The similarities of the market today to the late 1990s are unmistakable...

If you had any money invested in the late 1990s and early 2000, you'll remember what it was like. Everywhere you went, someone was bloviating about all the money they were making in the market. Your friends, your co-workers, even your mailman... everyone thought they were the next coming of Warren Buffett.

The promise of fast gains turned folks who had no interest in stocks into day traders overnight.

We all know how that ended...

Over the past few months, there has been similar excitement about stocks. The GameStop (GME) fiasco a few weeks ago forced dinner conversations across the country to revolve around the stock market.

The truth is that the S&P 500 Index has been on a one-way ride higher since the market bottomed in March. Stocks are up nearly 75%. It's incredible. And it's hard to ignore.

Like the late 1990s, you can barely go about your normal day without hearing someone talk about stocks.

Perhaps what's fueling this exuberance even more is the price action of bitcoin... It has been soaring recently. The cryptocurrency is up a remarkable 64% since the start of the year.

The euphoria we're seeing today only comes around every few decades or so. The last great one was in the late 1990s.

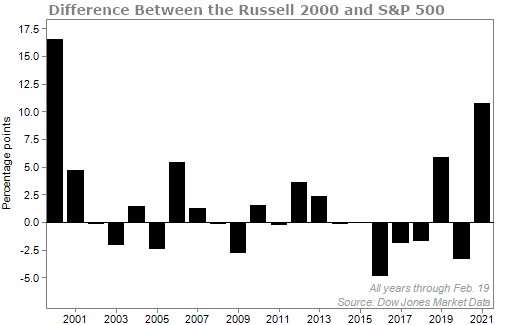

Another sign that today's market is similar to 1999 and early 2000 is the recent performance of small-cap stocks.

The most common way to measure small-cap stocks is by the Russell 2000 Index. This index is made up of the smallest 2,000 stocks in the Russell 3000, a benchmark of the entire U.S. stock market.

Small caps tend to be volatile. These businesses usually do not have big piles of cash and economic moats like many larger companies. For that reason, they usually don't hold up well in recessions. Small-cap investors tend to jump ship at the first sign of trouble.

But in times of euphoria and speculation, you want to own small caps. High-growth stocks are the ones that get the most attention. Plus, small-cap companies are more sensitive to the economy. As the economy rebounds, like it has been doing recently, it makes sense that small caps would outperform.

Since the beginning of the year, the Russell 2000 has climbed 15%. To put that in perspective, if the Russell 2000 continues at its current pace, it would earn over 200% for the year. While that's likely not going to happen, it shows that 15% in just under three months is a huge move for a big, diversified index.

The Russell 2000's return crushes the S&P 500's return of 4% over the same period.

This outperformance is no small feat. It's the widest difference in returns between the two indexes since... you guessed it, 2000.

The belief is that there will be another stimulus package approved any day now. That will keep driving gains for small caps.

Newly inaugurated President Joe Biden has proposed a stimulus package of $1.9 trillion, with stimulus checks up to $1,400 going to individual Americans.

On Monday, the package advanced out of the House Budget Committee and is now set for a vote by the House of Representatives later this week. It's expected to quickly pass and then make its way to the Senate.

To be fair, we're talking politics... and nothing ever goes as smooth as you'd expect. Still, another stimulus package could mean that over $4 trillion in total stimulus will be unleashed on the economy over the past year.

This sets the stage up for stocks to keep running higher.

In times of euphoria, you don't want to be the one stuck on the sidelines in cash. You'll miss out on life-changing gains. Of course, you also don't want to get suckered by greed only to lose everything on the way down.

Here at Stansberry Research we want to make sure you make money on the way up and avoid the inevitable crash.

One way to cash in on the euphoria we're experiencing today is with cryptocurrency. And I don't say that lightly... It's very easy to lose a lot of money in cryptocurrencies if you do not know what you are doing.

The key is having a good guide.

Here at Stansberry Research, we have our own cryptocurrency expert, Eric Wade. Eric has the connections and the boots-on-the-ground research that individual investors just can't access.

Eric believes there is one crypto investment that could soar if you get in today – and it's not bitcoin. He calls it an "unstoppable computer" that has already made $100 million for its founder. Early investors could make a small fortune... but the window is closing soon.

Eric explains everything here.

What We're Reading...

- From IPOs to trading cards, market euphoria is everywhere.

- Reddit day traders wanted to beat Wall Street to prove the system is rigged. Instead, they did it by losing.

- Something different: My senior analyst has been right on the money with the mania in Top Shot. You can read more about Top Shot here.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

February 24, 2021