It's a question popping up over and over again... "Is now the right time to buy a home?"

And for lots of people, the answer is "No." It seems too expensive. Mortgage rates are double what they were 18 months ago and housing prices are still high.

I (Jeff Havenstein) saw the dilemma first-hand last weekend.

My friend, his wife, and their five kids (with a sixth on the way) live in a three-bedroom townhouse. It didn't take long for me to realize they need more room. But when I asked if they planned to more to a bigger home, my friend told me, "I'm just waiting for home prices to drop."

I couldn't help myself but to respond with, "Well, you might be waiting awhile."

Doc and I have been covering the real estate market in this newsletter for quite some time. Doc last wrote in March that "housing will not collapse."

Doc's argument was that mortgage rates wouldn't stay this elevated forever. And he pointed out that there was little speculation in the housing market, unlike the rampant speculation we saw during the 2007 housing bubble. The folks buying homes today are real families who want to live in them, not Wall Street bankers betting on subprime loan pools.

I want to make things even simpler today... I don't see home prices falling a significant amount because of the supply and demand setup.

If you took Economics 101, one of the first things you would have learned is that when demand is greater than supply, prices increase.

Today, we're seeing an ultra-low supply of homes for sale.

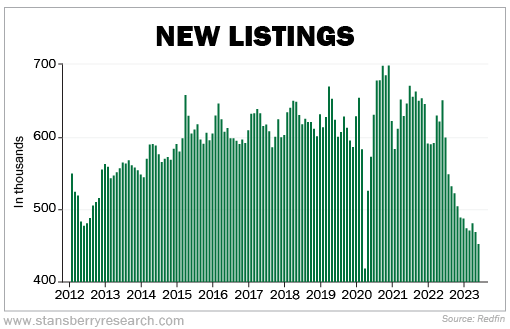

The following chart is from online real estate company Redfin. It shows that listings of homes for sale have hit the lowest level since the COVID-19 shock...

Today, inventory is approximately 46% below the average level since 1999. And according to real estate company Zillow, the U.S. ultimately needs 4.3 million more homes.

We'll likely see a tight supply of homes for the foreseeable future.

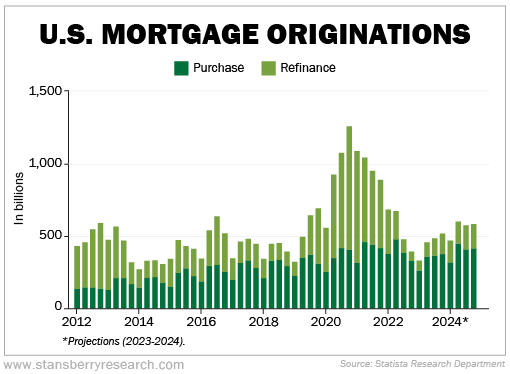

On the demand side of the equation, interest in buying homes hasn't collapsed as many have projected.

The next chart shows mortgage originations. You can see below how refinances boomed right after COVID-19 closed the economy. But look at mortgage originations for new purchases... They're down, but not by much. And originations are projected higher over the next few quarters.

We should see more folks searching for homes to buy in the future...

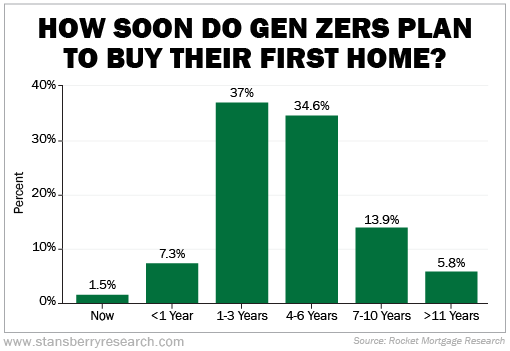

According to a recent Rocket Mortgage survey, 71.6% of Gen Zers plan to buy their first home in the next one to six years. Take a look...

With supply near lows and stable demand, I don't see home prices taking a dive anytime soon.

Like I said earlier, if you are waiting for home prices to drop before you look for a new home, you might be waiting a long time.

What We're Reading...

- Something different: IMF raises global growth forecast despite China's recovery 'losing steam'.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein

July 26, 2023