Things don't feel all that great in the U.S...

I get a sense of it every time I stroll into the office and talk to co-workers... or when I hop in an Uber and start up a conversation with the driver.

There's trouble brewing in the economy. And it's not that hard to see.

Let's start with the headlines that keep popping up day after day...

Many big companies are laying off their workers... by the thousands.

Late last month, delivery giant UPS popped up on the news as it announced it was laying off nearly 12,000 employees to "align resources for 2024." (Whatever that means.)

Global bank Citigroup announced it will be cutting 20,000 jobs by 2026. That comes out to about 10% of its workforce.

Payment-processing company PayPal is laying off about 2,500 employees, 9% of its workforce.

Even beauty titan Estée Lauder announced it would shed roughly 3% to 5% of its workforce.

We could go on and on... Snap, Zoom, DocuSign, iRobot, Paramount Global, and Cisco have all announced significant layoffs.

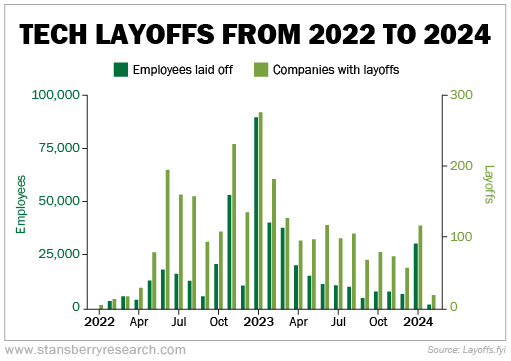

We're seeing the most carnage in the technology sector. The chart below shows that layoffs in the sector have been picking up steam lately, getting closer to levels seen in late 2022 and early 2023.

Even though the headline unemployment rate is still historically low at 3.7%, things don't feel all that cheery.

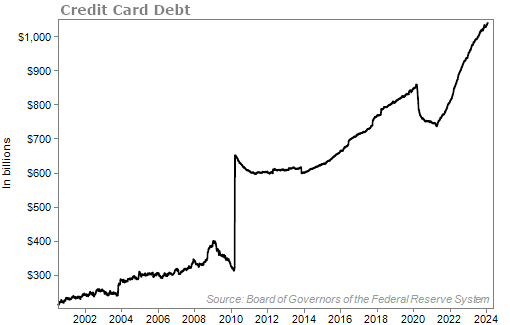

With higher interest rates, families all across the country are feeling the effects. Since our cash pile from the COVID-19 stimulus checks is mostly gone, folks have reverted to their old ways... using credit cards.

Before the pandemic struck, I issued multiple warnings about the growing credit card debt in America. We're starting to see signs of that again.

Credit card debt has now surpassed $1 trillion, well above pre-COVID levels. Take a look...

Today, the average credit card balance is a record of $6,360. That's 10% higher than a year ago.

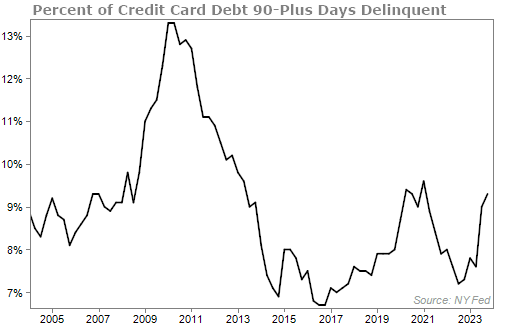

Worse, delinquencies on credit card debt keep rising...

The average family is starting to show signs of pain. Even though most analysts will tell you that our economy is strong and humming along, there's no doubt cracks have been forming.

Aside from individuals dealing with higher debt, corporate America is also facing similar issues. Higher interest rates are taking their toll.

According to S&P Global Ratings, the number of companies that defaulted on their debts last year was 153... That's up from just 85 companies the year before – an 80% surge.

In total, corporate debt has risen by 18% since 2020.

This year may be even tougher for corporate America than last year. And the years to follow may continue to get worse...

You see, my colleague Joel Litman believes we are facing a "Wall of Debt." And by that, he means many companies' debt piles have become so exorbitant that there's simply no way they can be expected to service it... given how much cash they're expected to generate.

These companies will hemorrhage money, employees (we're seeing a lot of that already, as I mentioned earlier), and assets to try to keep up... and they'll ultimately be forced to make some incredibly difficult business decisions. Some will be forced into bankruptcy.

It's hard not to agree with Joel on this point... especially when you do a deep dive into the numbers and see how much debt is coming up for maturity in the following years.

I believe Joel is right about his warning. And that's why I recently joined Joel on camera to talk about what may happen with this Wall of Debt.

It's scary.

If you haven't already, I suggest you watch our presentation carefully... We talk about ways to protect yourself in the years to come and how to ultimately come out on top by betting on the right companies – companies that will take advantage of the coming pain.

Click here to watch our presentation before it is taken offline.

What We're Reading...

- Average credit card balances jump 10% to a record $6,360, and more consumers fall behind on payments.

- Corporate-debt defaults soared 80% in 2023 and could be high again this year, according to S&P Global.

- Something different: Walmart inks deal to acquire TV-maker Vizio.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

February 21, 2024