One of our deepest survival instincts puts our finances at risk...

We're hardwired to follow the herd when fear strikes. Stress and anxiety set off chemical reactions in your brain (specifically in the walnut-shaped tissue called the amygdala) that spark an instinctive need to rejoin the crowd... When primitive man faced predators in the wild, this "safety in numbers" impulse could have saved his life.

But the problem with herd mentality is when everyone rushes into stocks at the wrong time. Following the herd leads you to buy at the top and sell at the bottom... terrible advice.

That's why today I want to introduce you to an asset class that once had a stampede of buyers, but has recently gone relatively calm. In fact, several analysts don't think this sector is worth bothering with right now. But we think this now-forgotten segment of the market has major upside ahead...

[optin_form id="73"]

I'm talking about emerging markets.

The term conjures images of far-off lands with uncertain economies and banana-republic leaders. It's easy for investors to shun those types of investments.

But emerging markets are simply countries that are growing and have the beginnings of a real economy in place, but haven't fully developed yet. There's no official list of countries that are emerging markets. However, index provider MSCI has a good list, as you can see in the following table...

| MSCI Emerging Markets | ||

| Brazil | India | Qatar |

| Chile | Indonesia | Russia |

| China | South Korea | South Africa |

| Colombia | Malaysia | Taiwan |

| Czech Republic | Mexico | Thailand |

| Egypt | Peru | Turkey |

| Greece | Philippines | United Arab Emirates |

| Hungary | Poland | |

Different agencies have variations of this list. The International Monetary Fund (IMF) adds Argentina and Bulgaria to the above list. But Standard & Poor's (S&P) excludes Qatar and United Arab Emirates.

The point is that, overall, emerging markets represent a big opportunity. They help you add international exposure to your portfolio (which is important for proper asset allocation). Plus, they're also in the "sweet spot" of economic growth...

They're not too big... Starting from a lower level means they can grow faster than a developed country, like the U.S. or Germany.

At the same time, they're not too small... Emerging markets can grow faster than the next group down the scale, frontier markets. These are countries like Bahrain, Kenya, and Pakistan that don't have enough of an economy in place to make growth easy.

Based on IMF projections, developed economies will grow 2.1% a year until 2020, while emerging markets will grow nearly three times as fast at 5.9% per year. And while GDP growth and investments don't always move hand in hand, emerging markets have outpaced developing markets significantly.

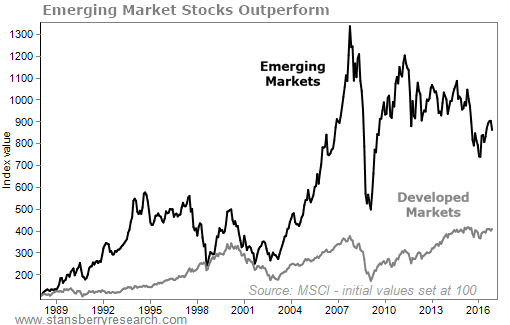

Since 1987, when MSCI launched its Emerging Markets Index, emerging market stocks have returned nearly 700%, while developed-market stocks have returned around 300%.

Emerging markets are an asset class that investors associate with risk. When everyone wants to lessen the risk in their portfolio, they cut their exposure to emerging markets. When everyone has an appetite for risk again, they step back in.

Of course, emerging markets do have higher volatility. We saw big swings in emerging markets in the 2008 financial crisis and another dip in 2015. This makes emerging markets a valuable tool to boost returns, but only with a well-diversified asset allocation.

Recently in my newsletter, Income Intelligence, we recommended a great way to take advantage of emerging markets while allowing for some margin of safety. We want to get in ahead of the crowd and ride the next boom in this sector. Research shows that emerging markets may outperform U.S. large-cap stocks by up to seven times in the next 10 years...

In fact, the last time emerging market stocks were this cheap, they returned 73% in a year. It's a great time to get some money out of expensive U.S. stocks and into cheap emerging market opportunities.

If you're already a subscriber, read the issue right here. And if you haven't tried Income Intelligence yet, you can start a subscription right now for 50% off, risk-free...

Each month we share insights into the best income investments, the state of the market, and check in on inflation, yields, and asset classes. Click here to get started today (this does not lead to a long video).

What We're Reading...

- The IMF's explanation on emerging market resiliency.

- Something different: Hitting the snooze button saved this man's life.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Retirement Millionaire Daily Research Team

Buffalo, New York

March 13, 2017