Beware of the zombies...

For those of you who have watched too much of The Walking Dead, I'm not talking about a reawakened corpse... I'm talking about a "zombie company."

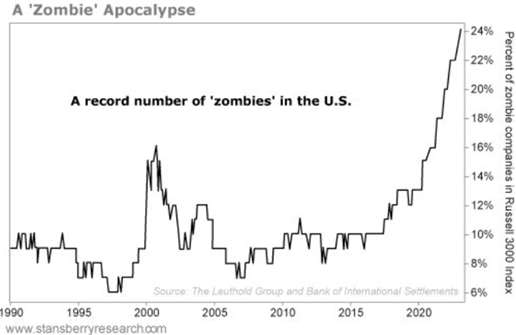

These are companies that don't make enough money to pay even the interest on the debt they've accumulated. Basically, they're living on borrowed time.

The number of zombie companies has been steadily increasing since the 1990s. But because of COVID-19, the number has skyrocketed. According to Bloomberg, since the start of the pandemic, a few hundred major companies have become zombies. There are now more than 700 of them out of 3,000 of America's largest publicly traded companies.

In total, they have roughly $2 trillion in debt – a figure almost the same size as Italy's economy.

Today, about one in four U.S. companies are zombies...

These businesses have been allowed to survive because their interest rates are near zero percent. The Federal Reserve has been buying corporate bonds and allowing them access to credit.

Many zombies are hotels, restaurants, and airlines. Think of companies like cruise line giant Carnival (CCL).

Many zombie companies will go bankrupt in the months and years to come. Others will survive – either because the economy will recover quickly enough to reverse their fortunes and they'll pivot their business models... or they'll be able to refinance their debt again and kick the can down the road.

A rise in the number of defaults will hurt the economy. And the companies that continue to limp along, barely covering their obligations, may depress employment and growth for years to come.

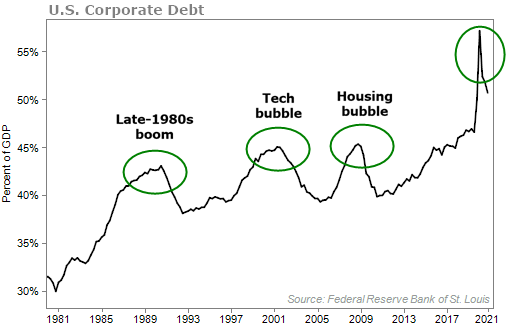

But that alone isn't a reason to pull your money out of the market and stash it under your bed. Debt bubbles – like the one it seems we're part of now – can often expand for years before they pop. It will likely be a while before the one we're in pops...

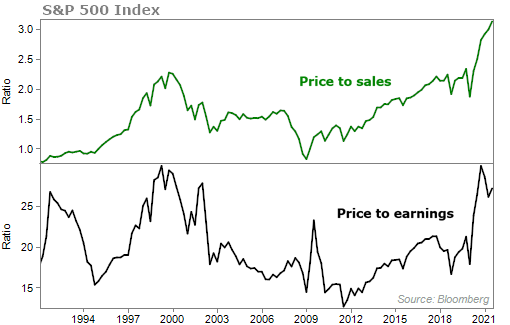

In the more immediate term, though, it makes sense to be cautious. The market is just too euphoric today...

Valuations are hitting new all-time highs, while the economy is still recovering.

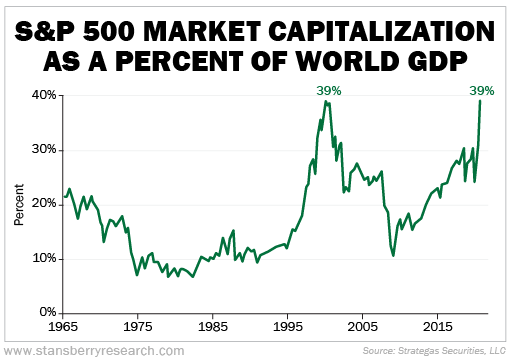

The S&P 500 Index's market cap as a percent of the world's gross domestic product ("GDP") can give a sense of how rich today's market is. As you'll see below, earlier this year it hit the same level as it did back during the dot-com peak.

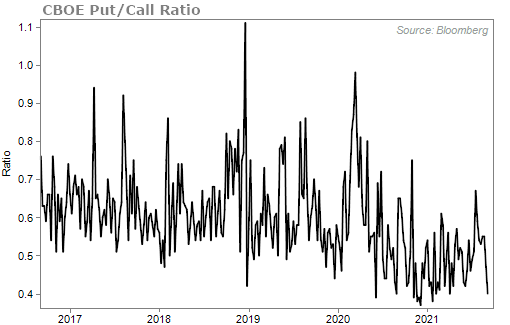

Another way to look at today's record euphoria is with the put-call ratio. This indicator measures how many call options outstanding versus how many put options are outstanding.

If more call options are outstanding than put options, then investors are believed to be positioned bullishly... meaning more folks are betting that stocks will move higher. If folks are trading more puts than calls, it means more of them are betting stocks will fall.

We tend to use the put-call ratio as a contrarian indicator. When too many people are doing the same thing, the opposite will typically happen shortly after.

Last week, this ratio hit 0.42. That's near a five-year low...

Given the froth we're seeing in the market, we're overdue for a market correction. Remember, corrections are just part of normal market behavior. Even great bull markets experience corrections all the time.

And to be clear, I'm not predicting some doomsday scenario. Just because something should – and needs to happen – doesn't mean it will happen right away.

But I can't ignore the glaring risks in the market. It makes sense to have a cautious mindset.

And all that may mean to you is to hold a little more cash than normal.

Just make sure to keep these risks in the back of your mind while you're making investment decisions.

What We're Reading...

- Concern is mounting over zombie companies.

- The pandemic has forced corporate debt higher.

- Something different: The U.S. just ended its 20-year war in Afghanistan.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

September 1, 2021