One look at today's market and it's hard to see any value.

But look hard enough and you will...

You see, despite the headlines about valuations ballooning for the "Magnificent Seven," there are buying opportunities, as I (Jeff Havenstein) will point out.

Everyone knows that the S&P 500 Index is historically concentrated in just a few stocks – giants like Nvidia (NVDA) and Apple (AAPL). The S&P 500 today is trading for 23 times earnings, more than its 10-year average of 19.5 times earnings.

It's not cheap.

Investors who focus more on value than growth may be tempted to sit on the sidelines and wait for the next correction to unfold. Then they'd pick up the best stocks on the cheap.

That sounds good in theory. But you could be waiting a long time for that perfect buying opportunity.

Instead, I'm urging folks to buy today... just not in the companies everyone is talking about.

Let's rewind a bit and I'll give you an example...

In the January issue of Retirement Millionaire, we did a bit of New Year's portfolio cleaning. By that, I mean our team went through every holding in the Retirement Millionaire portfolioand decided if, today, we would be willing to buy the stock anew. If it wasn't a strong buy at current prices, it meant we had to sell the stock.

This is a helpful exercise to do each year, as we've talked about before.

There was one stock in particular that gave Doc Eifrig, Director of Research Matt Weinschenk, and me a bit of trouble... It was a $7 billion company that made safety equipment.

Nothing had significantly changed with the business since we bought it in the summer of 2020. It was still growing and had a leading share of the market it's in. But profits were down a bit. Plus, the stock returned us only 76.6% since our recommendation, only slightly edging out the S&P 500 with a 71.9% total return.

It might sound snobby, but we expected this stock's outperformance to be much higher.

The question was brought up whether we would buy this safety-equipment stock at today's prices. And there was a moment's hesitation as we poured through the company's financial statements.

We determined that we still love the underlying business, even if profits had fallen... because we believe they would rebound shortly.

When we were deciding on the recommendation, Matt said, "At $7 billion, this is exactly the type of stock you'd want to own today."

That couldn't have been truer...

I think it's going to be hard for investors to significantly beat the market if they only focus on large-cap stocks. The attention and number of eyeballs on today's biggest companies is mindboggling.

Many of these stocks are priced to perfection. And that's why it's going to be very hard to produce large gains... because any single slip-up could knock them from their premium valuations.

I have been looking instead at mid-cap stocks. These are companies with a market capitalization between $2 billion and $10 billion.

These are not wild speculations that don't produce any cash. Instead, you'll find many businesses in the mid-cap sector that dominate their niche industry and are very profitable. They trade for cheap prices, too.

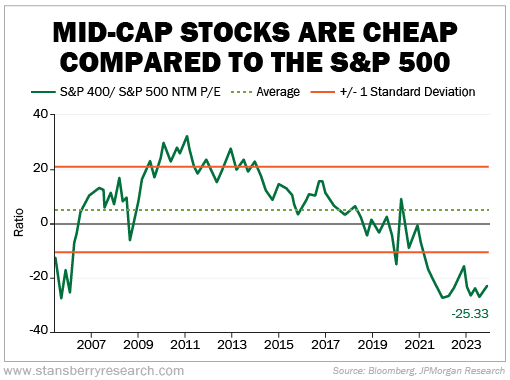

The chart below looks at the next-12-months ("NTM") price-to-earnings (P/E) ratio for the S&P MidCap 400 Index relative to the S&P 500. If you're not familiar, the S&P 400 is the index for mid-cap stocks. As you can see, mid-cap valuations remain near historic lows by comparison...

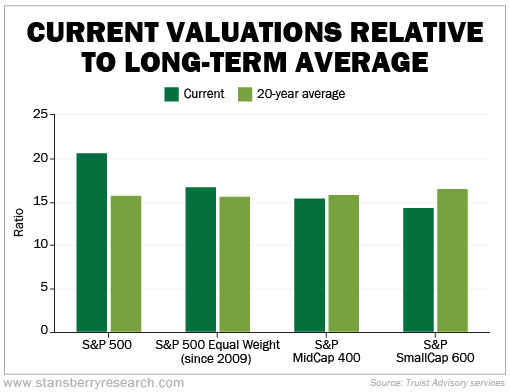

The next chart shows you more of the same thing. The S&P 500 is trading well above it 20-year average when you look at its forward P/E ratio. Even the S&P 500 Equal Weight Index is trading above historical norms. But you will find value in smaller companies. Take a look...

Small-cap stocks also look attractive given their valuation. And I do think the broad index looks like a good buy... It's just very hard to pick individual small-cap stocks given their speculative nature.

For me, I'm focusing on mid-cap stocks. There are plenty of fantastic, cash-gushing businesses that are currently being overlooked by the mega-cap-obsessed investor.

The March issue of Retirement Millionaire comes out in just a few hours... And Doc is recommending a company with an $8 billion market cap, right in that sweet spot.

This is a firm with a long history of expanding into new markets and establishing a leading market share. It generates a ton of cash from its underlying business and is generous returning that cash to shareholders.

Of course, it trades for a good value. No one is looking at this company... and that's exactly what we want to see.

If you're a Retirement Millionaire subscriber, check your inbox in a few hours for all the details.

If you do not have a subscription to Retirement Millionaire, click here for our latest offer.

What We're Reading...

- Something different: Inverted yield curve no longer a reliable recession flag.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

March 13, 2024