Beware bad advice...

Recently, a family member asked me (Laura Bente) for some credit card advice.

He's young and just starting to build his credit. He's worried about setting himself up for a solid financial future.

He spoke with an account manager at a big bank who said that in order to build credit, you should always maintain a small balance on your credit cards rather than paying them off.

That's not true.

I knew that account manager was either uninformed or lying. But when I quizzed some friends and coworkers, I was shocked to learn how many people believe this.

So today, I'm debunking three common credit myths. Not only are these myths costing you money, but they're putting your good credit at risk.

Let's start with...

Myth No. 1: I should carry a small balance on my credit cards.

Calling this terrible advice doesn't do it justice...

Some people think that you don't build credit history when you pay your balance in full each month and that you need to maintain a small balance to acquire history.

False.

You build a history just be using your credit card. And if you pay the balance off each month, that shows potential lenders you're responsible.

If you've followed this nonsense advice, you're wasting your money and hurting your credit.

When you leave a balance on your credit card, you have to pay interest on it. While it may not be a lot, it will add up over the years.

What's more, carrying a balance can actually hurt your credit, as it lowers your credit-utilization ratio (more on this in a bit). This ratio is one of the key components when it comes to calculating your credit score.

So if anyone tells you to keep a small balance to "help" your credit, ignore them. Remember, most people working in banks are salespeople, like account managers and tellers. I know from experience that they get incentives to keep you as a customer and keep you spending. And their companies make money when you pay interest on your credit balance.

Don't line their wallets while emptying yours.

Myth No. 2: Checking my credit report/score hurts my credit.

There are two types of credit inquiries – "hard" and "soft."

A hard inquiry typically happens when you apply for a loan, credit card, or mortgage and the lender or issuer checks your credit. Although hard inquiries can impact your credit score, just one won't do much.

If you're checking rates for something like a mortgage or a car loan (known as "rate shopping"), the hard inquiry shouldn't hurt your credit if you get a loan within 30 days.

However, if you're regularly getting hard inquiries and no loans, that will damage your credit because it suggests you're likely a credit risk. That's because lenders will think you keep getting denied for loans, and they don't want to take a chance on someone their competitors have already declined.

Then there's a soft inquiry... This type of inquiry includes things like employment verification or checking your own credit score and credit reports.

You should absolutely keep an eye on your credit. Nowadays, most credit card companies will give you your credit score for free.

And you get one free credit report from each of the three major credit bureaus in the U.S. – Equifax, Experian, and TransUnion – for free each year.

Knowing your credit score helps you haggle for better interest rates on loans. And keeping track of your credit reports is the No. 1 way to catch identity theft.

Here at Health & Wealth Bulletin, we've told readers for years that keeping an eye on your credit reports and score is vital to having healthy credit.

Myth No. 3: It's better to close a zero-balance credit card I don't use than to keep it.

This one isn't exactly a myth, but it's important to understand when you should and shouldn't close a credit card.

Closing a card will likely have some impact on your credit, but how much impact depends on factors like the age of the card and its credit limit.

First, you don't want to close your oldest credit card. A shorter credit history makes you look riskier to lenders.

This is where your credit-utilization ratio comes into play. A credit utilization ratio is the measure of how much of your total credit you're using. To calculate the ratio, you divide your credit card balance and other debt by your total revolving available credit.

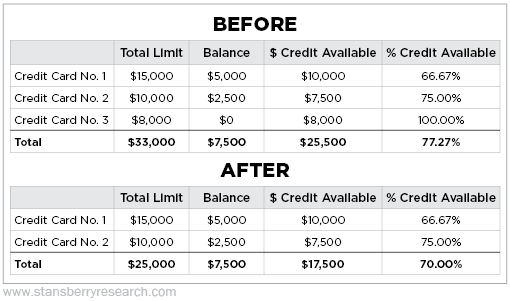

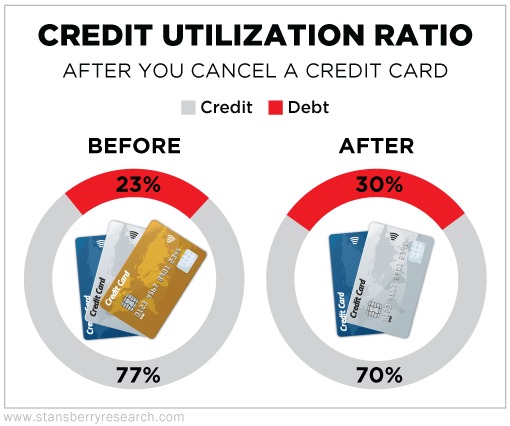

Let's say you have three credit cards. Here's what happens if you close the card without a balance...

You can see that the credit-utilization ratio jumps from 23% to 30%. That might not seem like much, but even a ratio that's just a little higher can stick you with higher interest rates on loans and other credit cards.

Now, if you're paying an annual fee on a zero-balance card, closing it begins to make sense – especially if you're not anticipating that you'll need any loans in the near future.

Also keep in mind that companies can cancel cards – without warning – due to inactivity.

This happened to me a few years ago. The bank closed my card, only sending a letter after the card was closed. I was fortunate that my card was my youngest card, and the one with the smallest credit limit. So there wasn't much impact on my credit.

If you're worried about a card being canceled, talk to your issuer about its policies. And maybe use that card to buy a tank of gas once a month. Or you can do like I do... set up a single subscription service – like Netflix – on that card and then just leave it in your drawer.

What are some other credit myths you've heard about? Share them with us at [email protected].

What We're Reading...

- American credit card debt fell in 2020.

- Something different: The Russian widow who bought a tank to take on the Nazis.

Here's to our health, wealth, and a great retirement,

Laura Bente, CFP® with Dr. David Eifrig

March 18, 2021