You need to pay close attention over the next couple weeks if you have any money invested in the markets...

What happens over the next month could determine the next major move for the markets. And it will tell us whether or not the economy is potentially on the verge of a crisis.

You see, this earnings season is more important than others. We're at a crossroads currently. And earnings from major companies will decide what road the market and economy take next.

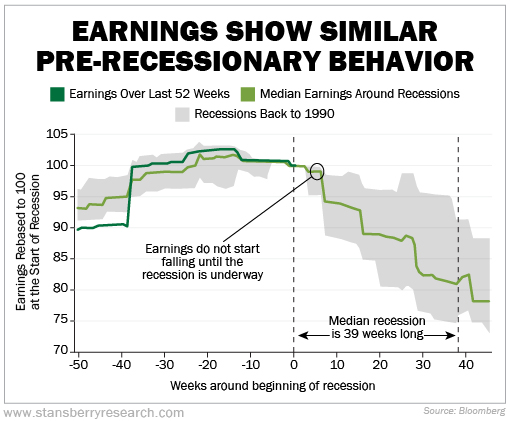

U.S. earnings are behaving similarly to previous recessions. Earnings have been slowing lately. If they fall significantly from here, we could be in for a long, nasty recession. Take a look...

Big banks kicked earnings season off this week and so far the results have been surprisingly positive... JPMorgan Chase (JPM) topped earnings estimates, as did Bank of America (BAC) and Goldman Sachs (GS). This suggests that the U.S. consumer remains strong.

But some CEOs of these major banks are not cheering just yet. They're actually pretty worried.

Here's Jamie Dimon, CEO of JPMorgan Chase...

These are very, very serious things which I think are likely to push the U.S. and the world — I mean, Europe is already in recession — and they're likely to put the U.S. in some kind of recession six to nine months from now.

Here's David Solomon, CEO of Goldman Sachs...

I think it's a time to be cautious, and I think that if you're running a risk-based business, it's a time to think more cautiously about your risk box, your risk appetite... I think you have to expect that there's more volatility on the horizon now. That doesn't mean for sure that we have a really difficult economic scenario. But on the distribution of outcomes, there's a good chance that we have a recession in the United States.

Thinking back to the chart we showed earlier, these CEOs expect earnings to follow a similar path to previous recessions. And that means we could be months, if not weeks, away from a recession.

Next week, we'll get earnings from many of the major tech companies, including Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), and Microsoft (MSFT).

We'll be paying close attention since these are the companies that drive the market. Together, these stocks make up about 18% of the S&P 500 Index.

While I think it's probably a smart idea to play it safe over the next few months – until we learn more about where the economy is and where it's headed – others think you need to batten down the hatches now. They think stocks will move much lower from today's prices.

Dan Ferris, editor of Extreme Value, is one of those editors.

Dan has not been shy about voicing his concern over the market for months now... And he's been proven right. The S&P 500 is down 22% year to date.

But Dan doesn't think it's time to buy just yet, even after all this carnage in the markets... Instead, he's predicting a major crash that could be worse than anything we've experienced.

Tonight, at 8 p.m. Eastern time, Dan will talk in-depth about his big prediction.

The event is 100% free to attend. All you have to do is reserve your spot by clicking here.

What We're Reading...

- Recession beat grows louder with slower earnings, weaker economy.

- JPMorgan Chase tops estimates as bank reaps more interest income than expected after jump in rates.

- Something different: Peloton extends refund period for recalled Tread+ for another year.

Here's to our health, wealth, and a great retirement,

Dr. David Eifrig and the Health & Wealth Bulletin Research Team

October 19, 2022