I (Laura) remember the exact day I bought my first investment...

I knew basically nothing about investing. I didn't even know anyone who invested in anything beyond savings bonds.

In college, I met someone who worked for an investment bank. He explained the importance of investing in the stock market if you really want to secure financial independence.

I didn't have a lot of money. I was a full-time college student, so I could only work 30 hours a week at the local bank. I spent a couple months saving and researching investments. Then I chose my first ever stock – a diversified mutual fund.

A few months later, the stock market crashed, and I watched that fund collapse more than 50%.

But I wasn't alone...

The financial crisis of 2008 shook the entire market.

Some blue-chip stocks dropped 60% or more. Conservative investors who thought bonds were a safe haven saw them drop 10%.

And the recession pushed a lot of people out of the stocks. According to a recent Gallup poll, prior to the 2008 financial crisis, 62% of Americans owned stocks. As of 2017, that number is down to 54%.

But anyone missing out on this bull market has left a lot of money on the table.

The current bull market is one of the longest in history. The stock market is hovering around historical highs. But now many people are calling for the end. Turn on the TV and you'll see analysts predicting the next crash.

I don't like making predictions. And I don't want to spend my time worrying about what stocks will do next.

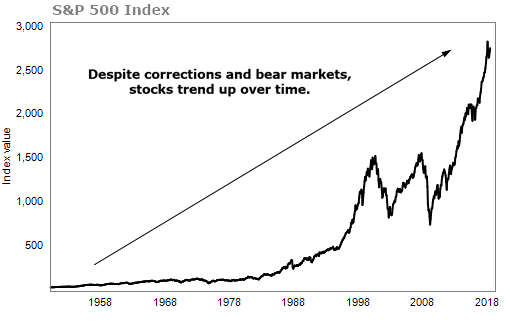

Take a look at the benchmark S&P 500 Index (a basket of stocks of the U.S.'s largest 500 companies) since 1950...

You can see the dips where we've been through corrections or bear markets. But despite those dips, the S&P is up more than 16,000% since 1950.

Lots of investors try to "time the market," essentially guessing when stocks will go up and when they'll go down. The idea is that you buy at the bottom (when a stock is cheap) and sell at the top to maximize your gains.

But that strategy often doesn't work for the average investor.

In 2016, research firm DALBAR tracked what individual investors actually earned on their stock investments. Over a 30-year period, the average investor earned just 3.7% a year... compared with 11.1% for a simple strategy of buying and holding the S&P.

Think about that for a moment... Most individual investors miss the movement of stocks and underperform.

That difference comes down to timing. Investors consistently get in and out of the market at the wrong time. They panic and sell at market bottoms. They grow euphoric and buy near the tops. Worse, they move to hot sectors or investments, but fail to catch the big moves.

In another study, Fidelity Investments analyzed client accounts to see who had the best performance. The highest-earning group was composed of those who actually forgot they had investment accounts at Fidelity and never touched them. How strange is that?

The buy-and-hold strategy is a favorite of legendary investor Warren Buffett (aka the "Oracle of Omaha").

In a 2016 interview with CNBC, Buffett said, "The money is made in investments by investing and by owning good companies for long periods of time. If they buy good companies, buy them over time, they're going to do fine 10, 20, 30 years from now."

Some of the best benefits of a buy-and-hold strategy are that you avoid paying excessive transaction costs and taxes, it helps remove some of the emotion of investing, and – if you reinvest your dividends – you're compounding your wealth... making you even richer, faster.

Bu this doesn't mean you should ignore your portfolio.

Even blue-chip stocks can go south... think Dell (once the No. 1 PC maker), Sears (formerly America's largest retailer), and General Electric (which was just booted from the Dow Jones Industrial Average).

Take a few hours at least once a year and go over your portfolio. See how the stocks are performing, check out the latest news and research, and readjust your holdings when you need to... not when the crowd is shouting "BUY" or "SELL."

If you want to become a better investor, follow these three rules...

- Be patient.

- Have a long-term view.

- Don't fear the ups and downs of the market.

Oh, and that fund I bought that collapsed? My patience paid off... It's up 140%.

Have a great week,

Laura Bente & Amanda Cuocci

June 24, 2018