It's a powerful driver for just about anything in life.

I'm willing to bet that this factor has impacted your decisions more than once...

Think back to your childhood... Did you ever ask your parents to buy you something just because everyone in your class had it?

It would be so embarrassing if you were the only kid that didn't own that new comic book or that new game... even though you didn't really want it. But you didn't want to feel excluded.

Adults are just as susceptible as kids. How about that time your friends were planning a vacation... but you knew it was out of your price range?

You probably found a way to come up with the cash even if it meant taking on more debt or working extra hours for it. There was no way you could miss that trip because what if something truly memorable happened?

This powerful driver is called the fear of missing out (or you might have heard the younger folks in your life call it "FOMO").

We also see countless examples of FOMO influencing market returns over the years, especially late in cycles.

Think back to the past two bull markets...

Back in the early 2000s did you feel any pressure to buy tech stocks because of how much money your friends said they were making in them?

And did you end up buying any property in the mid-2000s because you couldn't go anywhere without someone mentioning how hot the real estate market was?

After long bull markets, folks who were sitting on the sidelines in cash get tired of hearing how much money other people have. They feel like they are missing out, so they want in on the action, too.

This can lead to a lot of folks piling into the same investment at the same time.

With everyone buying at the same time, this creates a "blow-off top" rally... or what my colleague Steve Sjuggerud calls the "Melt Up."

When we think about market sentiment today, it seems like folks are starting to develop the FOMO mindset. We're hearing more people talk about how they want to put more money to work in the market. With the S&P 500 Index having a terrific 2019, that makes sense.

But it doesn't feel like everyone is infected with FOMO just yet... There's not a widespread feeling of euphoria when investors believe stocks can never go down. That's when it's too late.

As always, we want to see what people are actually doing with their money. Specifically, we want to see if folks are buying protection in the form of put options or if they're betting on higher upside by buying call options.

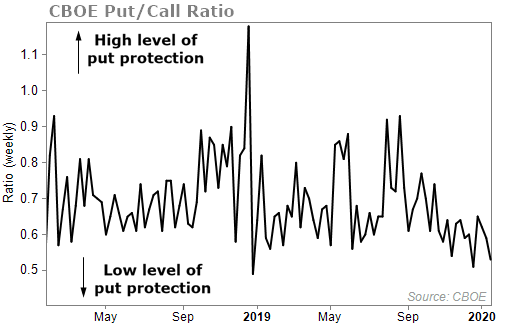

In the chart below, when the ratio rises, it means folks are buying more put options than call options. They want protection, and it signals bearish sentiment.

And as the ratio falls, that means folks are buying more call options than put options. When this happens, it signals investors are bullish. They don't see the need for put protection.

This chart is from January 16 – just three weeks ago. As you can see, most investors weren't looking for protection...

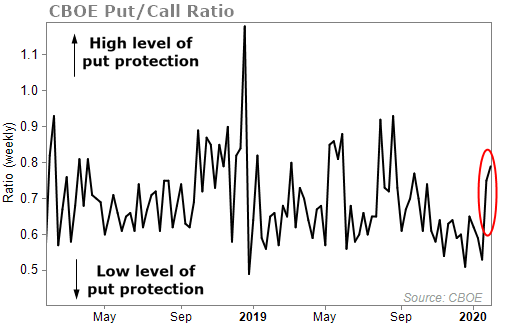

Let's fast-forward to today. You can see that folks have quickly become more bearish...

A lot can happen in a few weeks. Right now, the coronavirus has a lot to do with people buying more put protection, but it's not the only time we've seen investors get skittish... despite the strong, more than decade-long bull market

Investors aren't throwing caution to the wind and "going all in" like we've seen in previous late cycles.

Since there is no widespread FOMO just yet, Steve thinks there is still a lot of money to be made in this bull market... and that you should take the recent market pullback as a buying opportunity.

Bull markets don't end with a whimper... They end with a bang. And according to Steve, The Melt Up is about to take a dramatic turn this month.

That's why next Wednesday, February 12, Steve is staging a massive online event to show you exactly how to cash in on this dramatic shift in his Melt Up thesis... including what he believes to be the No. 1 stock to own during the Melt Up.

Also as a bonus and just for signing up to attend on February 12, you will receive a free copy of Dr. Steve Sjuggerud's e-book: The Last Bull Market.

Click here to reserve your spot.

What We're Reading...

- Did you miss it? 'Where's My Melt Up?'

- A 'Melt Up' in stocks will push the market 5% higher by March.

- Something different: Tesla is soaring again.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

February 5, 2020