If your 2019 New Year's resolution is to beat the market, good luck...

While the S&P 500 Index has averaged an annual return of about 10% since 1926, most investors have underperformed. And by a wide margin.

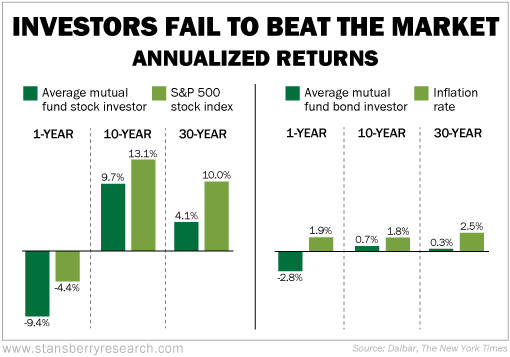

According to Massachusetts research firm Dalbar, the average mutual fund investor has done much worse than the markets for both stocks and bonds. The numbers especially don't look good for stock investors...

Over the past 30 years, stock mutual fund investors have underperformed the S&P 500 by 5.9 percentage points a year.

Over the past 10 years, they underperformed by 3.4 percentage points a year.

That's a lot of money that folks have been missing out on.

The average bond investor hasn't done much better. Most don't even keep up with inflation...

If the everyday investor can't do better than the market, what's the point of even trying? Why not just park your cash in an S&P 500 fund and earn 10% over the long term?

If you want to be hands-off with your investing, this might be a good idea. As famed economist Gene Fama Jr. once said, "Your money is like a bar of soap. The more you handle it, the less you'll have."

But you'll have to truly be hands-off... Because while 10% is the average annual return, the returns in any given year are far from average.

Between 1926 and 2014, the average return for the market was between 8% and 12% only six times. The rest of the time, the returns were either much higher or much lower.

Volatility, as we know, is king.

So if you become an index fund investor, you'll have to go through years of great highs and some soul-sucking lows. Most of us don't have the stomach for that. That rules out buying and holding an index fund for a lot of investors.

If you do want to invest your own money, you need to believe this... While beating the market sounds difficult, it can be accomplished.

Think about why most folks underperform...

A lot of it has to do with decisions of when to buy and sell. We tend to buy at tops and sell at bottoms. Even though most everyone understands not to do this, they just can't resist.

That's due to our emotions.

It's scary to hold on to a stock that has fallen 20%. And it's difficult to think that a stock that just jumped 30% can go higher. Emotions have a lot of influence over our decisions. Especially when it comes to money.

Diversification usually is a big factor as well. Many investors load into one specific sector and get crushed if there's a downturn.

Others hold too many long positions and don't have the necessary hedges in place if things go the other way.

There's a lot to consider when you're in charge of your own portfolio. History says you likely won't do better than the market... but with the right tools in place, I'm willing to bet you can.

If you need an example of how to beat the market, look no further than our very own Austin Root.

Austin Root is portfolio manager of our successful Stansberry Portfolio Solutions products.

Portfolio Solutions is a product that takes the guesswork out of investing... It tells you exactly what stocks to buy, when to sell, and even the exact number of shares you need to buy.

Porter Stansberry, Steve Sjuggerud, and myself join Austin to form the Portfolio Solutions investment committee.

In short, our portfolios performed extremely well last year. The market ripped higher for most of 2019, but we did better...

Our Capital Portfolio, which is designed to play Steve Sjuggerud's "Melt Up" thesis, crushed the market.

While the S&P 500's total return was 31% (with dividends reinvested) for the past year, the Capital Portfolio gained 42%. Now that's a wide margin.

Austin recently told his subscribers that one of the keys to outperform (besides picking great stocks, of course) was to keep losses as small as possible.

For 2019, he wasn't perfect. No one is. He picked some great winners like Apple (AAPL), which more than doubled, and an Argentine company that was up 95%... but he also had a few losers.

The key is that the losses he did take were small. For example, he sold two stocks before they hit their trailing stops. In the end, that proved to be the right move... And the losses he took on both positions – a loss of 8.5% and 5% – were minuscule to the gains the rest of the portfolio was earning.

As Austin said after he closed out 2018...

Going forward, we'll do a better job limiting our exposure to any single risk factor... And we'll exit more quickly when the story changes (i.e. the U.S.-China trade war altering our investment thesis), even if that happens before we hit our trailing stops.

Trust me, this is easier said than done.

It was a remarkable year for Austin and the Portfolio Solutions team, but 2020 is shaping up as another opportunity for stock market gains.

Austin, Porter, Steve, and myself are going to sit down next Tuesday at 8 p.m. Eastern Time, live on camera, to talk about how it's possible to beat the markets this year.

If you've been underperforming in your own investment accounts, this is a must-attend event.

Plus, as a bonus, Porter, Steve, and I will each share our No. 1 favorite stock for 2020.

Click here to reserve your spot.

What We're Reading...

- What's the average stock market return?

- Something different: A former 'Bachelor' contestant who won a million dollars on DraftKings just got accused of cheating.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

January 8, 2020