Markets have gone bonkers this week...

On Monday, the S&P 500 was up 2.6%. Yesterday, the market finished 3.1% higher.

Is this finally the bottom we've all been waiting for?

I (Jeff Havenstein) don't think it is, though I think we're pretty close to it.

One reason why I'm optimistic is because we're seeing record amounts of bearishness in the market. With everyone betting on stocks going down, it sets the stage for a sharp reversal higher, as I'll explain more in a moment.

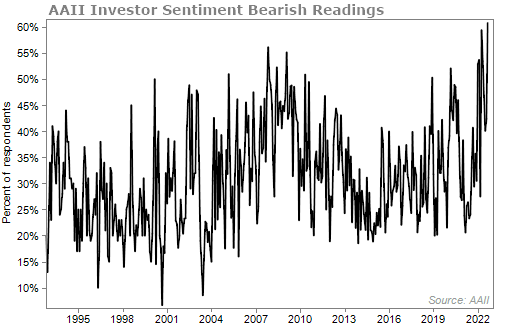

One of the first indicators I look at is from the American Association of Individual Investors ("AAII").

Since 1987, AAII members have been answering the same simple question each week: What direction do you feel the stock market will go in the next six months? The results are compiled into the AAII Investor Sentiment Survey.

Members are pretty evenly split between feeling bullish, neutral, and bearish – though they've been more bullish than not. Historically, about 38% of investors are bullish, 31.5% are neutral, and 30.5% are bearish.

This year however, they have been extremely bearish. Over 60% of respondents have said they are bearish – a 30-year high. Take a look...

This means investors do not have their portfolios positioned to take advantage of a market recovery. When stocks start to move higher, they'll feel left out and buy in droves. That will of course push the market even higher, prompting more buyers to join the fun.

Think back to the stock market bottom in April and May 2000 and you'll know exactly what I'm talking about. That was a time when cautious investors who were parked in cash for too long got punished.

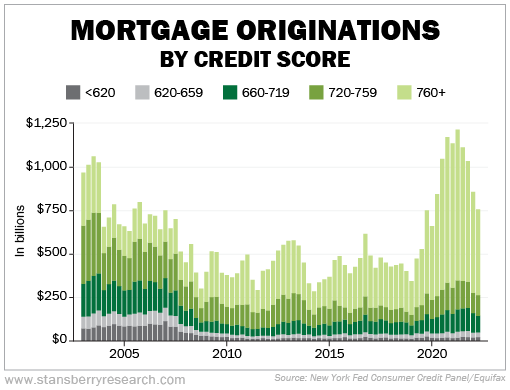

Second, while folks are concerned about a nasty recession and a housing bust like in 2008, I'm not as worried. I don't think we'll get close to the 2008 disaster because of one simple reason... There's little speculation and recklessness in today's housing market.

Think back to the years leading up to the housing crash of 2008. Anyone – and I mean anyone – could get approved for a mortgage. No job, no problem.

Everyone thought they could be a house-flipper and make a quick fortune.

But today, real families are buying homes. And these families have high credit scores. They'll be able to pay their mortgages even with inflation raging.

The chart below looks at mortgage originations (the total amount of mortgage loans) by credit score. The thing to note is that unlike the early part of the 2000's, there are very few credit scores below 660 (the dark gray and light gray bars). You'll see that most of the originations are from folks with a score of 760 or better.

Combine this with a (still) low supply of homes for sale on the market, and I don't think the housing market will collapse like it did in 2008. Besides, big banks have much better-looking balance sheets than they did in the early 2000s. Regulations have been strict.

In summary, extreme bearishness and too much fear surrounding an economic crisis means we're close to a bottom. Of course, short-term market movements depend entirely on what the Federal Reserve is going to do. That's why I'm not calling the bottom just yet. There still may be more selling to come.

But I don't think we'll see another 20% or so drop from here. And that means investors focused on the long term need to think about scooping up their favorite stocks on the cheap.

What We're Reading...

- The AAII Investor Sentiment Survey.

- The average credit score you need to buy a house in 2022.

- Something different: The Robert Sarver situation must prompt reform across professional sports.

Here's to our health, wealth, and a great retirement,

Jeff Havenstein with Dr. David Eifrig

October 5, 2022