Americans are saving more for retirement than ever...

Earlier this year, brokerage firm Vanguard released its annual "How America Saves" report. And one of the key findings is that the average 401(k) balance saw a huge rise – from $106,478 in 2019 to $129,157 in 2020.

Of course, most of this increase is due to the stock market rising around 16% in 2020, but it also points to a trend in more folks focusing on their retirement and investing in their 401(k) accounts. But a 401(k) plan is one of the most powerful instruments you can use to grow your nest egg.

Unfortunately, only about 60 million Americans have a 401(k) plan. And of the folks who have access to a 401(k), only around 40% actually put any money into it.

And now, with fears of recession growing and stocks entering bear market territory, I've heard from folks who wonder why they should bother investing in a 401(k) right now.

While it's true that, like a typical brokerage account, your 401(k) is at the whims of the market, that's no reason to avoid it...

Here are three reasons you should take advantage of your 401(k) to start building wealth for your retirement.

No. 1: The stock market is the greatest wealth-building tool in all of history.

If you own stocks over a long period of time, there will be some bumps along the way. When you look at stocks through a narrow lens, things can look pretty bad.

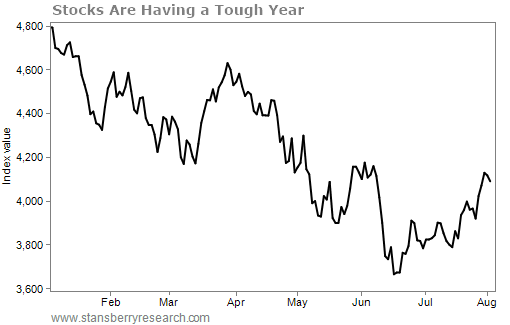

Take a look at this chart of how the S&P 500 Index has done this year. Pretty bleak, right?

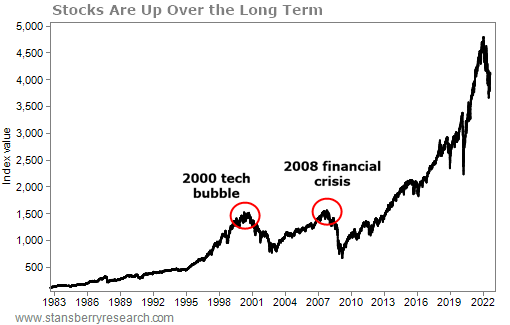

But take a look at a longer view...

When you invest for the long term, as we typically recommend in the Health & Wealth Bulletin, your portfolio will be up over time, despite the falls along the way.

But you can also see that – though fresh in investors' minds – the global financial crisis of 2008 was an outsized event. Yes, markets can get bad, but that was a truly historic crash that doesn't happen often.

Of course, this doesn't mean you should invest and then forget your portfolio. You don't want to get caught ready to retire in a year when stocks are down. That's why you should protect your portfolio through means we've detailed for readers before... like smart asset allocation, following your stop losses, and diversification.

No. 2: It's free money from your employer.

Many employers match 401(k) contributions up to a certain limit... These contributions are free money and are the biggest, 100% safe returns you will ever receive in the market.

For example, if you contribute 6% of your salary, and your employer matches half of that up to 3% – a fairly typical employer contribution – you've just earned an instant 50% return.

Take someone earning $4,000 a month before taxes. She can contribute $240 on her own (6%) and receive $120 from her employer (3% match). As a result, she'll save $360 a month.

No. 3: You're saving money on taxes.

Let's look at the employee example from above. Even if that employee's employer didn't match contributions, she'd still get a nice tax saving since her 401(k) contributions come out of her paycheck before taxes. If she's in the 25% tax bracket, she effectively saves $60 (her $240 contribution times her 25% tax rate). Her take-home pay is then reduced only by $180 because of that tax savings.

That means she gets $360 for $180... doubling her money on the first day.

That's because a 401(k) allows you to put away pretax money to save for your future. Plus, that money grows tax-deferred as well. No other investment can make that kind of money so fast (with so little risk).

You will pay taxes when you withdraw money from your 401(k). And if you take money out before you're 59 and a half, you'll have to pay an additional 10% penalty. But it's more likely that you'll be in a lower tax bracket in retirement than while you're working.

Bottom line... Having a 401(k) is one of the easiest and most efficient ways to grow your wealth. If you're not already investing in a 401(k), it's time to get started. And if you already have an account, see if you can invest more into your plan today.

Do you have questions about saving for retirement? Let us know... [email protected].

What We're Reading...

- Here's how much Americans have in their 401(k)s.

- Something different: Processed foods are ruining your brain.

Here's to our health, wealth, and a great retirement,

Laura Bente, CFP® with Dr. David Eifrig

August 4, 2022