In late 2019, Doc Eifrig talked about a crisis that very few people were concerned with...

It wasn't about corporate America's love affair with debt. It wasn't about a run-up in risk assets or anything like that. It wasn't even about the early warning signs of a coming global pandemic...

He talked about a savings crisis.

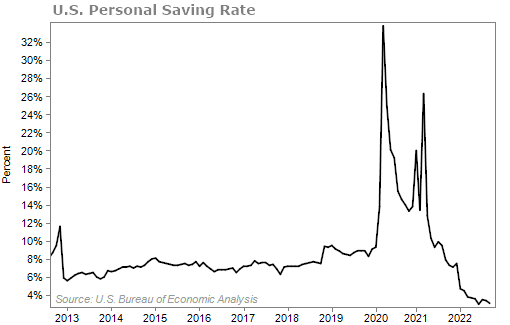

In late 2019, 40% of American households reported that they would have difficulty paying for a $400 emergency expense... The U.S. savings rate was only at 8.4%... And according to one survey, 15% of Americans had no retirement savings at all.

This wasn't going to end well for folks looking to retire.

What we didn't see coming was an economic lockdown the following year, forcing folks to not spend their money. And of course, we didn't envision thousands of dollars being handed out to families.

The pandemic essentially solved the savings crisis.

Stuck at home with nothing to spend money on, the U.S. savings rate shot from 8.4% in late 2019 to double digits for most of 2020 and 2021. It even hit 33.8% in April 2020.

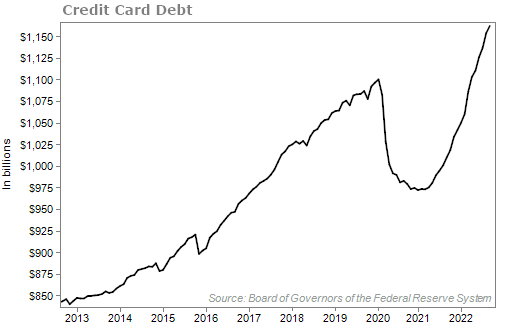

Folks were flush with cash and able to pay down debt. Of course, the pandemic was not a good thing, as it wrecked a lot of lives... But it was good for our savings accounts.

Let's fast forward a bit...

I (Jeff Havenstein) am writing to you today saying we're heading back toward the savings crisis of 2019. The sugar rush from the pandemic stimulus has worn off. No one is saving their money anymore.

The U.S. savings rate is at a decade low of 3.1%. Take a look...

Consumer spending is still strong, but most folks are simply spending on their credit cards. Credit card debt has surged in recent months...

What really scares me is how families can't even afford their homes.

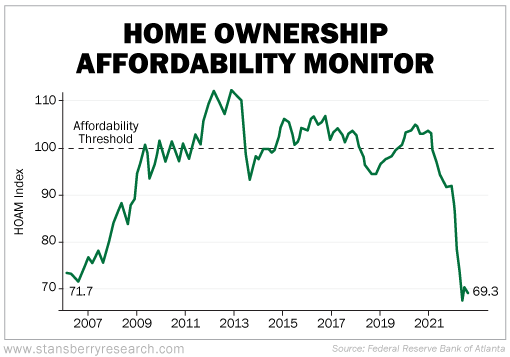

Think back to July 2006 for a moment – right before the housing bubble burst. Here are some statistics...

Median Home Price: $230,525

Median Income: $48,951

Interest Rate: 6.8%

Total Housing Payment as a Percent of Median Income: 42%

Here's how that that looks as of August 2022 (the most recent data we have)...

Median Home Price: $373,333

Median Income: $69,102

Interest Rate: 5.7%

Total Housing Payment as a Percent of Median Income: 43.3%

Families are spending a lot of their income just on their mortgages... more than they did in 2006.

We're not only at the beginning of a savings crisis, but also an affordability crisis.

The Federal Reserve Bank of Atlanta tracks housing affordability with its Home Ownership Affordability Monitor ("HOAM").

An index value lower than 100 indicates that the median household income is insufficient to cover the annual costs of owning a median-priced home. That means that a person's housing cost is greater than 30% of their income.

An index value of 100 or greater indicates that the median household income is sufficient to cover the annual costs of owning a median-priced home. (The housing cost is less than 30% of their income.)

In August, the HOAM index was down to 69.3. You can see how we're at the same level as 2006 in the chart below...

For those looking for another windfall of cash from the government to bail us out again... good luck.

The next inflation report comes out tomorrow. All eyes will be on the consumer price index to show any signs of slowing inflation. And the markets will likely react aggressively, either up or down, when it comes out.

I think high inflation is here to stay... Not the 8% inflation we're seeing today, but it's possible we don't see inflation drop below 5% for a long time.

It's likely this savings and affordability crisis will only get worse before it gets better.

Wall Street legend – and founder of our corporate affiliate Chaikin Analytics – Marc Chaikin has a new warning that could cause thousands of people to move their U.S. dollars out of cash… out of popular stocks… and into a unique type of investment vehicle.

And it could all happen on November 15.

What We're Reading...

- Mortgage demand drops for sixth week in a row, as rates remain above 7%.

- Something different: IRS should brace for 'broad and deep' scrutiny if Republicans win the midterms.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein with Dr. David Eifrig

November 9, 2022