Investing is hard.

It's tough to gain an edge on the market when the market is made of some of the smartest financial minds in the world.

And it's even harder to beat these professionals when you continuously make – often easily avoidable – mistakes.

Today, I want to go over three common psychological traps investors should avoid...

Trap No. 1: The Anchoring Trap

First impressions can be powerful. A lot of the time, folks who are hiring for a job will decide in the first minute or two if the candidate will get the job or not. First impressions are powerful in investing, too... Though they shouldn't be.

The anchoring trap is when an investor has an over-reliance on what he or she originally thought.

Let's say you used to be a frequent shopper at Toys "R" Us years ago. If you ever needed a birthday present for your grandchild or nephew, Toys "R" Us always had the best toys at the cheapest prices. And its customer service was top notch. As a result, anytime someone brings up Toys "R" Us, you think of a quality company.

You're so blinded by your initial perception of the company that you couldn't see that the competitive environment was changing for Toys "R" Us.

For decades, Toys "R" Us was the dominant force in the retail toy world. But by the 2000s, families didn't need to go to Toys "R" Us to buy toys anymore... Amazon made shopping for the same items a one click affair.

So if you were invested in Toys "R" Us during its heyday thinking the company was here to stay, you would have lost a lot of money when it declared bankruptcy.

You must always remain flexible in your thinking when you invest. Things constantly change and so should your thinking. Be open to new information. It's okay to change your opinions when the facts change.

Trap No. 2: The Pseudo-Certainty Trap

I see this one far too often. It deals with how much investors are willing to risk.

Let's think about the market today. Stocks are at all-time highs and consumer confidence is up near highs too. Many folks think the Fed will cut interest rates soon, which should boost the market. And the end of the trade war could be soon, which would be another tailwind for stocks.

Things feel good. There are a lot of reasons to be bullish.

This should be the time when most investors are willing to take a little more risk and ride the market higher. It's the basis of my colleague Steve Sjuggerud's Melt Up thesis. But investors aren't doing that. They're playing it safe.

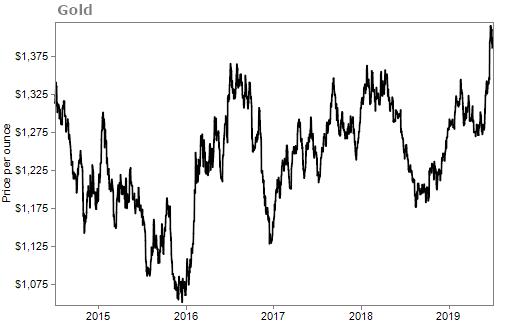

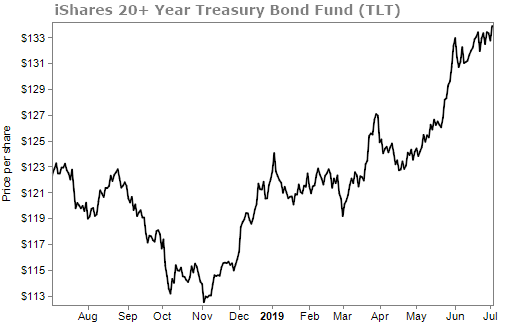

You can see that mindset by looking at the recent run-up in safe assets.

Gold is up near multi-year highs...

Safe and boring municipal bonds have been pushed up as well...

It's the same with Treasury bonds...

Despite the historic highs in stocks, investors are looking for safety.

There are two parts to the pseudo-certainty trap: The first is when investors remove risk when their portfolios are performing well. You can think of it like this... A NASCAR driver won't win a lot of races if he slows down every time he is in the lead.

The second part of this trap is when investors seek risk when their portfolios are falling. This can be detrimental and it's what you need to watch out for.

When most people start to see their portfolios turn red, they often act out of desperation. They pile on risk to try and win it all back. This is a huge mistake. Likely, your bet won't pay off and you'll lose even more money.

When the market is falling don't try to time it and buy when it's at a "bottom". Most people think they can catch a falling knife and it turns out they can't. They buy when they think the market is at a bottom only to have stocks fall by another 15%.

The pseudo-certainty trap is all about getting in when there is an uptrend and getting out when there is a downtrend.

Trap No. 3: The Sunk-Cost Trap

The sunk-cost trap may be the most dangerous trap of all. It's when a person will continue with something just because of the money, time, and effort that has been invested in it – even though they might not do the same thing if they hadn't already invested in it.

We've all done it...

We've all bought a movie ticket, sat down in the theater, and then realized halfway through that it's a terrible movie. But we made it this far and we've already paid for it... so might as well finish watching the movie.

Or we keep clothes in our closest that we know we're never going to wear since we already spent the money on them.

And of course, the sunk-cost trap happens when we buy a bad investment and refuse to sell it. Even when it's obvious we're wrong as we see the stock plummeting. We remain committed to the investment. And, worse still, we often put more money into the loser, thinking, "It has to go back up eventually."

This is easier said than done, but... Know when to cut your losses.

Emotions make cutting your losses so hard to do. That's why I usually recommend investors use some sort of exit strategy. Stop losses are a wonderful tool for combatting the sunk cost trap.

The bottom line is investing is hard... So don't make it harder. Be aware of these traps and actively think about ways to avoid them.

What We're Reading...

- How do you avoid the sunk-cost trap?

- The eight traps of decision making.

- Something different: How Poland became a front in the cold war between the U.S. and China.

Editor's note: Our offices here at Stansberry Research will be closed tomorrow in observance of the Fourth of July. Look forward to your next issue of Health & Wealth Bulletin on Friday, July 5. Have a great holiday!

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

July 3, 2019