If you and your friend have been accused of a crime, the most rational thing for you to do is betray your friend.

I'm serious.

It sounds harsh, but you want the best possible outcome for yourself, right? To think anything else would mean you're irrational. (And I know you're not irrational.) So you choose to rat him out.

This situation is known as the "Prisoner's Dilemma," one of the most well-known concepts in game theory.

Here's an example of the Prisoner's Dilemma you might see in business...

Let's say there are two companies that make furniture – Tom's Furniture and Jim's Furniture. These are the two biggest furniture makers in the region and control the majority of the market. Both companies produce similar-quality products.

For years, Tom and Jim have priced their furniture the same. But both companies are always faced with a decision about whether or not to change their prices.

Tom wants what's best for his company. He wants his employees to be paid well and he wants a second home in Hawaii. So he wants the company to maximize profits.

In order to increase sales, Tom could cut his prices and steal customers away from Jim. Since both products are of similar quality, the customers would go with whatever is cheaper.

Tom could also decide to stick to the status quo and not change his prices. Both companies would keep their market share. And things would remain the same.

But Tom also has to consider what Jim will do... What if Jim were to cut his prices, while Tom did nothing? In that case, Tom would lose a good chunk of his customers and his profits. That might put him out of business.

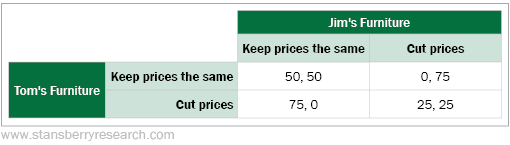

Below, I'll show you a payoff matrix for Tom and Jim. The first number in each cell is going to be the payoff or incremental profits in millions of dollars for Tom's Furniture. The second number in each cell is the payoff for Jim's Furniture. For example, in the top right cell, "0, 75" means that Tom's profits would remain unchanged, while Jim's profits would increase by $75 million.

When you look at this table, it's clear the best outcome for both companies is to keep prices the same. Tom's and Jim's profits would both increase by $50 million because of normal growth in the industry. But here's where game theory kicks in...

Tom can look at this payoff matrix and think to himself, "I can increase my profits by $75 million if I catch Jim off-guard and cut my prices. I'll take his customers and Jim will be in a world of trouble."

Tom also thinks that if he does nothing and Jim cuts his prices, then Tom could lose his customers and his profits won't rise. Because Tom is a rational person, he wants the maximum benefit for himself. That means he's going to cut his prices.

It just so happens that Jim is also a rational person. And he's in the same situation as Tom. He decides to cut prices, too.

As you can see, after they both cut prices, their profits only increase $25 million per company. They would have made more money by simply doing nothing!

You can see how the Prisoner's Dilemma leads to challenging decisions by business owners. Sometimes this back-and-forth gets so bad that companies start price wars – when businesses constantly lower prices to get an edge over their competition.

And while nothing good typically comes from wars... price wars lead to big-time benefits for consumers.

If you've been paying attention to the news, you'll know one price war has recently ended, which is great news for investors and traders. I'm talking about the pricing war between the big online brokers.

For a long time, many online brokers had similar commission structures. Most of them charged about $4.95 to $6.95 as a base trading fee. Customers just accepted that price and had no choice but to pay it. There were few alternatives.

But that has changed. Earlier this month, market leader Charles Schwab announced that it would eliminate commissions for U.S. stocks, exchange-traded funds, and options. And it didn't take long for the other brokers to follow suit. TD Ameritrade and E-Trade Financial cut their fees next. And just recently, Fidelity Investments did the same.

This all started with the emergence of Robinhood, a commission-free investment and stock-trading app. As Robinhood started gaining more users (it has grown its user base to over 4 million since its founding in 2013), I knew the entire industry would have to cut fees to keep up. And that would be a huge win for investors and traders.

Mostly, I'm extremely excited for my subscribers.

You see, I run two option-trading services – Retirement Trader and Advanced Options. Both have been wildly successful. Retirement Trader has amassed quite an incredible track record. We've closed 484 trades since we launched in 2010 and 460 of them have been winners... A winning percentage of 95%.

And although Advanced Options doesn't have the lengthy track record Retirement Trader does (since it was launched late last year), I'm happy with the early results. We've closed 22 trades in total and 15 have been winners. And the average return out of all those trades – winners and losers – has been 27% with an average holding time of just 37 days.

Our option services have been successful, but commissions have always been a pain for our subscribers... especially for folks who don't have big portfolios or who only trade one or two contracts at a time. With fewer contracts traded, commissions – particularly the extra commissions often associated with options – eat into profits and take away from their total returns.

But there being no commissions means that my subscribers get to keep almost all of that profit now. (Some brokers, like TD Ameritrade for instance, will still charge a small $0.65 per contract fee.)

This is a huge win for the everyday investor and trader. If high fees have ever stopped you from opening up a brokerage account, now is the time to start trading.

What We're Reading...

- Something different: Trump halts trade negotiations with Turkey, raises its steel tariffs to 50%.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

October 16, 2019