Doc's note: There's no greater wealth-building tool than the U.S. stock market...

Longtime readers already know this. Despite the market's ups and downs, the overall market is up since the start of U.S. stock investing. And stocks have outperformed every other asset. But this trend isn't true everywhere.

Today, I'm sharing an issue from my friend Joel Litman's Altimetry Daily Authority, where he explains why the U.S. has bucked this trend and why he's optimistic on the future of U.S. stocks...

(And make sure you don't miss out tomorrow when Joel will reveal a rare market anomaly that could allow investors to make hundreds-of-percent gains. Click here to learn more.)

Throughout the history of modern U.S. investments, stocks have outperformed everything else...

Look at the bond market, for example. U.S. stocks have outperformed bonds by an average of 4.6% per year over the past 150 years.

Meanwhile, you'd be losing money to inflation sitting in cash. And gold has barely returned more than 1% per year over the past hundred years.

That's the whole point of the stock market. It's riskier than bonds, gold, or cash in the short term... Yet over the long term, nothing could be riskier for your wealth than not owning stocks.

This trend isn't mirrored globally, though... For the rest of the world, stocks and bonds both return around 5% annually. The risk of investing in stocks doesn't seem worth it when your money would do just as well in safer assets.

Today, we'll discuss why the U.S. has remained an outlier for so long... and why it won't start acting like the rest of the world anytime soon.

The U.S. sets itself apart from other countries... because it's willing to let companies die.

Look at Japan, which created an army of near-dead companies when it prevented bankruptcies back in the late 1980s.

A similar situation seems to be brewing in China's real estate sector. Chinese housing developers are sitting on mountains of debt... and billions of square feet of unsold homes.

And yet, instead of letting the bubble burst, the Chinese government is doing whatever it can to sell those homes. It's easing its mortgage lending standards and cutting borrowing costs.

America doesn't step in to save dying businesses... at least, not often. While that can lead to a lot of bankruptcies, it also refreshes the economy every cycle. It opens up the field for new competitors.

Just last year, ATM maker Diebold Nixdorf went bankrupt as it struggled with rising interest rates. It was in that position in the first place because banking is becoming more digital.

There are entirely digital banks – look at Discover Financial Services (DFS) and SoFi Technologies (SOFI), for example – that don't own a single ATM.

As we move toward a near-cashless society, there's no need to keep stringing an ATM maker along. So the government let it fail.

Likewise, when companies are innovating, growing, and succeeding, regulators won't step in to slow them down without good reason.

E-commerce titan Amazon (AMZN) is a great example of this. Amazon has expanded from online retail into areas like health care, groceries, and entertainment. Its Chinese peer, Alibaba (BABA), was forced to give its Ant Group financial affiliate over to the Chinese government.

Our antitrust regulators are supposed to make sure companies like Amazon don't use their scale to overcharge consumers or limit competition. That said, regulators aren't going to stop companies from innovating out of fear that they'll perform better than their peers.

It's no secret that I'm bullish on the long-term prospects of the U.S. economy...

And the data backs me up.

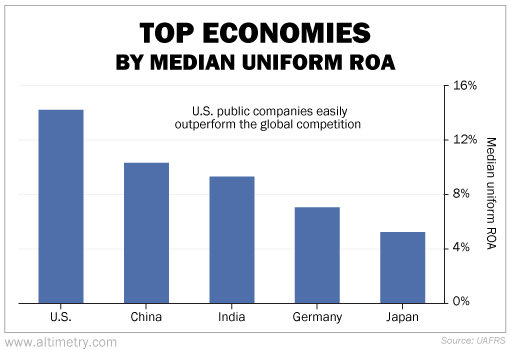

The following chart shows the median Uniform return on assets ("ROA") for established public companies – those worth $10 billion or more – in the U.S. and the other top four economies...

As you can see, with a median Uniform ROA of 14%, the U.S. easily tops the rest of the world's biggest economies. China has the next-highest returns, at 10%. And growing giant India follows close behind at 9%.

U.S. returns have bucked the trend because our country lets innovation dictate which companies win... and it doesn't get in the way of letting those companies win big.

It's no surprise U.S. stocks outperform bonds. We have the most profitable businesses on the planet.

Regular readers know I've been vocal about investing outside of stocks lately. As we approach a downturn, the bond market is one of the safest places to put your money.

That said, I'm still bullish on U.S. equities in the long term. As long as this cycle of innovation remains intact, the U.S. stock market will continue to outperform.

Regards,

Joel Litman

P.S. Tomorrow, Porter Stansberry is joining Joel to explain an opportunity in a select group of stocks we may never see again in our lifetimes. Porter says the story they'll tell is "without a doubt" the most valuable information you will ever get for free. Click here to make sure you won't miss out on the full details.