Doc's note: "Cheap, hated, and in an uptrend"... That's how my friend and colleague Steve Sjuggerud describes his favorite investments. But it's challenging to find these opportunities, especially in this historic bull market.

Today, Steve details an investment that's bouncing back from hatred extremes... and he shows exactly how you can buy in...

I built my career on three words...

I didn't think I'd be the kind of guy with a tagline or a catchphrase. But today, I am.

When I speak at conferences, the audience says them with me.

If you don't know the words yet, you will soon. They're the guiding philosophy behind how I invest.

I've used these three simple words to define three investment rules. These are the three things I always look for when investing. And they've shaped my career.

Today, I'll share my guiding philosophy – and one investment it points to right now.

Let me explain...

Before I put money to work, I want to find an investment that is cheap, hated, and in the start of an uptrend.

This strategy is contrarian by design. It means buying after investors have given up... when prices have fallen to attractive levels. It also means having the discipline to wait for prices to reverse.

That simple model has been the key to my success. And it's been responsible for the biggest gains of my career. That includes the calls I've made in the gold market, which have been some of the most profitable recommendations for my readers over the years.

Interestingly, these three principles point to gold as a fantastic opportunity right now.

You see, gold had recently spent the better part of seven years falling in price. It was down by more than a third over that period. So clearly, the metal was cheap.

Investors also hated the idea of owning gold. And it was easy to see why.

Gold is disaster insurance. It goes up when the global economy goes south. And we haven't had a disaster in more than a decade.

The result is that investors had moved on to greener pastures... They gave up on gold. In August, the metal hit its most hated level in 17 years. At the time, I told my DailyWealth readers we saw a similar degree of "hatred" in 2001... Before gold's last great bull market.

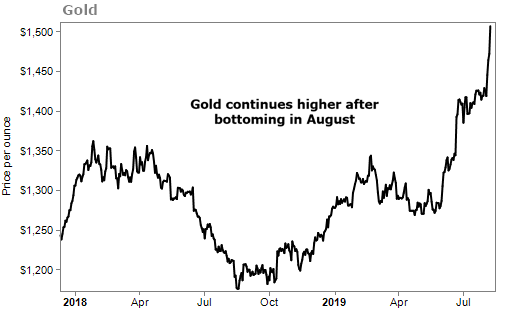

I love to see this setup. It's the kind of sentiment extreme that contrarian investors dream of. And right now, we're seeing gold in an uptrend. Take a look...

Gold has been trending higher since last August. The metal is up a little more than 25% since then.

This is exactly what I told DailyWealth readers was possible based on recent negative sentiment. And it's not over yet...

Remember, gold prices had been falling for years. Late last year, investors hit their most extreme negative sentiment levels in nearly two decades. And now, the price is in a defined uptrend.

Said another way, gold is coming off extreme cheap and hated levels... And it's finally back in an uptrend.

I've built my career looking for these kinds of opportunities. It's how I've found my biggest winners. And right now, gold fits this investment philosophy perfectly.

Gold has taken off in recent weeks... But you haven't missed all the gains. We are still bouncing back from extreme hated levels. And we could see higher returns as the uptrend continues.

You can get in on this opportunity today by buying shares of the SPDR Gold Shares Fund (GLD). This fund holds physical gold to back its shares... And it's the easiest way to take a position in gold.

Good investing,

Steve

Editor's note: On August 21, we're staging a massive online event... the 2019 Gold Rush with gold investing legend John Doody. Whether you're a total newbie or a billion-dollar fund manager on Wall Street, you'll get a chance to find out how you can make more money using gold than you've ever thought possible.