When you try to tell the story of a growing industry, it always feels better when you have that one trigger that explains everything...

For example, a shortage of oil sends other commodity prices soaring.

Technology, however, doesn't just have one. Instead, tech has multiple factors working together at once. And changes are happening fast.

Consider artificial intelligence ("AI").

It's no secret that AI and things like machine learning have been much touted and overhyped in past years, but they're real today. In fact, AI played a vital role in the development of the COVID-19 vaccine.

Typically, it takes decades to develop a new vaccine. But it only took three months after the first reported COVID-19 case for vaccine candidates to undergo human tests. AI models were able to help speed up the process by analyzing massive amounts of data.

You see, there are many thousands of subcomponents to the outer proteins of a virus. AI can sift through all of those subcomponents and help predict which ones are the most capable of producing an immune response. That helps scientists design targeted vaccines.

Another technology driving the industry is cloud computing.

The ability to store massive amounts of data in the cloud rather than on in-house hardware has created efficiencies for all different types of businesses. And it's because of COVID-19 that many companies were forced to use the cloud as offices were shut down. Cloud computing makes businesses nimbler, faster, and more profitable.

As Microsoft CEO Satya Nadella said in an earnings call last year...

As COVID-19 impacts every aspect of our work and life, we have seen two years' worth of digital transformation in two months. From remote teamwork and learning to sales and customer service to critical cloud infrastructure and security, we are working alongside customers every day to help them stay open for business in a world of remote everything.

Technology is also progressing to the point that immunotherapy has changed cancer treatment.

Immunotherapy redirects a body's own immune system to combat disease. Ipilimumab, the first "immune checkpoint inhibitor," was approved only in 2011. Now, cancer immunotherapy is a $100 billion industry and is forming a new standard of care in cancer. As the field progresses, therapies will become more targeted, more personalized, and more effective.

There are so many factors that will drive technology over the next decade. We haven't even talked yet about self-driving cars, blockchain, alternative energy, or 5G networks.

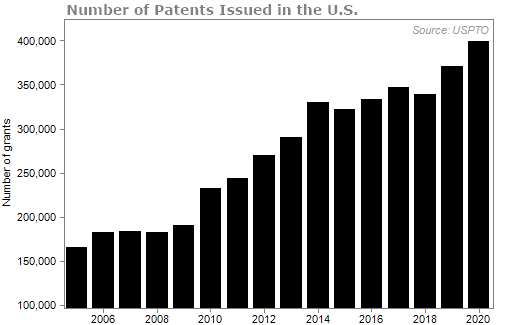

The rate of technological advancement is so strong that the number of patents issued in the U.S. has more than doubled since 2009...

Again, the boom in tech that we're about to see over the next few years isn't because of one thing. There are many driving forces. And that's the reason why Stansberry Research's new analyst Matt McCall is calling for the "Roaring 2020s."

If you recall, the original Roaring '20s were years where Americans were thriving. In the 1920s, investors enjoyed a rising stock market. Plus, many different kinds of companies launched brand-new cutting-edge products, like radios and washing machines.

In total, the nation's wealth more than doubled between 1920 and 1929.

And, of course, jazz-loving flappers flouted Prohibition laws and the Harlem Renaissance redefined arts and culture.

According to Matt, the next decade could be very similar to the 1920s – though jazz probably won't make a comeback.

Matt thinks the upcoming decade will be an amazing time to be invested in stocks – specifically, innovative tech stocks.

Matt focuses on small companies involved in 5G and the Internet of Things... artificial intelligence and the future of health care... electric and autonomous vehicles... and blockchain.

For years, these industries were nothing more than dreams. We'd always hear folks say, "Maybe one day we'll have robots" or "Maybe one day we'll have a self-driving car."

But the reality is that these technologies are becoming real.

And the best way to invest in them is with a proven stock-picker like Matt McCall.

Matt is looking for tiny companies within these booming industries that will become multitrillion-dollar behemoths by the end of the decade – the next Apples, Amazons, Microsofts, and Alphabets. Matt believes buying these kinds of companies and holding them over many years will deliver life-changing returns.

Earlier today, Matt sat down to talk about this massive opportunity. Matt also shared the name and ticker of his favorite tiny stock. He says that if he had to pick just one stock with 100-bagger potential, this company would be it.

You can click here to watch Matt's just-released presentation.

What We're Reading...

- Something different: Southwest drops plan to put unvaccinated staff on unpaid leave.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

October 20, 2021