The bull market has run for more than seven years now. Crisis and ruination seem like they're just around the bend...

The mainstream financial media are wringing their hands and agonizing over all the things that could send the markets or the economy into a tailspin.

And no one can guarantee when the economy might enter a protracted downturn. Stocks started the year on a sour note and have been volatile ever since.

But emotions aside... the data that tell us what's really happening in the everyday economy – where people drive to work, buy groceries, and pay their credit-card bills – say American consumers are as strong as they've been in a while.

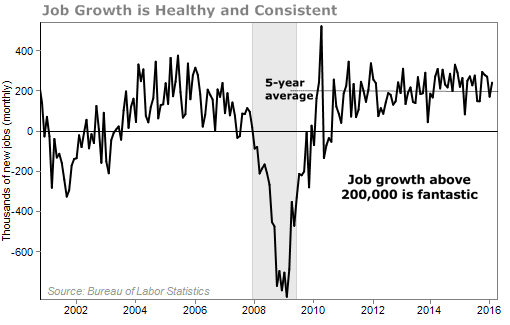

The strongest signal of an economy's health is job growth and employment – when employers reach out to hire folks. In terms of the economy, each of those hires represents a new consumer with disposable income.

And the numbers have been consistent... The Bureau of Labor Statistics' job reports show a record 66 straight months of positive job growth.

For a healthy economy, we want to see job growth in the neighborhood of 200,000 per month. And we've averaged 203,000 going back to October 2010, as you can see in the following chart...

Not only are more folks working, but folks are working more...

The length of the workweek has been expanding consistently since the end of the financial crisis. At the depths of the recession, the average workweek was 33.7 hours. Now, it's up to 34.4 hours. That's good: It means less of the employed are stuck in part-time jobs.

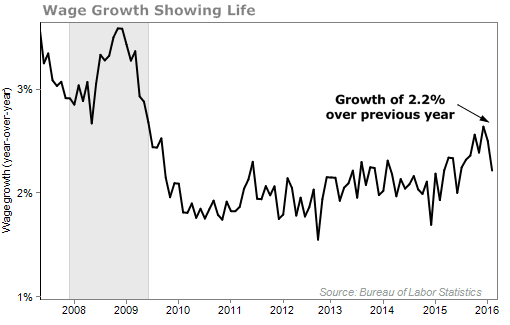

And we're finally seeing wages growing.

Wage growth has been slow. During the first few years of the recovery, workers' wages showed slowing signs of growth. But it's starting to show up now. This February, workers earned 2.2% more than last February...

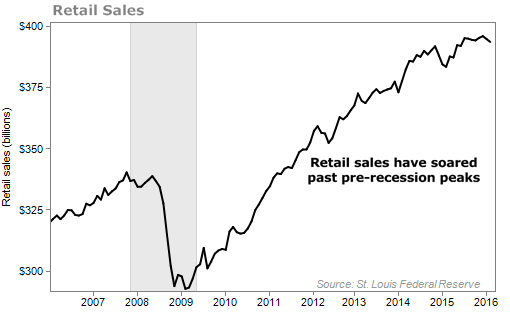

More jobs and rising wages mean that folks are spending more...

Retail sales continue to climb higher. We're well past the peaks of pre-recession times.

Looking at the above chart, it's clear that people are spending money. More importantly, Americans can afford to spend more.

The American household's balance sheet is stronger than it has been since 2003. The average household could pay off its debt with one year of its disposable income. That's down about 23% from 2007, when it would have taken 1.33 years to pay off a household's car loans, credit cards, student loans, etc.

Right now, the typical American consumer has a healthier wallet than he has had in a long time. And the strongest signal of economic health continues to look resilient.

This doesn't mean that you should ignore the possibility of a prolonged downturn in the market...

Good investors prepare for "bad" times by maintaining diversified portfolios that include some assets with prices that move independently from stocks – assets that we call "chaos hedges," like gold, silver, and even farmland. That little bit of protection is key to sleeping well at night.

I just recommended my Retirement Millionaire subscribers buy shares of a discount retailer that is benefiting from thriving urban professionals.

I also told subscribers why now is a great time to buy my favorite "chaos hedge" – gold.

If you're a Retirement Millionaire subscriber and you haven't yet read our April issue, it's right here.

And if you're interested in creating an entire gold portfolio, Porter Stansberry and his team just launched a new advisory service, Stansberry Gold Investor.

If you missed their April 6 Emergency Briefing about gold, you can watch it in full here.

What We're Reading...

- Steve Sjuggerud: Gold's shocking benefit that nobody's talking about.

- Americans are still really worried about the economy.

- Something different: Did ancient human sacrifice help create today's modern society?