Doc's note: When volatility in the markets rises – even just a little – investors immediately start wondering if the worst is about to happen. But volatility doesn't often signal that a crash is imminent.

In today's issue (adapted from a recent Chaikin PowerFeed issue), Marc Chaikin explains why market volatility is predictable... just not in the way you want it to be...

Folks, I see this happen just about every time the market makes a big move...

In fact, I've seen this pattern repeatedly since 1966. That was when I got my start on Wall Street as a broker at Shearson, Hammill.

And even though we hadn't yet landed on the moon... a lot of things about humanity, and the markets, still remain the same today.

When things change, you see the fear come out. And you see the speculation. That's just as true in the markets as with humanity in general.

If the markets have been on a big run higher and things start changing, people start asking questions like...

Is this the end of the bull market?

Is the Federal Reserve about to tip the economy over?

Has the U.S. consumer finally run out of steam?

It's a constant cycle of worst-case scenarios and fear.

And it happens every year.

Think back over the past decade. There's not a single year that hasn't been plagued by a swirl of crash warnings in the media.

This is especially true when it comes to fear around predictable events. But the reality is that market volatility is predictable.

It's just that it probably isn't predictable in the way you want it to be...

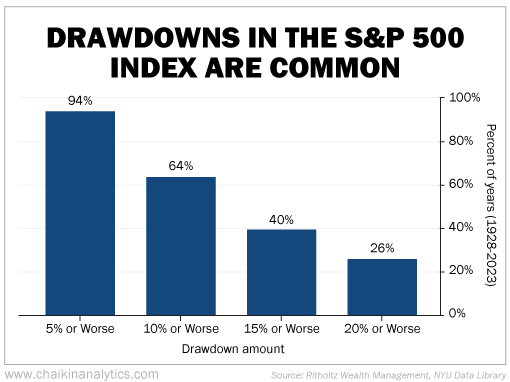

That's because broad market volatility isn't just a regular occurrence. It's the regular occurrence. Take a look...

When you stop to think about it, it makes sense. Of course just about every year sees a 5% or worse drawdown. Markets rise and fall. I've said time and time again that pullbacks happen – even in a bull market.

And looking closer at the chart, we see that we can expect a 10% or greater drawdown in a given year more than half of the time. That means so-called market "corrections" are hugely common.

But we need to be honest with ourselves. These incredibly common events often feel like a big deal when they're happening.

As you know, the markets had a volatile summer. The broad market S&P 500 Index hit an all-time high on July 16. Then it started to slide. The next week on July 24, the index suffered a big single-day drop of 2.3%.

As you would expect, the media was all over it. As NBC News said that day...

Signs of a broader economic pullback continue to mount: The U.S. unemployment rate is rising, excess savings from the pandemic have been exhausted, and consumer borrowing stress is at fresh highs.

And in early August, the markets took another big hit. On August 5, the S&P 500 fell about 3%.

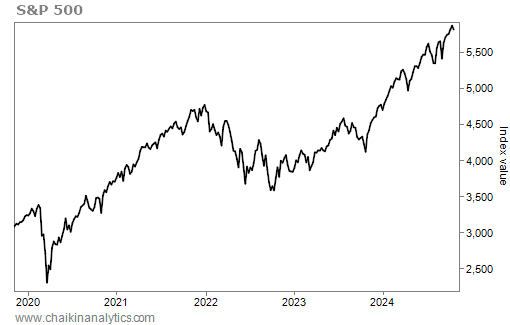

Despite that, the volatility looks pretty run-of-the-mill on a five-year chart of the index. Take a look...

The recent zigs and zags simply don't look all that different from the ones of the past few years. And when you look at this year specifically... there's no question it has been a big one.

Despite the volatility, the S&P 500 is up about 22% in 2024. And since those deeper lows in August, it has climbed more than 12%.

Folks, the point is simple...

Volatility is normal.

It's part of how the market works.

And finding success in the market depends on you avoiding the noise – and the emotions –when volatility stirs up.

So don't let the volatility fool you. It's normal in up years. And it's normal in down years.

The trick is looking past it and seeing where the market is really headed.

Good investing,

Marc Chaikin

Editor's note: Tomorrow morning, Marc is unveiling the biggest breakthrough of his career: A new way for you to handle your money that could double your portfolio, by allowing you to spot the biggest potential buying sprees on Wall Street, before they occur.