I was standing in front of hundreds of investors who all wanted to hear my next big moneymaking idea... But I'm sure my advice disappointed them.

It was early October and I, along with the rest of Stansberry's top editors, was at the Bellagio in Las Vegas for our annual Alliance conference.

During my presentation, I talked about bitcoin, consumer confidence, inflation, and a range of other economic topics. Other editors were pitching their moneymaking ideas to the crowd... Like how to potentially double or triple your money with particular investments.

My advice was a little different...

Go to cash-like stuff... Right now is the best time in the past nine years to reduce your risk and keep some of your portfolio on the sidelines in short-term cash and cash-like investments.

It was time to reduce risk. The indicators I was tracking told me that things in the market were overheated. I was worried about a sharp market correction... which happened two months later. And I was worried about the upcoming bear market.

My "move to cash" advice was nearly seven months ago. Since then, stocks have recently hit new all-time highs as they came roaring back after the December correction.

Some folks may think I regret making my cash recommendation, but I don't. It was the advice I would have wanted to receive if our roles were reversed. And I think my advice still holds true today.

This brings up the question... When is it too early to move to cash and cash-like investments?

In a perfect world, you'd ride a bull market all the way up, sell at the top, and move to cash right before the plunge. But we don't live in a perfect world...

Most investors ride the bull up... and just when stocks are near their peaks, they pour more money into the market. Then they ride the bear all the way down, getting crushed.

To answer that question, we have to consider opportunity cost. Opportunity cost is the loss of potential gain from other options when an alternative option is chosen.

For example, if you choose to play video games in your free time instead of reading books, the opportunity cost is the knowledge you might have gained from reading books.

In investing, if you have your money in cash, the opportunity cost is the gains you could be missing out on by owning stocks.

But sometimes, giving up gains helps protect your portfolio from huge losses. Take a look back at what happened in 2011...

We saw stocks peak in April 2011. Then, in August, stocks crashed after the ratings agency Standard and Poor's downgraded the U.S.' credit rating.

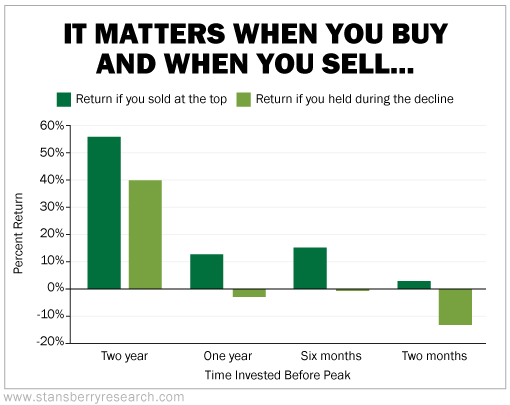

The chart below shows you what kinds of returns you could have made if you bought at different times before the peak: two years before, one year before, six months before, and two months before.

If you had a crystal ball and you sold at the top, you'd have gains no matter when you bought. But most of us don't. As I said earlier, the average investor tends to get out near the bottom. So we also looked at what your returns would be if you stayed in stocks through the decline.

As you can see in that chart, unless you bought two years before the peak, the decline would have wiped out your gains.

Instead of staying in the market, you could earn about 2% in cash and cash-like investments such as certificate of deposits (CDs) and money-market funds. In 2011, you'd have been better off just holding cash and earning that safe 2%.

We've seen this over and over again throughout history's market cycles. If you invest within one year of a market top, cash outperforms stocks and protects your wealth.

Holding cash won't make you rich, but there's an important place for it in a well-balanced portfolio, especially given today's market conditions.

To discuss these precarious conditions, we're holding a Bear Market Survival Event next Wednesday, May 15, at 8 p.m. Eastern time.

During the event, Stansberry Research founder Porter Stansberry and legendary investor Jim Rogers will explain today's fragile financial situation... why the coming bear market could be the worst we've seen... and what proven strategies they recommend to protect yourself before trouble hits.

Click here to reserve your spot now.

What We're Reading...

- Something different: The chefs who don't want Michelin stars.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

May 8, 2019