Hidden fees pervade the financial industry...

For example, the fees on fund investments always look small to the untrained eye. A mutual fund can easily charge 2%-3% of assets without looking too expensive.

When the percentages are that small, it can seem like it's not worth your time to fret over fees.

Don't fall for this Wall Street trick...

Remember, these aren't one-time fees. It's a 2% hit every year. Over time, that 2% adds up substantially. And it's particularly egregious considering you can easily find funds with fees as low as 1%, or even 0.25%.

Even more troubling, each year you pay a fee, you lose decades of compounding that would grow on top of that money.

The results add up...

Consider an investor who saves $5,000 a year, earns 8% in returns on investments, and pays a 2% annual fee. Over 40 years, he amasses $786,000.

If he cut that fee to 1%, he would finish with $1,045,000.

Think of how hard you work to save $5,000 every year for 40 years. It's not easy. No matter how much you earn, life gets expensive. Over all that time, you set aside $200,000.

But here's the catch: You can earn an additional $259,000... by just spending five minutes controlling the fees on your funds.

That's easy money.

Step 2 of boosting your 401(k) is figuring out what fees you're paying... and lowering them if possible. You should be able to get your fees to less than 1% if your retirement account has reasonable options.

And you can do even better than that.

Skeptics might wonder... When we switch to cheaper funds, aren't we going to get worse performance? Don't bargain prices mean bad funds?

Nope. The truth is the exact opposite...

[optin_form id="288"]

This is Step 3: Picking the right funds.

The cheapest funds in the game are index funds.

Index funds don't have a Wall Street trader behind them, trying to outcompete everyone else and beat the market. (The majority of these "smart guys" fail.) Rather, index funds follow simple rules designed to help them track the overall performance of a particular asset class, like U.S. stocks or Treasury bonds.

Most "actively managed" funds (those with a manager trying to pick the best stocks) underperform the market year after year. In fact, 96% of actively managed mutual funds fail to beat the market over a sustained period.

That means you don't have a 50-50 chance of picking a "good" fund or a "bad" fund... It hardly even matters which one you pick. The vast majority are bad and won't beat the market.

On the other hand, index funds don't need to pay superstar managers or an army of analysts. Ironically, they keep costs extremely low and provide better performance.

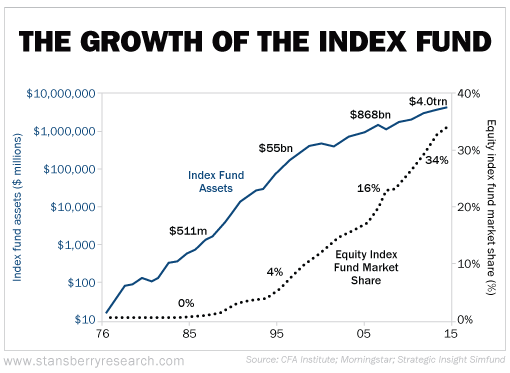

Investors are finally catching on. The index-fund industry is growing...

In the chart below from index fund giant Vanguard Group founder John Bogle and creator of the world's first index fund, you can see how the market share of index-fund assets has grown from 4% in 1995... to 16% in 2005... and then more than doubled in a decade to hit a record high of 34% last year.

And last year, Vanguard's Bond Index Fund surpassed PIMCO's Total Return Fund as the largest bond fund in the world.

Vanguard's low-fee index fund offerings and Fidelity's "Spartan" brand of index funds are great places to start. (On a side note, while at Goldman, I helped Fidelity set up its Spartan funds decades ago. My group spent time teaching it ways to use derivatives to streamline its money-management processes.)

It's likely your plan offers a few mutual funds that track an index.

By following these three simple steps, you can fix your retirement account and boost your lifetime returns by hundreds of thousands of dollars... in just a few minutes.

(Note: If you missed Step 1 in yesterday's Retirement Millionaire Daily issue, you can find it right here.)

Take the time to review your 401(k) today with these three steps in mind... It will be the easiest money you make in your entire life.

What We're Reading...

- Fees on mutual funds fall... Thank yourself.

- Again... If you haven't seen it yet, make sure you read my June 2015 issue of Retirement Millionaire... especially the "total control mode" that your employer and 401(k) provider might offer that can get your fees down even lower. (If you're not yet a subscriber, you can learn how to join here.)

- Something different: Could 1 trillion species be living on Earth?