Doc's note: Today, we're continuing our essay series from my colleague Ben Morris, the editor of DailyWealth Trader.

Last week, Ben detailed how the relationship between the dollar and commodities is breaking down. In today's issue, he's talking about a commodity that's hitting a decades-long low... and why it could start to rise.

***

In January 2016, the Bloomberg Commodity Index hit its lowest level ever...

The index – which was created in 1991 – tracks a basket of about 20 global commodities, like crude oil, gold, copper, corn, and natural gas. And it had plunged 65% from its mid-2008 peak...

Commodities have risen a little off their lows. But as I noted last week, the tide may be turning...

For folks who missed last week's issue, commodities have had an inverse relationship with the U.S. dollar for most of the past 10 years. When the dollar went up, commodities went down... and vice versa.

In fact, the 2008 peak in commodities coincided with an all-time low for the U.S. dollar. And the 2016 low in commodities coincided with a U.S. dollar that was, at the time, just 1% shy of a 14-year high.

This leads lots of folks to believe that commodities and the dollar must trade inversely. But the dollar isn't the only force that acts on commodity prices...

Supply and demand are big ones. For much of the past decade, global economies have been weak... So worldwide demand for commodities has been relatively low.

At the same time, money has been cheap due to low interest rates... So commodity producers have been able to borrow more, produce more, and increase supplies.

More supply alongside weak demand means lower commodity prices.

Plus, as the U.S. Federal Reserve stopped printing so much money in 2014 and started to raise interest rates, the dollar soared relative to other major currencies. (Other major central banks still had looser monetary policies.)

[optin_form id="73"]

It was a double-whammy for commodities.

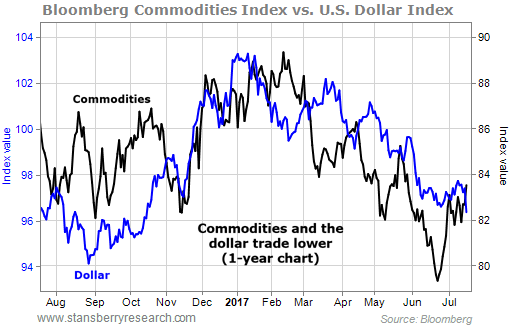

But now, economies around the world are improving... And their central banks are tightening monetary policy alongside the Federal Reserve. The dollar has dropped in response. But commodities have fallen, too.

The chart below shows the U.S. dollar and the Bloomberg Commodities Index over the past year. Their inverse relationship was breaking down last month...

This could be a sign that commodities are starting to trade on their own... instead of mostly opposite the dollar like they've done in the past.

Commodities are used in different areas of the economy – for energy, agriculture, and industry. And many of their prices are at or near long-term lows.

This latest decline – which came in the face of a falling dollar and improving global economies – may have been the final washout. It could have been the decline that finally forced bullish commodity traders to throw in the towel.

And considering the Bloomberg Commodity Index still trades above its 2016 lows, it could mark a turning point.

Commodities are known to boom, bust, then boom and bust again. They've been in bust mode for a long time. And while it's too soon to say whether another boom is beginning, we could be well on our way.

Global population keeps growing. And more important, the global middle class is growing. It's expected to grow from 2 billion to 4.9 billion by 2030.

People with a little more wealth eat a lot more food. And they especially eat a lot more meat. Stanford University researchers estimate that due to the growing population and its desire for better food, meat consumption will double by 2020.

And that's good news for agriculture commodities.

Agricultural commodities include things that grow out of the ground, like wheat, sugar, soybeans, corn, coffee, and cotton.

The growing global demand for food could skyrocket in the coming years. And with it, push agriculture commodities into a boom.

Next week, I'll tell you about one stock that tends to explode higher when agricultural commodities rise.

Good investing,

Ben Morris

Doc's P.S. DailyWealth Trader is one newsletter I rarely miss reading. Each issue is jam-packed with great research... And you get a wide variety of investment recommendations – from commodity stocks to option trades. Ben also regularly features some of the best research from Stansberry analysts (including myself). Click here to learn more.