got a little credit-card debt and before really tackling your student loans – at least up to the employer match.

It's free money. You wouldn't turn down a free $20 on the street... so why would you turn down free money from your employer match?

And even if you are well off and have been saving for years, I still encourage you to talk about this with folks who are close to you. Ask your children if they are saving. Ask your neighbor or your nieces and nephews.

We're in a savings crisis. It doesn't always make the front-page news but unless we start tucking away more money each month and encouraging others to do so, it's going to continue for years to come.

There are plenty of ways to store your savings... but one thing I would encourage all my readers is to have a portion in gold. It's the ultimate "chaos hedge."

Tonight, Stansberry Research is hosting the 2019 Gold Rush event with legendary gold investor John Doody. And just for logging at 8 p.m. Eastern time tonight, you'll be eligible to win as many as 13 MS64 Saint-Gaudens gold coins – for FREE.

That's not a bad way to bolster your savings. You'll also hear how a massive trend is now underway that could make you five times... 10 times... maybe even 20 times your money in the coming weeks.

Click here to reserve your spot.

What We're Reading...

- Americans have nothing saved for retirement.

- Something different: The Fed chief wedged between a slowing economy and an angry president.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

August 21, 2019