If you're a new investor, you probably make this mistake. Heck, if you are a seasoned veteran, you may still make this mistake from time to time...

You think that a growing or profitable company always makes for a good stock.

After years in the markets, I (Jeff Havenstein) have learned this is simply not true.

The problem is that growing profits are already reflected in the price of a stock. It doesn't matter what a company has done for the past 10 or 20 years... or even what it's doing today.

All that matters is what a company is going to do.

You see, the market is priced on expectations of the future. To outperform, you need to find stocks that will grow at a higher rate than the market expects.

Take Apple (AAPL)... It's one of the most profitable companies in the world by net income. That's no secret. Everyone knows Apple makes gobs of money.

But last week, Apple warned its suppliers of weakening demand for some of its key products. According to news outlet Nikkei Asia...

In a sign of the gloomy outlook for consumer electronics, Apple has notified several suppliers to build fewer components for AirPods, the Apple Watch and MacBooks for the first quarter, citing weakening demand.

Of course, this is troublesome as an Apple shareholder. You want to see demand increasing, not the other way around.

But this doesn't mean Apple is losing money. Far from it...

The company will still earn around $110 billion in free cash flow – the purest measure of profits. It will also pay the same dividends and buy back the same number of shares as it has in past years.

Even so, shares fell about 4% after the announcement. That company shed $77 billion worth of value... all because the outlook for future earnings has dropped a bit.

Nothing has fundamentally changed about Apple. It's still one of the best businesses in the world. And, as I pointed out, it will still make lots of cash, and it rewards its shareholders. But sentiment has changed.

The collective feelings of market participants have assigned Apple a different price. In August, investors would pay about 28 times current earnings for the future of Apple. Today, they'll only pay 21 times earnings.

It's the same with stocks in general. As measured by the S&P 500 Index, they've reduced their prices from 21 times earnings to 18.8 times earnings.

Right now, markets are definitely pricing in recession. They're scared. And manufacturers are also expecting contraction ahead...

You see, heavy industrial businesses aren't like consumers. They don't buy more or less in a given month because of their optimism, tax refunds, bonus season, or the weather.

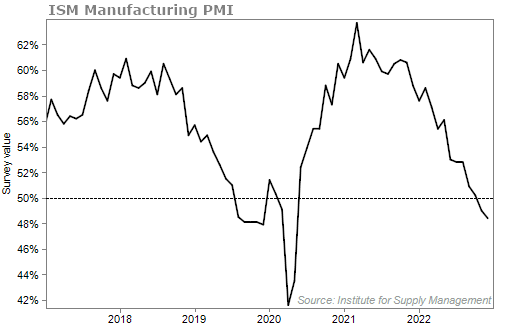

Industrial corporations plan months to years in advance. They carefully weigh potential returns and capital costs. They only start expanding when they're highly likely to be profitable. To measure how the industry is doing, we look at the Institute for Supply Management's ("ISM") Manufacturing Purchasing Managers' Index ("PMI").

The PMI surveys executives in manufacturing. A reading above 50% means growth and expansion. A reading below 50% means contraction.

The December reading came in at 48.4, the lowest since the COVID-19 pandemic. Take a look...

If you are going to navigate this market in 2023, you need to be aware of expectations.

My colleague Greg Diamond has his own expectations for the market in 2023. As we shared on Monday, he's bullish.

But there's more to it than that... Specifically, he's predicting that a rare event is coming to the markets this year, which has occurred just three times in 25 years. It can lead to a huge moneymaking opportunity.

Greg is going live with his prediction tomorrow at 10 a.m. Eastern time.

You can reserve your spot for his presentation – which is 100% free to attend – by clicking here.

What We're Reading...

- Something different: Coinbase to slash 20% of workforce in second major round of job cuts.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

January 11, 2023