Doc's note: Joel Litman is one of the smartest guys I know. So smart, in fact, that when I first met him 10 years ago, I was willing to give him all of my money to manage. He wasn't managing money at the time, but now he shares his research with readers all over the world.

In today's issue, Joel explains why you can't trust the numbers you get from Wall Street and how to find numbers you can trust...

Few things make a stock go up or down more than its quarterly earnings announcement.

If a company beats Wall Street's expectations, the stock usually takes off. If it doesn't, the stock often plummets.

But I've discovered something controversial about these earnings announcements... something so eye-opening, I've been invited to lecture about it at Harvard, Wharton Business School, and the world's top CFA societies.

Simply put: You can't trust any of the numbers you read on Wall Street.

But as I'll explain in today's essay, I've developed a way to correct for this, using something called "forensic analysis."

One glance at the real data can help you see which stocks have the realistic potential to rise 1,000%... and which could be worthless.

Let me explain...

In short, almost every single publicly reported earnings number for thousands of different companies contains huge miscalculations of earnings, assets, and even debts that 99% of investors are unaware of.

The companies aren't lying, per se... They're reporting what they believe to be accurate records of their earnings, based on the current accounting laws.

But after nearly 30 years on and off Wall Street – at places like Credit Suisse and as a certified public accountant at Deloitte and PriceWaterhouseCoopers – I've discovered that the generally accepted accounting principles ("GAAP") are chock full of misleading inconsistencies.

The current accounting laws simply don't allow for a true representation of the business. Profits, assets, and entire financial statements are completely distorted from economic reality. Altogether, I've found more than 130 inconsistencies within GAAP that cause earnings to be distorted every single quarter.

Over decades, my team and I have developed a form of forensic accounting that allows us to see the true numbers, weeks or even months before the general public catches on.

It takes weeks to run our forensic analysis on a single company, because we have to correct or "adjust" hundreds of items in the financial statements.

But it's worth the effort... because the numbers we uncover are often hundreds of percent higher or lower than what's reported to the public... which can send the stock price soaring.

Take Advanced Micro Devices (AMD), for example.

A few years ago, the semiconductor company appeared to be barely making any money. But in reality, AMD's earnings were nearly three times higher than what was publicly reported.

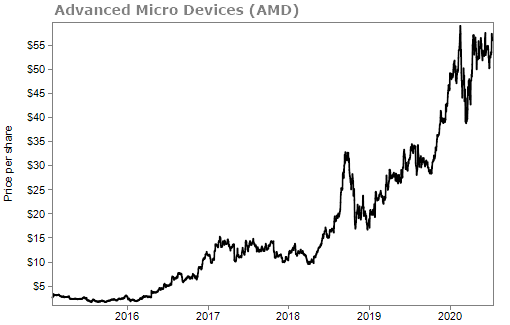

In January 2015, in an article in Barron's, I said, "The credit markets and credit-rating agencies are grossly overpricing default risk at AMD." As you can see, the stock has since risen more than 1,700%...

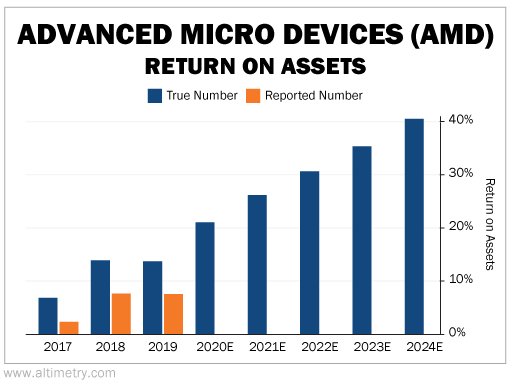

Even after this historic run, the market still doesn't recognize AMD's true earnings. Wall Street continued to underestimate the company's return on assets ("ROA") over the next few years. Take a look...

After its historic run higher, AMD is a $60 billion company and its biggest gains are likely behind it. But it's still growing its real ROAs each and every year, so I wouldn't bet against it altogether...

Now, you might be surprised to learn that "forensic accounting" has this much power. But the fact is, this strategy is how we've uncovered and recommended huge winners over the years.

In fact, some of my institutional clients pay us up to $100,000 per month for our forensic analysis, which has uncovered so many earnings distortions that the FBI asked us to teach it at the National FBI Forensics Conference.

As my good friend Porter Stansberry recently said, "This approach is like a crystal ball. You can see the world in a way other folks don't... yet."

How can a company legally report a certain number for its earnings when the real number is much different?

Well, frankly, the GAAP rules weren't built for individual investors.

Instead, they're a mishmash of overly complex, unclear, and often antiquated rules that result in huge distortions from economic reality... Like whether you depreciate expenses based on five years, 10 years, or 20 years... where debt is categorized... and hundreds of "non-cash" items that can distort the company's true earnings generation ability by hundreds of percent.

In the wake of the 2020 coronavirus crash, my team and I ran forensic analysis on the entire stock market... and we were surprised to discover that the biggest distortions have occurred in microcap stocks.

Microcap stocks have far bigger upside than any other group of stocks over the next several years. In fact, my team and I have used forensic analysis to identify seven tiny stocks in particular that I believe have 1,000% upside from here... And we're in the early stages of identifying dozens of others that are positioned for similar gains.

Regards,

Joel Litman

Editor's note: Right now, Joel is sharing his newest discovery... A rare investment that appears after every crisis–with 10-bagger potential if you get in immediately. Click here for details.