Kevin Clark decided not to replace two of his aging cruise boats... And that should worry you.

Clark is the Chief Executive of Argosy Cruises, a small Seattle tour-boat operator. While Argosy doesn't directly impact your life and investments, this does show there is trouble brewing in the broader economy...

Argosy didn't invest in new vessels because of high prices and economic uncertainty. A new 500-passenger boat would cost the company about $9.5 million – $1 million more than it cost two years ago.

That nearly 12% increase clearly outpaces the 1.8% annual inflation rate.

According to Clark, the main cause of the rapid price increase is tariffs. He also said trade tensions were reducing the number of Chinese tourists coming to Seattle.

Clark couldn't justify a massive multimillion-dollar investment without a clearer picture of what the next few years will look like.

Argosy was one of many small businesses profiled in a recent Wall Street Journal article which detailed economic confidence among small businesses.

It seems President Donald Trump's trade war is spooking them all.

According to a survey of more than 670 small companies, optimism is near a seven-year low...

And you can't blame them... Any increase in costs caused by tariffs hurts their ability to profitably run their businesses.

Most investors only buy stocks of big companies... Companies much bigger than Argosy Cruises. So why should you care if it didn't upgrade its fleet?

Because it shows businesses are reluctant to spend money right now. And that's bad news for the economy.

It's not just small businesses either... Business investment is weakening for both big and small companies. They may want to invest less because of uncertainty surrounding the economy – either from the trade war or because of signs of slowing global growth – but it might also be due to the benefits from the 2018 tax cuts that are fading away.

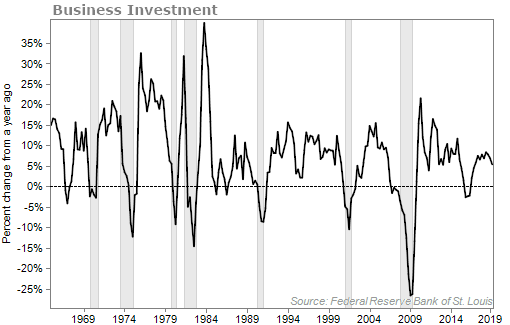

Gross private domestic investment – a measure of business spending on things like inventory, machinery, or new buildings – just had its worst drop in about four years.

As you can see, business investment is still growing compared to a year ago, but the growth rate is trending down. If we continue to see this fall over the coming months, history says we should expect a recession.

Looking back at the chart, businesses investment slowed sharply before every single recession over the past few decades. That's why we need to keep a close eye on it.

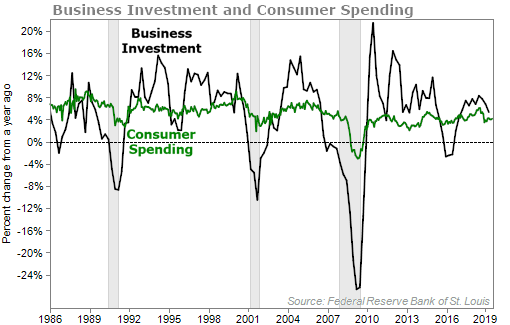

As businesses invest less money and don't expand, they hire less. And when the job market gets softer, consumers become tighter with their money and spend less. This will lead to an economic contraction.

Business spending tends to fall before consumer spending slows and before a recession hits. You can see the relationship below from the past three recessions...

There hasn't been much talk of business spending in the media. That's because the headlines are focused on robust consumer spending. And that makes sense because consumer spending makes up about 70% of the economy.

The U.S. consumer is strong right now.

So we don't need to panic over the business investment data just yet... But my team and I are going to keep a close eye on it.

It could turn out that businesses are just being cautious with their money. And if the trade situation with China clears up, businesses will resume their high rate of investment. In that case, this bull market could go on for many months.

Or it could turn out that this latest quarter was not an outlier and businesses continue to not spend. In that case, it will only be a matter of time before we see signs of weakness in consumer spending. And since this expansion is being propped up by the consumer, brace yourself.

Only time will tell... If this trend continues, we'll know it's time to sound the alarm.

What We're Reading...

- Small businesses' faith in economy hits low on tariff uncertainty.

- Consumers are spending. Businesses aren't. Who's right about the future?

- Something different: How do people learn to cook a poisonous plant safely?

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

September 4, 2019