I wrote yesterday that there are big benefits to converting your IRA or 401(k) to a Roth.

Of course, you must decide whether these benefits are worth the immediate tax that you pay to convert.

To help you out, I have two secrets about the process that ensure you maximize your savings and limit how big a chunk the IRS claims... and why Roth IRA distributions can be more valuable than other retirement income.

Secret No. 1: The Free Government Option

First, set up at least two separate traditional IRA accounts. Put bonds and fixed-income securities in one IRA, and stocks in the other.

Next, create two Roth accounts and move the respective securities to each. This move allows you to take advantage of what I'm calling the "Free Government Option" offered by Roth accounts.

If the value of the securities in your new Roth accounts immediately drops, you can "recharacterize" the rolled-over amounts. This means you switch the investments back to a traditional IRA and get back the taxes you paid. It's truly a free option.

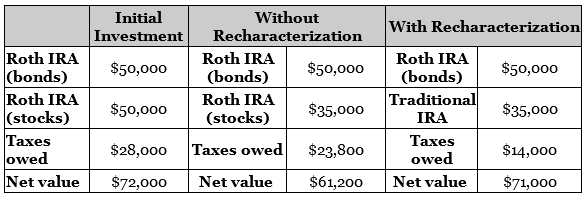

Say you moved $100,000 into two Roths (one invested in stocks and the other in bonds), you would owe $28,000 in taxes on the combined balances.

Now, imagine the stock fund drops in value from $50,000 to $35,000. Why pay tax on $15,000 that you don't have anymore? So the IRS allows you to reverse the move and put the $35,000 back into a traditional IRA. You would not have to pay tax on that $50,000, saving $14,000.

The only catch is, you have to "recharacterize" the Roth by October 15 of the year you file taxes on the original conversion. That offers plenty of time to see how your investments do.

Secret No. 2: Annual Roth Contributions for Everyone

To contribute to a Roth in 2017, you have to make less than $133,000 a year ($196,000 for joint filers). But we have a perfectly legal way around the IRS rule...

Just put money in a nondeductible traditional IRA ($5,500 max, $6,500 if you're over 50), and immediately convert it to a Roth. You won't pay taxes on the conversion because the money is already post-tax. And you have no capital gains to pay taxes on since you just put the money in.

It's important to note that this type of conversion works best if you don't hold other assets in your traditional IRA. You owe taxes, proportionally, based on post-tax and post-tax percentages when you convert.

For those of you wanting to contribute to the Roth IRA, the annual deadlines are identical to the traditional: the tax due date for the prior year.

Of course, it makes sense to put the money in the IRA long before then. If you get it in on January 1 of the tax year, you can compound your returns tax-free all year.

But keep these two dangers in mind...

[optin_form id="73"]

Danger No. 1: Make Sure You Can Pay Your Taxes

Make sure you have enough money outside of your IRA to pay the taxes due on the conversion. Paying taxes from your retirement money severely cuts your future earnings potential.

If you convert $100,000 and your tax rate is 28%, you'll pay $28,000 in taxes. If you pay the taxes out of your conversion proceeds, you'll only move $72,000 into the Roth. In that case, you would need to earn 7% a year for five years just to get back up to the $100,000 you started with.

Worse, if you're younger than 59 and a half and take from the converted amount, you'll pay a 10% penalty on the $28,000. You technically didn't convert it... You used it to pay taxes, so the IRS calls it an "early withdrawal". It would take you an extra six months to break even.

If you can't pay all the taxes from outside money, I recommend decreasing the conversion amount until you can. Just convert a little at a time, year after year.

Danger No. 2: Don't Miss Your Required Minimum Distribution (RMD) Dates

Finally, if you're older than 70 and a half years and convert an IRA to a Roth, remember to take out your RMD before the conversion!

Otherwise the IRS assumes you rolled an excess contribution to your Roth and will penalize and tax you for that. So don't miss your dates...

- If you turned 70 in 2016 on or before June 30, then you turned 70 ½ in 2016. That means you had to take your first RMD before April 1, 2017. If you missed it, then penalties apply.

- If you turned 70 in 2016 after June 30, you'll turn 70 ½ in 2017. So you will need to take your first RMD before April 1, 2018.

After your first RMD, you need to make subsequent RMDs by December 31 each year.

However, because of this rule, most folks will need to collect two RMDs in a single year (one in April and another in December). To avoid doing this, consider taking your first RMD sooner rather than waiting until April 1.

Failing to take your RMD on time or not taking the correct amount results in a huge fine. You'll pay 50% of the missed withdrawal. And if you don't take the full amount, you still owe 50% of the leftover amount. Make sure you know how much to take out and when. Use the IRS worksheets for RMDs right here.

Are you planning on converting an IRA or 401(k) to a Roth IRA? Let us know by e-mailing us at [email protected].

What We're Reading...

- Something different: This spring, you won't have to be super-rich to own a Picasso.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Retirement Millionaire Daily Research Team

April 25, 2017