Everyone wants you to think America is booming...

On the surface, it is. A new report from the Federal Reserve just confirmed that our net worth is at all-time highs.

When you think about what really drives our wealth, it comes down to two things: stocks and real estate. This is what the average American relies on for their financial well-being.

In the first quarter of this year, the value of equity holdings increased by about $3.8 trillion. The S&P 500 is right around all-time highs as I (Jeff Havenstein) write. Also, the value of real estate held by households rose about $900 billion to a record high.

In total, household net worth rose to $160.8 trillion earlier this year – a 3.3% increase from the end of 2023.

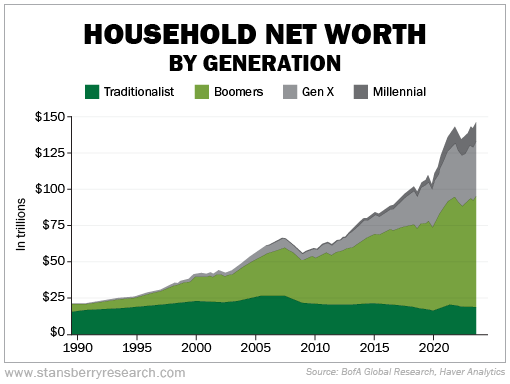

The chart below shows household net worth by each generation. Take a look...

Boomers are the richest they have ever been. And younger generations are catching up as well.

You might think that it's a great time to be an American.

Well, not exactly...

Think about your own experiences. Things just don't feel that great in America today.

Did you know the average American today says they need to earn at least $233,000 a year to be comfortable? That's a far cry above the national average salary of $60,000.

Meanwhile, nearly two-thirds say they don't feel financially secure. Granted, lots of folks are to blame for their own financial woes. For too many Americans, their only "investments" are flat-screen TVs, car payments, and expensive vacations.

Life is expensive today. There's no other way to put it...

The price of orange juice is up more than 250% since 2019. The price of sugar is up by about 125%. Chocolate bars, mayonnaise, and a loaf of bread all cost about 50% more than they did in 2019.

It's not just everyday essentials, either. Health care is brutally expensive. And if you're saving for your kids or grandkids to go to college, you know what an uphill task that is. In 1980, the price to attend a four-year college was $10,231 annually. In recent years, the price has skyrocketed to $28,775 annually.

And having two young kids myself, don't even get me started on the price of childcare. According to Bank of America, the average childcare payment per household rose more than 30% between 2019 and 2023. The average family spent more than $700 per month in September 2023. (Here in Baltimore, we'd be ecstatic to just spend $700 per month.)

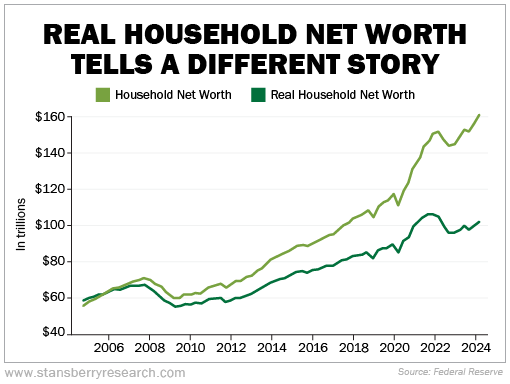

I'm going to show you one more chart to prove that things aren't as rosy as they seem. While household net worth is at all-time highs because of a strong stock market, high cash yields, and rising real estate values... you still have to consider inflation.

When you adjust net worth for inflation, you'll see household wealth remains below its 2021 peak...

We're at an interesting moment in time for anyone in retirement or preparing for it.

Given the risks that our research team sees in the market, you have to be careful how you invest your nest egg moving forward. It's clear that you need to earn a return on your investments that beats inflation – and you need to minimize risks.

This means turning to assets that diversify your portfolio... something Dr. David "Doc" Eifrig has been preaching for a long time.

In just a few hours, Doc is going to publish two new reports for his Retirement Millionaire subscribers.

The first is all about three overhyped investments that you need to dump right now... before they burn you and lose you a lot of money. And then Doc also gives you three unusual investments that every diversified investor should make. These are stocks that offer you exposure to three assets most folks don't even think of. But these are assets that have proven to hold their value in times of crisis.

The second report is all about safe income. Doc has cherrypicked the five best "capital compounders." These are stocks that increase their dividend payments every year and have business models made to thrive in just about all economic conditions.

If you are already a Retirement Millionaire subscriber, you can find those reports by clicking here. Again, they will be published in just a few short hours.

If you're not a subscriber to Retirement Millionaire, I urge you to consider joining right now. I have a feeling most folks will agree with me that things don't feel all that good in America today. And I think there's no better person to help navigate the next few years than Doc Eifrig.

If you are interested in Retirement Millionaire, click here to learn how to get started now.

What We're Reading...

- Something different: Baltimore key shipping channel fully reopens after Francis Scott Key Bridge collapse.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

June 12, 2024