So long sweet, dull summer... It's time for stocks to get back into full swing this fall.

You've probably heard that Wall Street takes a breather from trading as soon as the weather gets warmer. Traders making gobs of money take their families on vacations to exotic islands and try not to think about the markets for a while.

The average investor will also step away from their laptop to travel and enjoy the sunshine. As a result, fewer investors are on their computers ready to react every time the Federal Reserve makes an announcement.

We often see less volatility in the markets during the summer months.

That has certainly been the case this summer...

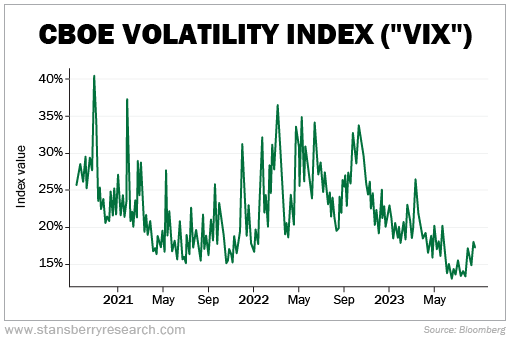

Consider the CBOE Volatility Index ("VIX"). The VIX is a measure of expected volatility. It reflects the price investors are willing to pay for protection on the upcoming returns of the S&P 500 Index. The higher the index, the more investors think the market will move.

Today, the VIX is around 17 as I write. And it has been hanging below 15 this summer. That's around the lowest level in three years...

You can see the VIX has already bounced off its lows in recent weeks. History says we should expect volatility to pick up even more.

You see, we're heading into the rockiest part of the year...

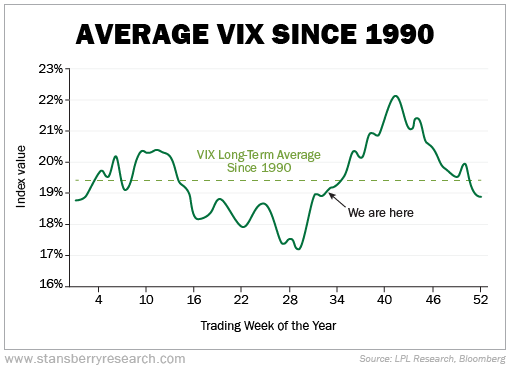

The chart below looks at the averages of the VIX since 1990. You can see from around April to August (weeks 14 to 35), there's not much going on in the markets. Volatility is below 20.

But summer is almost over. It's around this time of year that we often see the VIX shoot up above its long-term average. Take a look...

You can also see that volatility heads lower as the end of the year approaches. Once again, traders want to spend more time with family during the holidays than sitting at their desks.

I (Jeff Havenstein) am not writing to you today to try and scare you. I just want you to be prepared for the rest of the year.

Many investors have been lulled into a sense of calmness over the past couple months. The S&P 500 hasn't done much but inch higher. It's up about 14% this year. But based on history, it's time to start paying more attention to the markets and, in particular, your portfolio.

My advice is to give your portfolio a long, hard look before we move into the fall.

Make sure you are properly diversified across many different asset classes. It's easy to see the S&P 500 grind higher and want to move all your money into stocks. But we've always preached here at Health & Wealth Bulletin that the best investors are ones who stay discipled and never make all-or-nothing bets.

It's also a good idea to have a bit more cash on hand as we move out of summer. As volatility picks up, you'll be able to find better deals on stocks you love. You'll want some "dry powder."

For your stock portfolio, go through each one of your holdings and make sure the reason you bought the stock originally is still true today. If the story has changed, it's time to sell. And make sure you are practicing proper position sizing. In general, we believe no one stock should make up more than 5% of your overall portfolio.

Right now, Chaikin Analytics founder Marc Chaikin is calling for more volatility headed our way. And he's revealing a strategy that is specifically designed for this type of market environment. Marc explains how to harness this volatility and use it to generate quick gains in very short periods of time.

So if you're ready to get your money working for you, click here to see how Marc does it...

What We're Reading...

- Something different: S&P downgrades multiple U.S. banks on growing liquidity worries.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

August 23, 2023