The feedback keeps pouring in...

Back in mid-May, one of our readers sent us a question about one of our investment recommendations in my income-focused newsletter Income Intelligence.

The question was a good one. And it was a question I'm sure many had about municipal bonds (or "munis").

Here's what C.M. asked us...

Muni bonds. Do you not put much credence in all the info out there about local governments unfunded pension problems that may force them into bankruptcy or at least to a lower credit rating which would be problematic for muni bonds, would it not?

And in a recent Health and Wealth Bulletin Q&A, I said...

Do we wish municipal budgets were in better shape? Of course we do! But the bonds aren't backed by the money in the city coffers – they are backed by the power to tax.

Defaulting on bonds is a major disaster for a city or state. They won't be able to borrow again in the future. That's why they'll do nearly anything to avoid defaulting... and it's why defaults are exceedingly rare. Even if we do see defaults rise a bit, muni bonds are still one of the safest asset classes you could own.

I thought that response would suffice for C.M.'s question. But boy was I wrong.

Since that issue, we've received a barrage of emails about muni bonds. Some folks have been advocating for them. And others saying they won't touch them.

Typically we only get this much feedback from hot topics like cryptocurrencies or marijuana investing... So I was thrilled when it was about boring old muni bonds.

Today, I'll share the details on munis... In short, I think they're a safe place to put your money today given all the craziness in the market. Before we get into the "why," let's start with the "what"...

Municipal bonds are loans that investors make to cities and states to build roads, schools, or other public buildings. For example... toll roads in California, water distribution in Texas, and maintenance of the New Jersey Turnpike.

In return, the government promises to send investors regular interest payments, plus return the initial investment, called the "principal," at the end of a set period of time.

The first muni bond on record was issued by New York City in 1812 to fund the construction of a canal. Ever since, states and cities have used these bonds to fund various projects such as the Golden Gate Bridge and the Erie Canal.

The muni market has exploded and grown to about $4 trillion. And it's no wonder when you consider their safety...

Most are backed by the full taxing power of the issuing municipality. If money runs short, the city or state can raise taxes and pay off its bills. That's what makes munis so safe.

But one of the biggest complaints I see about munis is the yield.

Typically, the knock against munis is that their yields are so low that it's hard to justify a spot in your portfolio. If it pays you less than a 10-year Treasury or even less than inflation, what's the point?

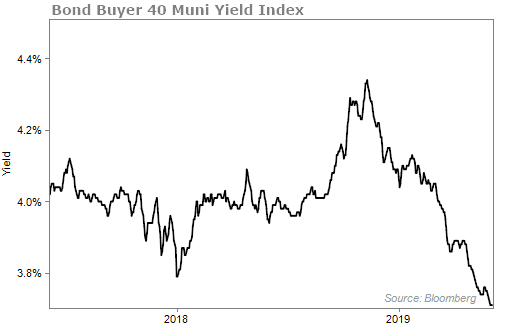

Although yields have come down from when I recommended to buy them back in October, you could do a lot worse than a 3.7% yield...

The best thing about munis is that their interest payments are exempt from federal income taxes. And if you buy bonds from your own state, they are likely exempt from state taxes, too.

This means, if you're in the 24% tax bracket, a 3.7% yield in tax-exempt bonds is equivalent to a nearly 4.9% yield on a normal bond.

And earning nearly 5% is just about as good as you'll find for the level of risk you're taking.

That brings me to the risks of munis... Another major concern.

The biggest risk is default. But, like I said earlier, muni bonds are backed by the power to tax. It's incredibly rare that you'd ever see a muni bond go belly-up.

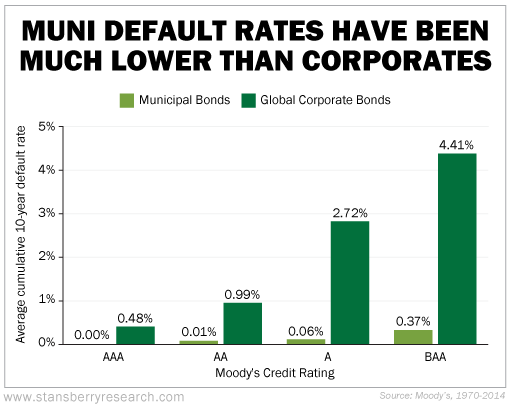

From 1970 to 2015, there were only 99 muni bonds that defaulted. And that's over a period where many thousands of bonds were issued. Compared to corporate bonds, munis are 50 to 100 times less likely to default if they have the same credit rating. You can see the safety of muni bonds below...

Now again, C.M. brings up a valid concern: the financial health of most local governments... and if they'd be able to handle a recession and still pay interest.

I can't stress this enough... It is very unlikely you'll see a wave of muni bonds default. Cities and states can't afford to default on their bonds and could potentially raise taxes in hard times.

You may be skeptical about lending your money to the government, but history says you'll get it back – with interest and no federal taxes.

For those interested, I've got a fast and easy way to have exposure to muni bonds: muni-bond funds. And a longtime favorite fund of mine is the Invesco Value Municipal Income Trust (IIM).

IIM is a fund that holds a portfolio of municipal bonds, an extremely safe, income-generating investment. If you subscribe to our Retirement Millionaire or Income Intelligence advisory services, you'll recognize it immediately. It has been one of our favorite vehicles for safe, steady income.

When you buy IIM, you get a diversified portfolio of nearly 500 bonds. About 60% of the bonds are rated "A" or higher. If you buy IIM, you'll get a yield around 4.8%.

For years, I've told readers to buy municipal bonds. I even went on national television to make my case. Municipal bonds have been – and will continue to be – a great deal for income-seeking investors.

What We're Reading...

- Something different: A global Nutella shortage?

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

June 5, 2019