I get asked all the time why I strongly recommend that investors hold cash.

And I get it... Having your dollars on the sidelines rarely feels good. If I told my buddies that a good chunk of my portfolio was sitting in cash during a bull market, I'd probably get laughed at and get called a sissy.

During good times, cash is a drag on your results. Today, the interest on a one-year certificate of deposit ("CD") is only 0.7%. That's nothing.

And if I'm right and we see significant inflation in the months ahead, your purchasing power will decline. So it's easy to see why most folks write off cash as an asset class not worth investing in.

I want you to think about cash differently though...

Look at the example of legendary investor Warren Buffett. As Alice Schroeder writes in The Snowball: Warren Buffett and the Business of Life...

He thinks of cash differently than conventional investors. This is one of the most important things I learned from him: the optionality of cash. He thinks of cash as a call option with no expiration date, an option on every asset class, with no strike price.

If you're new to options, a call option is a derivative security that allows you to buy shares of an underlying asset. Basically, if things go your way, call options can allow you to purchase stocks for prices well below market prices.

So Buffett is saying that cash has an underrated value. That value is the opportunity to buy stocks and other risk assets at bargain prices.

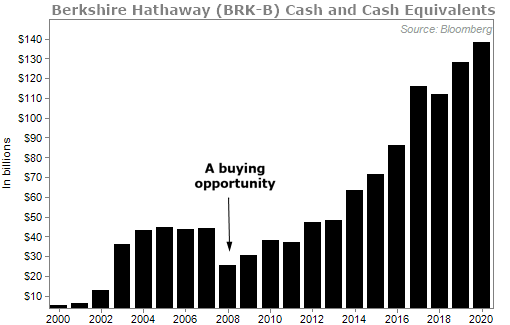

Buffett is true to his word. He consistently hoards cash in his conglomerate Berkshire Hathaway (BRK-B). Buffett explained why in a meeting with students at the University of Maryland in November 2013...

[Berkshire] always has $20 billion or more in cash. It sounds crazy, never need anything like it, but someday in the next 100 years when the world stops again, we will be ready. There will be some incident, it could be tomorrow. At that time, you need cash. Cash at that time is like oxygen.

When you don't need it, you don't notice it. When you do need it, it's the only thing you need. We operate from a level of liquidity that no one else does. We don't want to operate on bank lines.

The chart below shows Berkshire's cash position over the past couple decades. As you can see, Berkshire's cash levels have grown significantly over time. The one time it dropped was in 2009 when stocks were dirt cheap, and Buffett used a bunch of that cash to scoop up attractive companies.

While your cash pile obviously won't be as large as Buffett's, it plays a similar role for you...

If you are fully invested today in the S&P 500 and it crashes 40%, you're going to look around and see tons of wonderful businesses trading at great prices... world-class stocks like Disney (DIS), JPMorgan Chase (JPM), and Coca-Cola (KO).

But you'll be stuck. You'll need to sell your stocks that are down 40% to free up cash to buy discounted stocks... at the same price where you just had to sell.

If you are fully invested, you can't take advantage of opportunities that come your way.

Think back to the housing bubble...

Let's say you saw the warning signs in the market before the bubble burst in 2007 and 2008.

At the beginning of 2005, you moved a portion of your portfolio to cash. At the time, you would have been scoffed at. And it probably didn't feel great as stocks climbed 30% over the next two and a half years, while you earned less than 1% on that piece of your wealth.

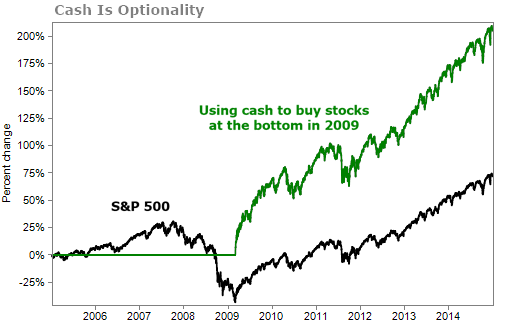

The chart below shows the S&P 500 from 2005 to the end of 2014. And it shows the returns of an investor holding all cash.

Let's imagine this all-cash investor was able to put all of his money into the market the day stocks bottomed in March 2009. You can see how he significantly outperformed the market since 2005...

This is obviously a cherry-picked example. No one goes from all cash to all stocks on the very day the market bottoms. But you don't have to time the market perfectly to take advantage of crashes.

Let's say you bought back into the market but were off a bit. You may have bought in too early, when stocks still had 25% to fall, and then were timid and waited for stocks to rise 50% from their bottom before you deployed your cash pile.

Still, your cash position allowed you to crush the market...

You don't need to time the market perfectly. Holding cash allows you to tread water during rough patches in the market and eventually put yourself in a position to become rich when things settle down.

Because cash is optionality, it gives you freedom. You can pay for unexpected expenses or investment opportunities.

And to be clear, when I say cash, I mean money you have in savings, checking accounts, CDs, and U.S. Treasury bills. Any investment with one year to maturity or less can be considered cash.

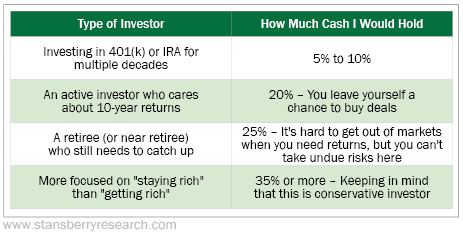

As for how much cash to hold, well that depends on what type of investor you are. This table will give you the best guidelines for different types of investors...

Don't ignore cash any longer. It may very well be one of the best-performing asset classes over the next year or so.

What We're Reading...

- Something different: Buyers beware as "altcoin" frenzy bruises bitcoin.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

May 19, 2021